By Francis Allan L. Angelo

Finance Secretary Ralph G. Recto has called on the life insurance industry to play a pivotal role in poverty alleviation by expanding market penetration.

Speaking at the Philippine Life Insurance Association’s (PLIA) 74th Anniversary on July 30, 2024, Recto emphasized the industry’s potential to mitigate poverty through adequate insurance coverage.

“Risk is a significant driver of poverty, and adequate insurance coverage is among the powerful tools for mitigating this challenge. Therefore, all of you [in the life insurance industry] hold key positions in winning our battle against poverty,” Recto said.

Recto outlined the government’s goal to reduce poverty incidence to a single digit or 9% by 2028.

As of 2023, the government has lifted 2.5 million Filipinos out of poverty, reducing the rate to 15.5%.

To achieve its target, an additional 10 million Filipinos must be elevated above the poverty line within the next four years.

According to the 2024 World Insurance Report, life insurance penetration in the Philippines remains low at 1.2% of GDP, compared to the global average of 2.9% and 2.2% in emerging Asia.

Recto described this as both a challenge and an opportunity, urging the industry to innovate, educate, and advocate for the importance of life insurance.

“This is both a challenge and an opportunity—a call to action for the industry to step up efforts in ensuring that every Filipino, especially those in low-income brackets, is protected and shielded from falling below the poverty line,” he said.

Recto encouraged the PLIA to redefine public perception of life insurance, emphasizing its role in legacy planning and family empowerment.

He highlighted the benefits of investments in life insurance, including higher education, homeownership, and small business ventures.

“It is not a mere transaction but a selfless act of love that they can bestow upon their families. Hindi lang ito dapat tingnan na isang gastos. Hindi lang ito para sa may-kaya. At hindi lang ito napapakinabangan kapag pumanaw na ang isang mahal sa buhay,” Recto said.

“These investments are stepping stones towards getting higher education, owning a home, or starting a small business—all meant to help more Filipinos live healthier, longer, and better lives.”

Recto also noted favorable economic factors such as the Philippines’ vibrant labor market, growing middle class, demographic sweet spot, and projected ascent to an upper-middle-income country by 2025 and the world’s 13th largest market by 2030.

He urged the industry to innovate beyond conventional solutions, making products simpler, affordable, customer-centric, and digitally integrated.

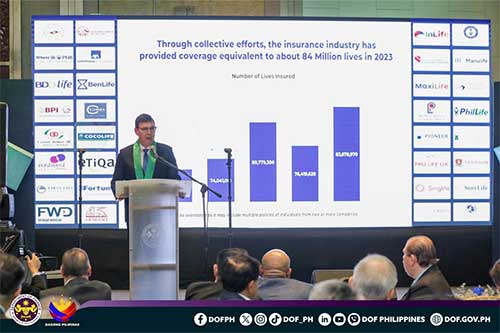

In 2023, the life insurance industry provided coverage for approximately 84 million lives, a 16% increase from the pre-pandemic figure of 72 million, with 44 million lives covered by micro-insurance products.

The average investment in life insurance also rose to PHP 2,745.7 in 2023 from PHP 2,182.8 pre-pandemic.

Recto assured PLIA of the Department of Finance’s strong support through the Insurance Commission in closing the protection gap.

He concluded by emphasizing the industry’s responsibility to earn and maintain clients’ trust through exceptional service.