By Institute of Contemporary Economics

When asked about a choice between having a low-cost but unreliable supply of electricity and a reliable but relatively expensive supply of electricity, consumers, particularly business consumers, would almost always choose the latter. Of course, this does not negate the fact that reliable and competitively priced electricity is a major factor in creating an attractive economic environment.

Fragility in electric distribution

Since the start of the year, the Institute has done a lot of work on the energy sector focusing on the role of reliable power supply in fostering vibrant and sustainable economic development.

Last week’s brownouts in Bacolod and neighboring areas shines a bright light on another component of the power sector – electricity distribution.

Without generalizing, the fraying infrastructure of many of the country’s distribution utilities presents a clear obstacle to the provision of reliable electricity.

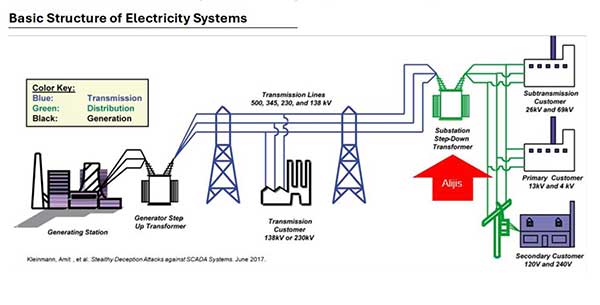

The breakdown of the 37 MVA Alijis sub-station transformer points to a troubling case which belies a cautionary tale behind the maintenance of electricity infrastructure.

The transformer has been identified as having been only 13 years old. This puts it well within typical life cycles of this type of equipment which can range from between 30 to 40 years.

By all indications, the damaged transformer has been deemed as a total loss needing replacement. For equipment of this age, this determination could have been caused by (1) some embedded defect that had not been discovered when it was purchased; (2) unnoticed damage caused during its operation; and/or (3) insufficient maintenance.

Whatever the cause of the Alijis breakdown, it highlights the fact that electricity distribution is a highly capital-intensive industry. Beyond the high cost of the initial infrastructure build-out, investments need to be continuously made on equipment upgrades, replacement and maintenance.

Moreover, with the strong increase in demand for power, the cost of acquiring equipment has also been rising at significantly higher rates than inflation. The cost of foregoing or skimping on these is an unreliable utility distribution system.

Bacolod dodged a bullet by having Negros Power as a partner of CENECO as a distribution utility. What could have been a more prolonged event was averted by the provision of a 10MVA mobile substation lent by Negros Power’s sister company, MORE Power. However, not all electricity distribution utilities in the Philippines have this luxury.

The Philippine Electricity Distribution Utility Landscape

The Philippines has a total of 152 electricity distribution utilities. The overwhelming majority of these (81%) are electric cooperatives. In Western Visayas (including the Negros Island Region) there are 11 distribution utilities. Ten of these are electric cooperatives (including CENECO which has a partnership agreement with Negros Power) and one privately-owned utility, MORE Power.

Panay-based Utilities Ramp Up Investment

In data provided by the National Electrification Administration (NEA) (Note: MORE Power not included), there appears to be a marked difference in spending on capital expenditures between utilities in Panay (including Guimaras) and those in Negros Occidental.

For context, in 2022, only ILECO I and ILECO II reported positive net margins (i.e. profits). All the other utilities posted losses. As a result, spending on capital expenditures was minimal relative the cash inflows of the utilities.

By 2023, almost all of the utilities reported profits. The only utilities which continued to post losses were CAPELCO and NONECO. This change in financial performance drove a significant increase in capital expenditures.

On average, the Panay-based utilities spent 14.0% of their cash flows on capital expenditures. On the other hand, the Negros-based utilities only spent 3.5% of their cash inflows on capital expenditures.

The quality of these expenditures also indicates a conscious effort to improve network infrastructure.

Except for GUIMELCO and ILECO I, the other Panay-based utilities spent the majority of their investment budget on network assets.

The Need to Assess the Way Forward to Improve Reliability and Lower Energy Costs

As we pointed out earlier, the energy industry including the distribution utility sector is a capital-intensive industry. Consumers in industries such as this, benefit from having service providers which are able to take advantage of economies of scale, provide professional management (particularly in non-energy specialties like finance) and have access to better (and cheaper) financial sources.

While we are heartened by the relatively healthy financial condition of most of the local electric cooperatives as well as their seeming commitment to investing in infrastructure, they will need to examine their current business models. This is necessary in light of the (still) relatively expensive electricity prices in the region.

The public-sector initiated cooperative model best serves under-invested and missionary areas and markets. This is no longer true in many electricity markets compared to the 1960s and early 1970s when electricity cooperatives were encouraged as an instrument of the state to improve rural electrification.

The Institute of Contemporary Economics is a multi-disciplinary think tank which aims to be a credible thought leader in the policy-making space. It seeks to promote a vibrant and sustainable economic environment particularly in Western Visayas.