Whether you’re scouring the virtual aisles of an online marketplace or getting lost inside your favorite neighborhood superstore, it’s surprisingly easy to make snap decisions that end up costing more than you expected. This has always been true, but it’s taken on a new dimension with the proliferation of new cashless payments. These provide convenience for online and offline transactions, but they do require a different mindset compared to traditional cash.

Tried-and-tested strategies for scoring great deals remain as relevant as ever. However, the entry of new payments in Philippine retail does mean that smart shoppers must adjust their habits. Here are some important pointers for getting more for your money in the Philippines’ digitally transformed retail scene, especially if you intend to use your credit card:

1) Use Generous and Trustworthy Credit Card Cashback Rewards Programs

While new cashless methods like digital wallets offer convenience, credit cards are still one of your best options if you’re focused on long-term savings. Credit card rewards programs are gaining a lot of steam in the Philippines, thanks to incredible deals that allow cardholders to earn cashback points on all purchases—both online and offline.

Cards like the Landers Cashback Everywhere Credit Card by Maya turn every purchase into a saving opportunity, making it a potent tool for stretching your peso. On top of offering excellent cashback rates of up to 5% per Landers Superstore purchase, 2% per dining experience, and 1% for other transactions*, this card promises safe and hassle-free buying experiences everywhere thanks to Maya’s dependable security features. Be sure to sign up for the Landers Cashback Everywhere Credit Card if you want the safest credit card for online shopping.

*transactions that don’t qualify include: cash in, cash advance, quasi cash purchases, casinos and gambling, fuel, supermarket, pharmaceuticals, utilities, telecommunications, and government

2) Take Advantage of Credit Card Promotions

Speaking of credit card rewards, some card issuers have special promotions that offer additional cashback reward points or bonuses for specific purchases. Depending on your lifestyle, these extra points can add up.

For instance, if your card offers extra discounts when you shop at a particular supermarket or retail chain, it might be worthwhile to prioritize that chain so that you can get consistently better deals. Keep an eye on your credit card provider’s website or app to stay updated so that you can seize these opportunities as early as possible.

3) Stack Discounts with Credit Card Offers

Stacking discounts and promotions with your credit card offers can give you significant savings on key purchases. For example, if a store is having a sale, using a coupon or promo code, then paying with a credit card that offers cashback or points, can multiply your savings. This is especially relevant for popular online stores since many of them offer exclusive discounts simply for signing up.

4) Monitor Prices with Apps and Extensions

Prices can vary significantly between stores, particularly online. Before making a purchase, compare prices across different platforms and even overseas markets so that you’re absolutely sure you’re getting the best deal.

Thankfully, there are numerous mobile apps and browser extensions designed to help you find the best deals online. Tools like ShopBack and Priceza can be used to quickly search for coupons and compare prices across different stores. Some stores will also provide built-in price tracking features, notifying you when prices decrease.

5) Use Price Matching Policies

Speaking of price comparisons, price matching is now more frequently being employed by online stores to secure customer loyalty. Find businesses that offer these and use price matching apps and image search tools like Google Lens to find lower-priced offers of the items you want. To get an even better deal, pay with a card like the Landers Cashback Everywhere Credit Card, which will offer you cashback rewards on these offers.

6) Shop During Sales Events and Holidays

In the Philippine market, major sales events like 8.8 and Black Friday have joined traditional holiday sales as much-awaited times for smart shoppers. Timing your purchases to land on these events can earn you significant discounts both online and in-store. Again, using a credit card with generous cashback rewards is key to making the most out of these purchases.

7) Join Loyalty Programs

A growing number of Philippine retailers have loyalty programs that offer members exclusive early access to sales and rewards points. If these retailers are the ones you already frequent, these programs can lead to significant savings over time, especially if signing up is free. As you may have guessed, using a good credit card will effectively let you stack rewards and discounts, further increasing your savings.

Get the Most Value from Every Shopping Experience

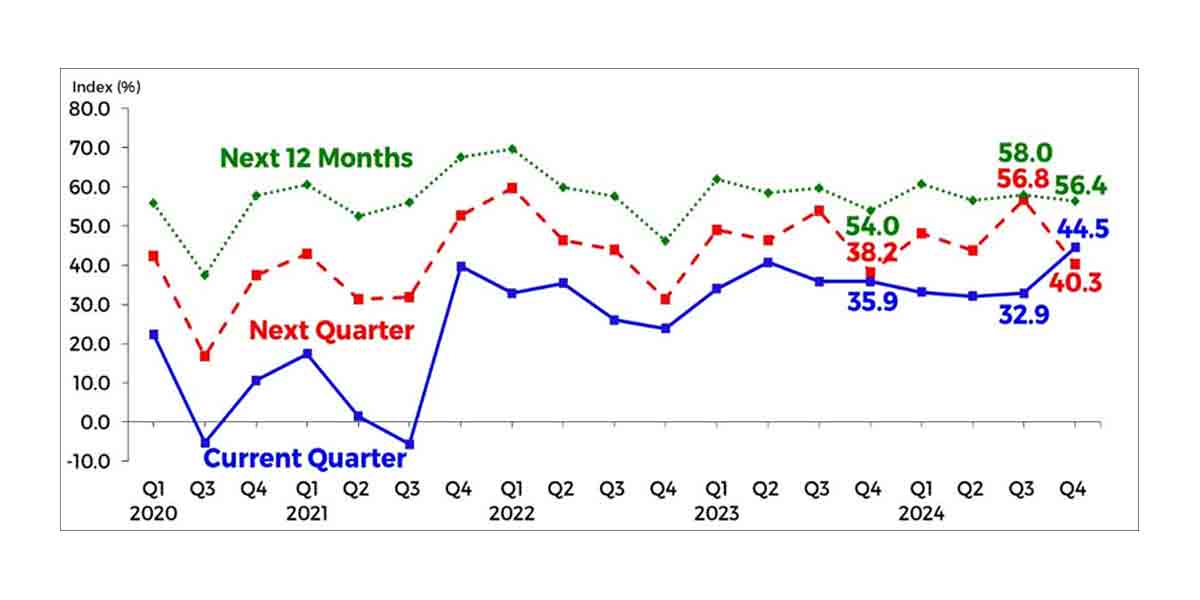

If you want to get the best shopping deals across multiple channels, you’ll need to rely on a combination of strategy and the right tools. The Philippines’ positive economic outlook has made it a great time for consumers from the country to take advantage of credit card rewards.

The best credit card will offer you a consistent way to maximize promotions and increase your savings, regardless of whether you’re shopping online or in-store. In the end, signing up for a card with a solid set of incentives, paying it off on time, and using common-sense price-matching tips will help you squeeze the most out of every peso.