By Francis Allan L. Angelo

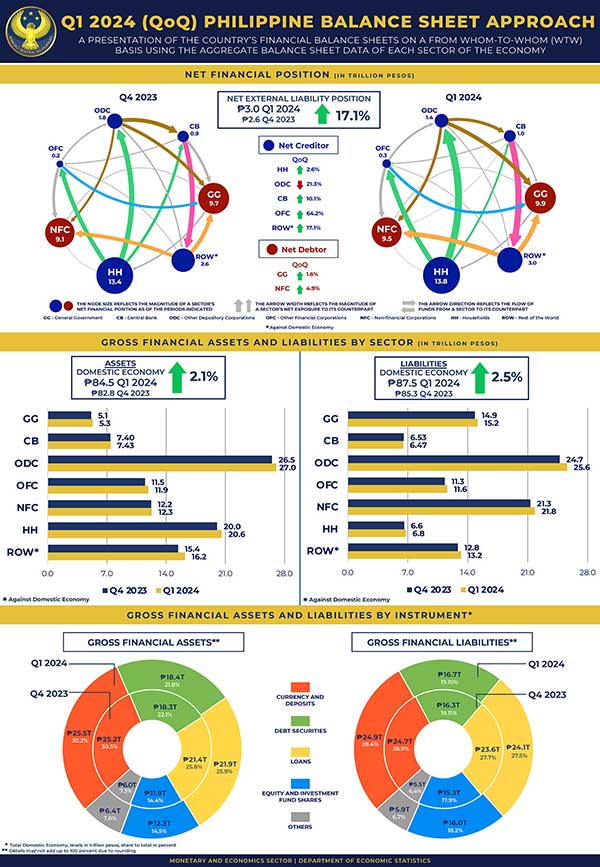

The Philippines’ net external liability position grew by 17.1% in the first quarter of 2024, reaching PHP 3 trillion from PHP 2.6 trillion at the end of 2023, according to preliminary data from the country’s Balance Sheet Approach (BSA).

The increase indicates larger debt of both the government and private corporations to foreign entities.

The rise in liabilities primarily stemmed from increased borrowing by the general government and non-financial corporations, highlighting the nation’s reliance on external funding for infrastructure and development.

Government Borrowing Rises

The general government, which includes national and local government units, saw its financial liabilities increase to PHP 9.9 trillion, up 1.6% from PHP 9.7 trillion in the previous quarter.

The growth was driven by higher loans and debt securities purchased by foreign investors, as well as increased holdings of government securities by local banks.

While the government took on more debt, it also increased its deposits with the Bangko Sentral ng Pilipinas (BSP), slightly balancing the rise in liabilities.

On a yearly basis, the government’s liabilities rose due to foreign loans and higher demand for government securities by both local and foreign investors.

Corporations Add to Debt Load

Non-financial corporations—companies outside the banking and financial sectors—experienced a 4.9% increase in net liabilities, which reached PHP 9.5 trillion.

The growth was fueled by increased foreign financing through loans and equity investments. At the same time, corporate bank deposits shrank, further contributing to the rise in liabilities.

Year-on-year, the debt load of non-financial corporations also rose as they issued more shares to foreign investors and increased their borrowing from both local banks and international lenders.

Households Strengthen Financial Position

While government and corporate liabilities grew, Filipino households saw their financial assets increase by 2.6%, reaching PHP 13.8 trillion.

The rise was largely due to increased savings in bank deposits and higher investments in stocks, insurance, and pension schemes. This trend reflects growing confidence among households in financial instruments that offer long-term security.

On an annual basis, households have consistently strengthened their financial positions by increasing their deposits and investments.

Impact on Banks and the Central Bank

The banking sector, categorized as “other depository corporations,” saw its net financial assets shrink by 21.3% to PHP 1.4 trillion, mainly due to higher savings and time deposits from households.

Additionally, banks reduced their placements in short-term investments, such as reverse repurchase agreements with the BSP.

The BSP, however, saw a 10.1% increase in its net financial assets, reaching PHP 962.6 billion. This growth was driven by a decline in its short-term debt to banks and an increase in the country’s foreign reserves.

Economic Implications

The widening of the country’s net external liability position indicates that both the government and private sectors are increasingly reliant on foreign financing to support their activities.

While external borrowing helps fund infrastructure projects and corporate expansions, it also exposes the country to risks related to foreign exchange fluctuations and global financial conditions.

The growth in household financial assets, on the other hand, signals that Filipino families are building a stronger financial foundation through increased savings and investments, which could provide a buffer against potential economic challenges.

For more details, the Q1 2024 Philippine BSA report and statistical tables may be accessed through the following links:

Full Report: https://www.bsp.gov.ph/Media_And_Research/Philippine Balance Sheet Approach/BSA_1qtr2024.pdf

Statistical Tables: https://www.bsp.gov.ph/Media_And_Research/Media Releases/2024_09/news-09302024a2.xlsx