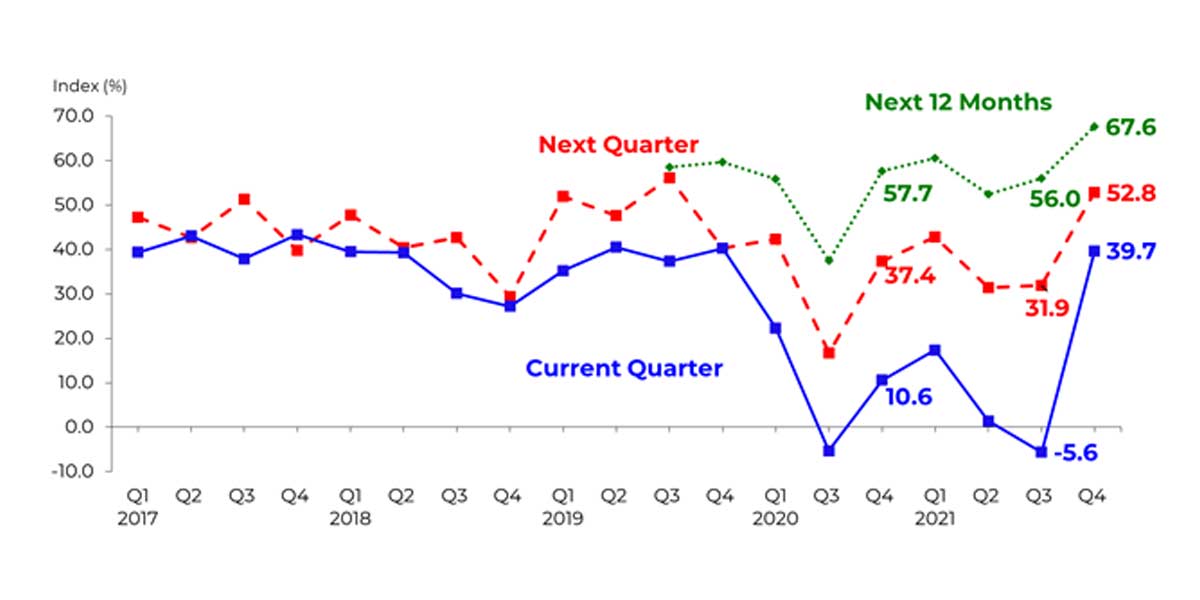

In Q4 2021, the outlook of business owners on the economy turned optimistic as the overall confidence index reverted to the positive territory at 39.7 percent, the highest level since the onset of the COVID-19 pandemic in the country in Q1 2020, from -5.6 percent in Q3 2021. The positive index resulted from the combined effects of increase in the percentage of optimists and the decrease in the percentage of pessimists.

The respondents’ optimism was attributed to the: (a) easing of COVID-19 restrictions and opening of borders, (b) increase in demand and sales, (c) continuous vaccine roll out, leading to herd immunity, (d) seasonal factors, such as the uptick in demand during the holiday season, and start of mining and milling seasons, as well as (e) decreasing number of COVID-19 cases. The release of positive economic news, such as the real GDP performance for Q3 2021, may have also influenced the more sanguine business expectations.

For the next quarter, the business sentiment further improved as the overall CI increased to 52.8 percent from 31.9 percent a quarter ago.

For the next 12 months, business sentiment was more optimistic as the overall CI increased to 67.6 percent from previous quarter’s survey result of 56 percent.

All types of trading firms are optimistic in Q4 2021 and more confident for the near term

Optimism prevailed across the different types of trading firms (i.e., exporter, importer, dual-activity, and domestic-oriented) in Q4 2021.

Importers and domestic-oriented respondent firms turned optimistic, while exporters and dual-activity firms were more confident. For Q1 2022, the outlook across all types of trading firms was more buoyant as the indices were higher compared to the Q3 2021 survey results. Moreover, for the next 12 months, the CIs of all types of trading firms reached record highs.

Buoyant business sentiment is evident across all sectors in Q4 2021 and more bullish for Q1 2022 and the next 12 months

All sectors indicated a more positive outlook for their sectoral performance in Q4 2021 as the CIs turned positive for firms from the construction, services, and wholesale and retail trade sectors and more positive for the industry sector. For Q1 2022, business outlook across all sectors was more bullish. Likewise, the CIs across all sectors for the next 12 months reached all-time highs.

Firms’ outlook on their business operations is optimistic in Q4 2021

Meanwhile, consistent with the national trend, the outlook of firms on their own business operations turned optimistic in Q4 2021. This positive outlook emanated from the hopeful views of firms on higher volumes of business activity and total orders booked. The same upbeat expectations were recorded for Q1 2022 and the next 12 months as well.

Capacity utilization inches higher in Q4 2021

The average capacity utilization of the industry and construction sectors in Q4 2021 increased to 70.6 percent (from 69.8 percent in Q3 2021).

Firms expect financial conditions and access to credit to remain tight in Q4 2021

The financial conditions index declined to -22.4 percent in Q4 2021 from -33.1 percent in the previous quarter. Further, more firms indicated that their access to credit in Q4 2021 was still constrained as the credit access index remained in the negative territory at -7.7 percent in Q4 2021 from -11.4 percent in Q3 2021.

For Q1 2022 and the next 12 months, the employment outlook is more optimistic, while more firms plan to expand operations for Q1 2022, but fewer for the next 12 months

The employment outlook index climbed to 24.5 percent for Q1 2022 (from 6.2 percent in the Q3 2021 survey results) and was higher for the next 12 months at 32.4 percent (from 24.3 percent). The higher positive readings suggest that firms are looking forward to hiring more people for Q1 2022 and the next 12 months. Moreover, the percentage of businesses with expansion plans in the industry sector rose to 23.2 percent for Q1 2022 (from 9.6 percent in the Q3 2021 survey results), but slightly declined to 26.8 percent for the next 12 months (from 27.3 percent).

Firms expect a weaker peso, and higher borrowing and inflation rates in Q4 2021 and for the near term

The survey results showed that businesses expect the peso to continue to depreciate against the U.S. dollar and peso borrowing rates and inflation to rise in Q4 2021, for Q1 2022, and the next 12 months. Further, businesses expected that inflation will breach the upper end of the government’s 2–4 percent inflation target range for 2021 and 2022.

About the Survey

The Q4 2021 BES was conducted during the period 8 October – 18 November 2021. There were 1,511 firms surveyed nationwide, consisting of 584 companies in NCR and 927 firms in AONCR, covering all 16 regions nationwide. Samples were drawn from the Top 7,000 Corporations ranked based on total assets in 2016 from the Bureau van Dijk (BvD) database. The nationwide survey response rate for this quarter was lower at 58.5 percent (from 60.6 percent in the Q3 2021). The response rate was lower for NCR at 49.7 percent (from 56.5 percent) but higher for AONCR at 64.1 percent (from 63.2 percent). Similar to the previous quarter, the data collection for the Q4 2021 BES was subcontracted to RLR Research and Analytics, Inc. The data collection was done amid the heightened mobility restrictions, which may have caused the low response rate.

Full report: https://www.bsp.gov.ph/Lists/Business%20Expectations%20Report/Attachments/19/BES_4qtr2021.pdf