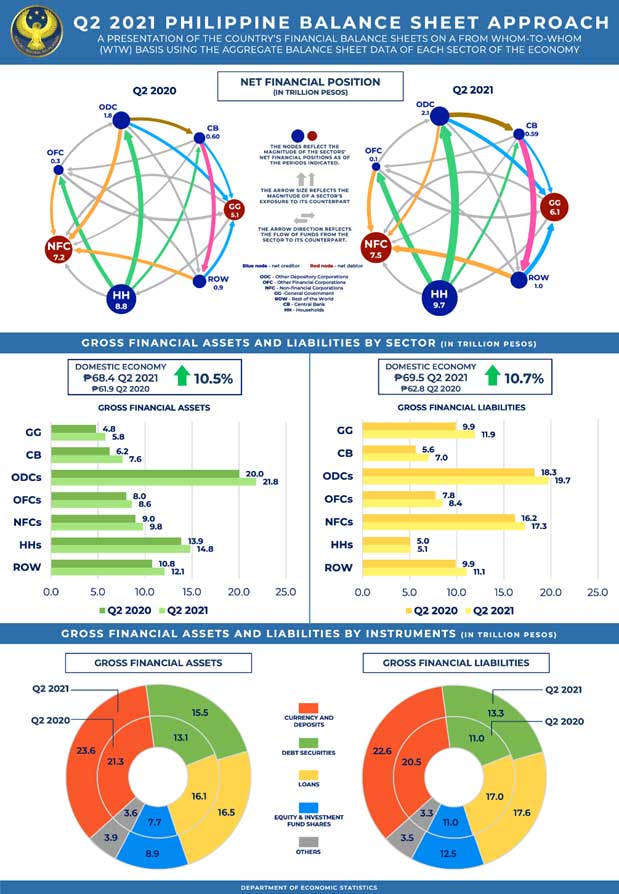

- External Exposure. The country’s net external liability position widened by 19.2 percent to P1 trillion from P873.6 billion in Q2 2020. The increase in the country’s net debtor position against the rest of the world (ROW) was mainly driven by the expansion of the net external liability positions of the general government (GG) and the non-financial corporations (NFCs).

- Key Developments and Cross-sectoral Exposures of the Domestic Sectors.

o The GG’s net debtor position widened by 19.6 percent to P6.1 trillion from P5.1 trillion in Q2 2020. This was driven by the double-digit growth in the GG’s net financial liabilities against the ROW, other depository corporations (ODCs), and the Central Bank (CB). The GG’s gross liabilities grew to P11.9 trillion from P9.9 trillion in Q2 2020, following the rise in government security liabilities, attributed to the expansion in the holdings of the ODCs, CB, and the ROW. Similarly, the GG’s outstanding loans increased by 27.3 percent to P2.3 trillion from P1.8 trillion in Q2 2020. The loans extended by the ROW expanded by 21.3 percent to P1.4 trillion from P1.2 trillion a year ago, while loans owed to the CB surged by 60.6 percent to P608.4 billion from P378.7 billion. Majority of such loans were then financed by the ROW and the CB at about 63 percent and 27 percent, respectively. This ensued as the Bangko Sentral ng Pilipinas (BSP) extended provisional advances to the National Government (NG), which were necessary to support NG’s

pandemic-related measures.

o The NFCs’ net debtor position increased by 3.8 percent to P7.5 trillion from P7.2 trillion in Q2 2020. The NFCs recorded higher net financial liabilities against the ROW and OFCs as the NFCs continued to tap said sectors for sources of financing. In particular, the NFCs’ net debtor position against the ROW expanded by 9.9 percent to P3.3 trillion from P3 trillion, while that against the OFCs increased by 13.3 percent to P2.2 trillion from P2 trillion.

In contrast, the NFCs’ net debtor position against ODCs was lower at P1.6 trillion from P1.9 trillion in Q2 2020. This was on account of the: 1) higher deposit placements of the NFCs with the ODCs and 2) decline in the NFCs’ loans from ODCs as banks continue to impose strict credit standards for loans to enterprises and exhibit low risk tolerance amid the less favorable economic outlook.

o The households (HHs) posted the highest net financial asset position at P9.7 trillion, 10.2 percent higher than the P8.8 trillion recorded in Q2 2020, following higher net claims of HHs on the FCs. This was on account of the HHs’ higher deposits with ODCs, bigger investment in equity and investment fund shares of the OFCs, bigger insurance technical reserves attributed to the HHs, and increased currency holdings.

o The ODCs’ net creditor position expanded by 18.9 percent to P2.1 trillion from P1.8 trillion in Q2 2020. This was driven primarily by the ODCs’ larger net claims on the CB and GG, which rose by 23 percent (to P3.8 trillion from P3.1 trillion) and 34.6 percent (to P1.9 trillion from P1.4 trillion), respectively. The ODCs’ gross financial assets grew by 9 percent, surpassing the 8.1 percent increase in its liabilities. The sector’s investments in debt securities surged 36.7 percent to P5.2 trillion from P3.8 trillion, which were predominantly issued by the NG, BSP, and non-residents. Similarly, the ODCs’ deposits with the BSP rose by 7.7 percent to P2.8 trillion from P2.6 trillion, due mostly to the considerable increase in banks’ placements in the BSP’s term deposit facility.

Amid the decline in the ODCs’ loans to the NFCs, the ODCs have continued to accumulate equity and debt securities issued by the NFCs. Overall, the ODCs’ equity and debt security holdings surged 43.2 percent (to P75.9 billion from P53 billion) and 37.2 percent (to P340.5 billion from P248.3 billion), respectively.

The CB’s net creditor position declined by 2.3 percent to P590.1 billion from P603.8 billion in Q2 2020, following the 23 percent increase in its net financial liabilities against ODCs. This ensued as the CB’s gross liabilities with the ODCs rose by 22.2 percent as the sector augmented its deposit placements with the CB and investments in BSP debt securities. This was partly offset by the 14.1 percent increase in the CB’s net claims against the ROW (to P5.3trillion from P4.6 trillion), owing to the country’s robust gross international reserves (GIR). Moreover, the CB’s net claims on the GG rose by 32.7 percent to P640.8 billion from P482.9 billion in Q2 2020, attributable to the notable increase in the CB’s investments in government securities and extension of provisional advances to the NG.