By Francis Allan L. Angelo

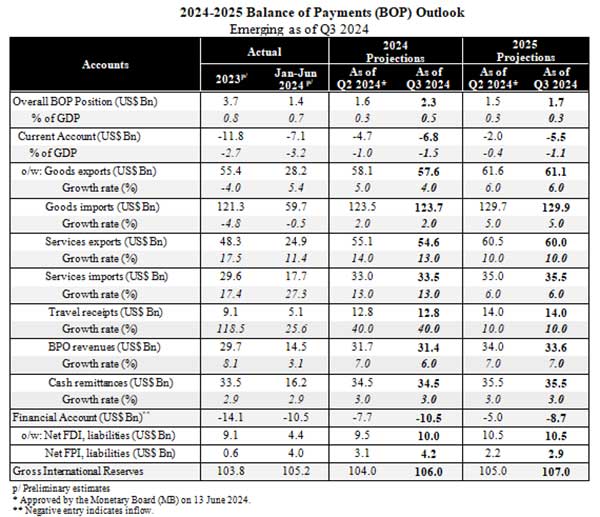

The Philippines is set to record a higher balance of payments (BOP) surplus for 2024 and 2025, as sustained financial inflows and improving global economic conditions boost the country’s external position.

The upward revision from the June 2024 projections is driven by strong financial account inflows and resilient domestic demand, according to a Bangko Sentral ng Pilipinas (BSP) statement.

BOP refers to the record of all economic transactions between a country and the rest of the world.

A BOP surplus means more money is flowing into the country than going out, which strengthens the Philippine peso and builds up foreign exchange reserves.

“The higher surplus for this year and the next reflects the significant rise in non-resident inflows, which helped mitigate the impact of a wider current account deficit,” the BSP stated in the press release.

Global Economic Trends Buoy Prospects

The BSP highlighted that the global economy is expected to expand at a stable pace in 2024, with growth slightly improving in 2025. This is backed by stronger forecasts for emerging markets like China, which will help offset the slower growth expected in the United States.

World trade is also expected to pick up, driven by rising demand for products tied to the energy transition and artificial intelligence (AI), such as electric vehicles, solar panels, batteries, and semiconductors.

“AI and energy transition products are spurring global demand, which is expected to benefit our export sector,” BSP officials noted, adding that the global tech replacement cycle will help drive the export of electronic products.

Local Factors Support BOP Position

The Philippine economy is forecasted to maintain its momentum, supported by robust domestic demand, lower inflation, and government investment in infrastructure.

These factors are seen to improve the business environment, enhancing the country’s ability to attract foreign investments.

The BSP also pointed to the rise in foreign direct investments (FDIs) and foreign portfolio investments (FPIs) as a major contributor to the higher financial account net inflows in 2024 and 2025.

“The stronger outlook for financial inflows is also tied to the anticipated easing of monetary policy by the US Federal Reserve,” the BSP explained.

Risks and Challenges

However, the BSP warned of potential downside risks.

These include volatility in commodity prices driven by geopolitical tensions, particularly the brewing conflict in the Middle East, and extreme weather events.

Additionally, trade tensions between the US and China, as well as potential public health risks from emerging diseases, could dampen the country’s external sector outlook.

Meanwhile, the country’s current account deficit is expected to widen in 2024 due to a subdued performance in merchandise exports, particularly semiconductors.

Despite this, exports in other electronic products, such as telecommunications and automotive electronics, are expected to offset some of these losses.

For 2025, the current account gap is expected to narrow, helped by a recovery in the services sector, particularly the IT-business process management (BPM) industry.

The healthcare segment of the IT-BPM sector, which includes services like medical coding and telemedicine support, is seen as a growth driver.

Looking Ahead

The BOP surplus for 2025 is expected to exceed previous projections, as net inflows from the financial account remain strong.

Improvements in the global economy and rising trade activity will also contribute to increased goods exports, particularly in mineral and agro-based products.

“Despite the optimistic outlook, we remain vigilant of downside risks, especially those stemming from geopolitical instability and the global economic environment,” the BSP said.

With continued foreign exchange inflows, the BSP also sees a buildup in the country’s gross international reserves (GIR), which provide a cushion for the Philippine economy in times of external shocks.