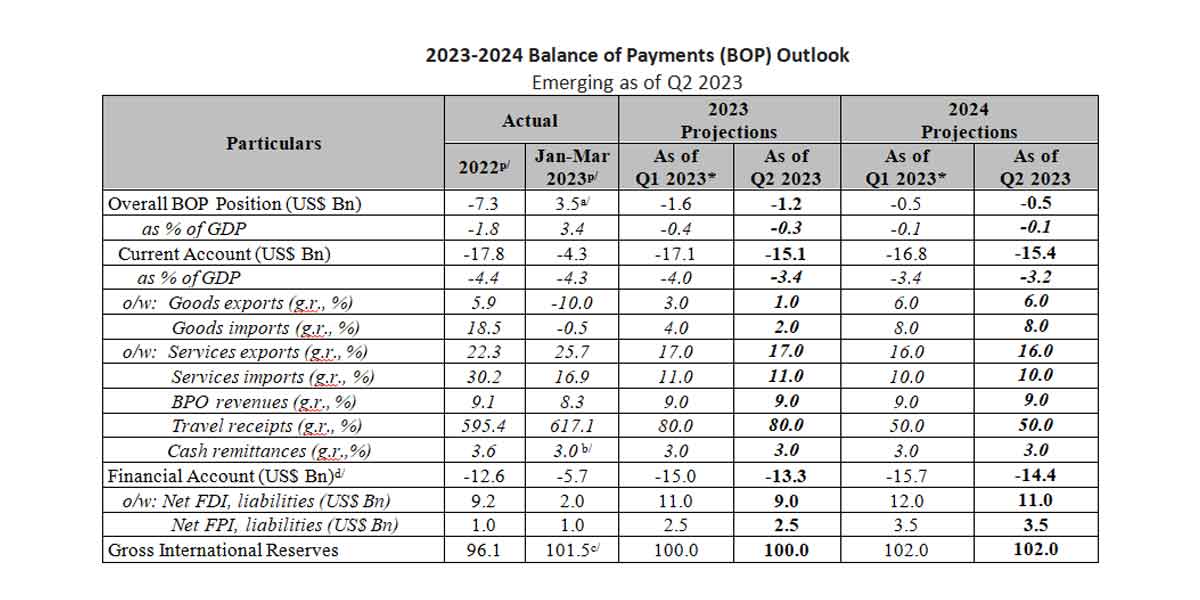

The Monetary Board approved the new set of 2023 and 2024 balance of payments (BOP) projections during its 15 June 2023 meeting.

The current set of BOP projections incorporates latest available data and recent emerging developments.

The emerging BOP forecasts for 2023 and 2024 reflect mainly the slightly weaker global growth prospects for this year and the next relative to the assumptions of the previous projection exercise.

While some upside risks have been identified, particularly that of China’s economic reopening, the unwinding of supply-side disruptions, and decelerating inflation, downside risks continue to dominate the global and trade outlook particularly in the near term.

Weak external demand is likely to continue as uncertainties have been amplified by overseas financial system woes in recent months. These developments continue to weigh on the trade and investment prospects in emerging market economies, including the Philippines.

Even as the domestic economy sustained its robust recovery from the pandemic, the spillover effects from the global economic slowdown can be a major drag.

Nonetheless, the Bangko Sentral ng Pilipinas (BSP) remains vigilant and stands ready for any necessary policy action to support its stabilization function and, in turn, help engender continued resilience of the domestic economy.

For 2023, the overall BOP position is seen to register a lower deficit relative to the March 2023 projection exercise.

This development is underpinned largely by a narrower merchandise trade gap, as goods imports growth is expected to slow down sharply following the pullback in international prices of major commodities, particularly fuel.

This is accompanied by a sustained fall in goods exports as global demand weakens further.

Despite the optimism attached to the reopening of China’s economy, such view remains tentative given its numerous domestic challenges, among which is declining property sales and real estate investment.

Nonetheless, prospects for business process outsourcing (BPO) and tourism industries remain positive, alongside stable remittance inflows from overseas Filipinos (OFs), providing support to the current account.

Meanwhile, inflows from foreign direct investments (FDIs) are projected to be lower than in the previous projection round in line with the slowdown in non-residents investments globally. This is attributed to the observed geoeconomic fragmentation of FDIs and slowdown in the globalization process triggered primarily by rising geopolitical tensions between major economies.

Emerging market economies are more susceptible to FDI relocation as most rely heavily on capital investment from distant countries.

Furthermore, emerging financial market vulnerabilities combined with the after-effects of monetary policy adjustments in advanced economies, such as the US, cast a shadow on the country’s external sector prospects for the year.

For 2024, the overall BOP position is projected to post a slightly lower deficit relative to the previous forecast. This is hinged mainly on the foreseen normalization and return to pre-pandemic levels of global and domestic economic activity.

The IMF projects global economic activity and trade to rise by 3.0 percent and 3.5 percent in 2024, respectively, both higher than their 2023 forecasted growth rates. These developments bode well for the country’s trade and investments prospects for next year, with the downturn in the global semiconductor market predicted to bottom out by the middle of 2023 and into 2024.

Global demand for electronics, which remains a key growth driver of Philippine exports, is therefore seen to make a recovery.

Meanwhile, goods imports could continue to benefit from the government’s infrastructure projects lined up over the medium term and increased domestic production capacity shoring up inward shipments of capital goods as well as raw materials and intermediate goods.

Meanwhile, growth prospects for BPO and travel sectors remain on a steady course. The latter is forecasted to exceed its pre-pandemic level by 2024 buoyed by much-improved international mobility and supported by government-led tourism promotion programs to regain market losses from the pandemic.

Remittance inflows from overseas Filipinos (OF) are likely to expand at a steady pace as Filipino workers fill in for the labor shortage resulting from pandemic-induced job losses and aging populations in host economies.

On the other hand, non-resident investment inflows are seen to improve by 2024 underpinned by better domestic economic growth prospects and the expected finalization of the rules and regulations governing recently enacted FDI-supportive legislation.

The country’s comfortable level of international reserves likewise continues to provide a sufficient buffer against external shocks and a source of confidence for Philippine external sector prospects moving forward.

The BSP continues to emphasize limitations to the forecasts, particularly given continued buildup of external challenges. The BSP will continue to monitor closely emerging external sector developments and risks and how these may impact the BSP’s fulfillment of its price and financial stability objectives.