By Francis Allan L. Angelo

Business confidence in the Philippines remained positive during the third quarter of 2024, with optimism expected to surge even higher in the fourth quarter and the next 12 months, according to the Business Expectations Survey (BES) conducted by the Bangko Sentral ng Pilipinas (BSP).

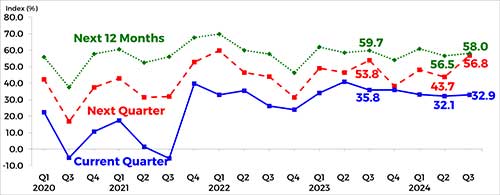

The survey’s overall confidence index (CI) for the third quarter stood at 32.9%, a slight increase from the 32.1% recorded in the previous quarter.

This stability, according to the BSP, was attributed to a drop in the percentage of pessimistic respondents, offsetting a similar drop in the number of optimists.

Business optimism was driven by various factors, including a forecasted rise in demand for essential goods and services such as food, beverages, apparel, education, and personal services.

Easing inflation, the seasonal boost from the school term’s start, and pre-holiday inventory stockpiling were also cited as key contributors.

Looking ahead, the confidence index for the fourth quarter of 2024 jumped to 56.8%, up from 43.7% in the second quarter. The outlook for the next 12 months was also upbeat, with the index climbing to 58%, an increase from 56.5% previously.

Sector Performance

Confidence across different sectors remained mixed.

The construction and services sectors were more optimistic in the third quarter, while sentiments in the industry and wholesale and retail trade sectors were slightly subdued.

The construction sector’s positive outlook was fueled by ongoing infrastructure projects and expected government spending.

On the other hand, firms in the industry sector remained cautious amid concerns about rising production costs.

Despite the overall positive trend, businesses also reported challenges.

The average capacity utilization for the industry and construction sectors dipped marginally, from 72% in the second quarter to 71.9% in the third quarter, reflecting cautious production adjustments.

Financial Conditions and Inflation Concerns

While businesses maintained their optimistic outlook, many firms expressed concerns about tight financial conditions.

Access to credit remained challenging, with the index on credit access staying negative.

Moreover, inflationary pressures continued to weigh on the outlook.

Businesses expect the inflation rate to average 4.3% in the third quarter, rising slightly to 4.4% in the fourth quarter and into 2025.

This is above the government’s inflation target range of 2-4%.

Peso and Interest Rate Expectations

In terms of the peso’s performance, businesses expect the local currency to depreciate against the U.S. dollar in the third quarter. However, a reversal is anticipated in the fourth quarter and the next 12 months, as companies predict the peso will regain strength.

Peso borrowing rates are expected to rise for the remainder of 2024 and into the next year, contributing to the financial pressure businesses are feeling.

The BES, conducted from July 5 to August 27, 2024, surveyed 1,525 firms across the country, with 582 respondents from the National Capital Region and 943 from other regions.