If you’re excited for a loved one working abroad to come home for the holidays, you’re not alone.

In 2023, a whopping 2.3 million Overseas Filipino Workers (OFWs) were sent to work overseas, marking the highest number ever recorded in Philippine history. This also means that over 2.3 million families are waiting back home, not just taking care of everyone else but also relying on “padala” from OFWs for their household budget. While families are always thankful for the help, it’s not always easy to make the most out of the remittances received from abroad.

The upcoming Christmas season may be a time for celebration, but it also means more expenses and high prices. With the constant worry about unexpected fees and fluctuations, as well as their own cost of living, OFWs must ensure that they can send remittances in time to meet their family’s needs.

To help maximize your loved one’s hard-earned money, consider these practical tips:

- Set up an emergency fund

Setting up and sticking to a household budget helps manage the money available, but it is also important to set aside money for an emergency fund. Even a small amount, when saved regularly, can create a safety net when unexpected expenses arise.

- Be honest with your loved one abroad

Discussing where the money goes with your family or loved one overseas helps ensure that everyone is on the same page when it comes to money issues and priorities. By having realistic expectations about remittances, everyone in the family can work towards their financial goals.

- Choose a convenient way to receive your money

To ensure that the value of your loved one’s hard-earned money is stretched to the fullest, select a platform with a wide range of features and benefits. Having an e-wallet that allows you to receive remittances instantly while enabling you to save, invest, pay for necessities, and send money in the same app, can help streamline your financial transactions.

Remittance, straight to your GCash wallet

Remittance fees can take a lot away from the hard-earned money of your loved ones overseas. Sending ₱10,000 back home could cost nearly ₱600 in transaction fees. Aside from money lost on fees, traditional remittances can also be slow and inconvenient, with some wire transfers taking over 24 hours and requiring trips to remittance centers. This can be frustrating when an emergency calls for urgent funds.

Finance superapp GCash allows OFWs to send remittances straight to their family and loved ones in the Philippines – on their GCash e-wallet, anywhere 24/7, and completely free for verified users.

You can now receive your remittance through GCash in real-time, as GCash has partnered with trusted remittance partners all over the world, such as Remitly, TapTap Send, Ria, Western Union. Enjoy the flexibility of receiving money anytime, anywhere in the Philippines, with no cut-off times and holiday breaks. With the remittance directly deposited to your GCash wallet, there’s no need for the hassle of visiting a remittance center, waiting in line, or filling out paperwork.

Receiving it through the GCash wallet also means you can instantly use the funds, from paying bills and purchasing the kids’ school supplies via Scan-to-Pay in-store to ordering online or sending allowances through Send Money.

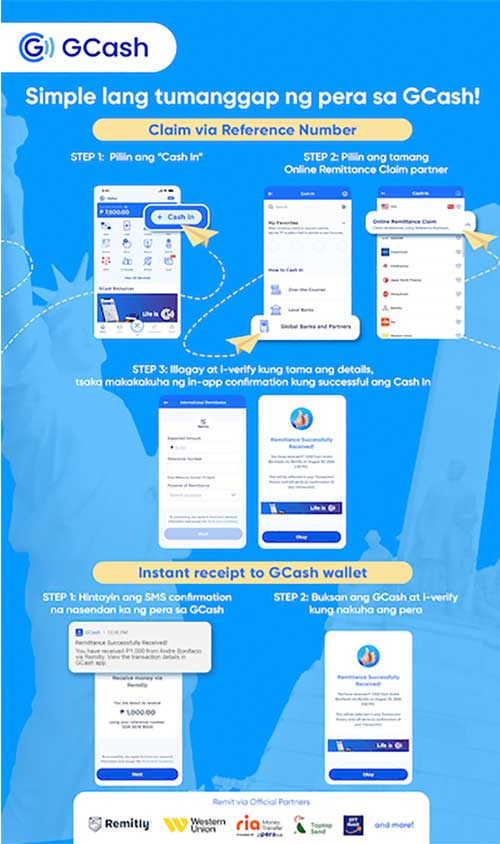

You can receive remittance in two ways: instant receipt to GCash wallet or claim via reference number. To claim via reference number, simply select ‘Cash In’ on the dashboard and select the Online Remittance Center partner. Then, fill out and verify the details to get an in-app confirmation that the remittance has been successfully cashed in.

For instant receipt to GCash wallet, users should wait for an SMS confirmation that they have been sent money through GCash. They will then need to open GCash to verify that they have received the remittance.

Working abroad is already a struggle as it is. Provide your family or loved one abroad the peace of mind that their hard-earned money is sent whole, directly to you. With GCash, every peso counts, kaya sabihin mo sa pamilya o mahal sa buhay abroad, sa GCash magpadala ng pera.

Pwede mo nang matanggap ang padala abroad diretso sa GCash mo. Download the GCash App on the Apple App Store, Google Play Store, or Huawei App Gallery! Kaya mo, i-GCash mo!