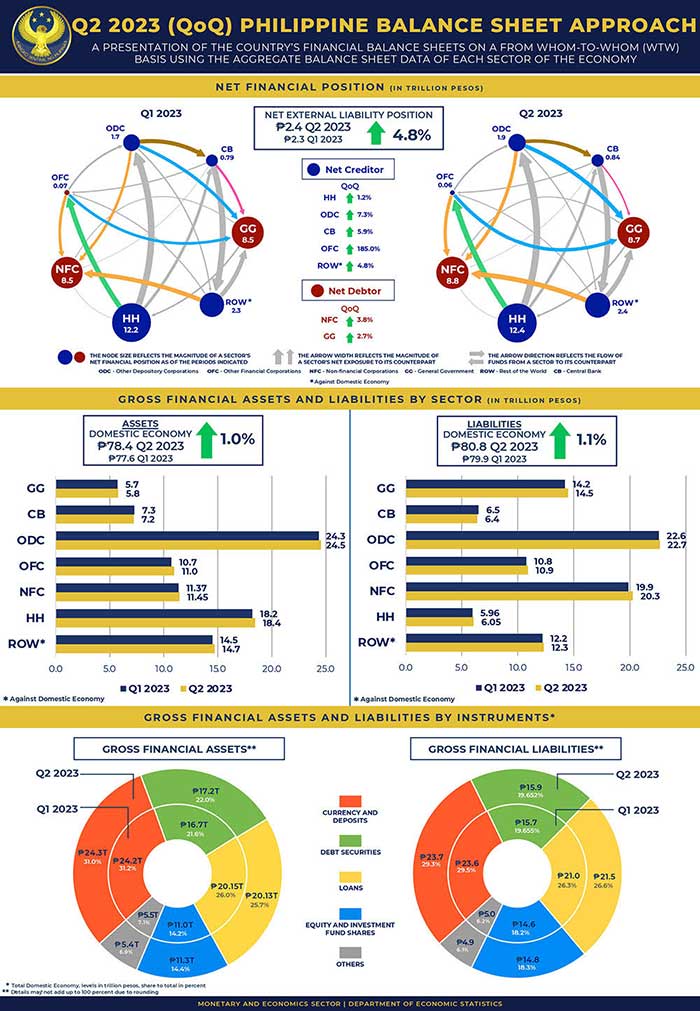

The country’s net external liability position widened by 4.8 percent quarter-on-quarter to P2.4 trillion in Q2 2023 from P2.3 trillion in Q1 2023 due to the higher net external liability positions of the non-financial corporations and the general government.

However, this was partly offset by the lower net external liability position of the other financial corporations.

By sector, the non-financial corporations continued to be the largest net debtor as its net financial liability position widened by 3.8 percent in Q2 2023 to P8.8 trillion from P8.5 trillion. This resulted from the increase in the other financial corporations’ holdings of equity and investment fund shares and debt securities issued by the non-financial corporations.

Further, loans from non-residents and other depository corporations increased.

Year-on-year, the sector’s net financial liability position widened driven by higher loans availed from banks as well as the rise in the other financial corporations’ holdings of equity and debt securities issued by the sector.

Likewise, loans from the rest of the world and non-residents’ holdings of equity securities issued by the sector expanded.

The general government’s net financial liability position expanded by 2.7 percent in Q2 2023 to P8.7 trillion from P8.5 trillion due to the sector’s lower deposits with the other depository corporations and the higher holdings of government securities of the other depository corporations and the other financial corporations.

However, these were dampened by the sector’s higher deposits with the central bank.

Meanwhile, the sector’s net financial liability position widened year-on-year driven by the increase in government security holdings of the rest of the world, the other financial corporations, and the other depository corporations.

Similarly, the general government’s loans from non-residents increased.

The households’ net financial asset position increased by 1.2 percent in Q2 2023 to P12.4 trillion from P12.2 trillion backed by the rise in the sector’s holdings of equity and investment fund shares issued by the other financial corporations.

Consistent with the quarterly development, the households’ net creditor position increased year-on-year due primarily to the increase in the sector’s holdings of other financial corporations-issued equity and investment fund shares.

Likewise, the sector’s net creditor position to the other depository corporations grew as the households’ deposits increased.

Despite the increase in its financial liabilities, the households’ stock of financial assets was three times more than the amount of its financial obligations.

The other depository corporations’ net financial asset position widened by 7.3 percent in Q2 2023 to P1.9 trillion from P1.7 trillion driven by the decline in the general government’s deposits along with the increase in the sector’s government security holdings.

Further, bank loans to non-financial enterprises increased. These were tempered by the decline in the sector’s deposit placements with the central bank.

The sector’s net financial asset position declined year-on-year due to the increases in

(a) deposits from the other financial corporations, (b) loans from the rest of the world, and (c) holdings of bank-issued equity securities by non-residents. These were partly muted by the increase in loans extended to non-financial corporations.

The central bank’s net financial asset position increased by 5.9 percent in Q2 2023 to P836.5 billion from P789.7 billion as deposits from the other depository corporations declined. This was mitigated by the increase in deposits from the general government. Year-on-year, the sector’s net creditor position increased driven by the decline in the national government’s deposits.

For more details, the Q2 2023 Philippine BSA report and statistical tables may be accessed through the following links:

(https://www.bsp.gov.ph/Media_And_Research/PhilippineBalanceSheetApproach/BSA_2qtr2023.pdf)

(http://www.bsp.gov.ph/Media_And_Research/MediaReleases/2024_01/news-01192024b1.xlsx)