By Francis Allan L. Angelo

Western Visayas’ financial strength, as shown by its PHP 533-billion deposit base as of June 2024, is tempered by a low loans-to-deposit ratio (LDR) of 27%, according to Bangko Sentral ng Pilipinas (BSP) data.

The LDR reflects a cautious lending environment despite substantial liquidity, which also point to untapped opportunities for economic growth.

Universal and commercial banks dominate deposits in Western Visayas, holding 93% or PHP 495 billion of the total.

Banks operate on a model where deposits from individuals and businesses are considered liabilities. These deposits earn interest, which the banks pay to depositors.

To generate income and cover these liabilities, banks lend out the deposited money to borrowers at higher interest rates. This process creates a cycle where deposits fund loans, and the interest margin sustains the banks’ operations.

In Western Visayas, the low LDR suggests that a significant portion of deposits is not being reinvested into the local economy through loans.

As a result, banks may face challenges in fully maximizing their profitability and supporting regional economic growth.

The region’s total loan portfolio reached PHP 146 billion as of mid-2024, with 71% of loans—or PHP 103 billion—provided by universal and commercial banks.

However, the BSP warned that unutilized deposits could flow out of the region if not aligned with local economic development.

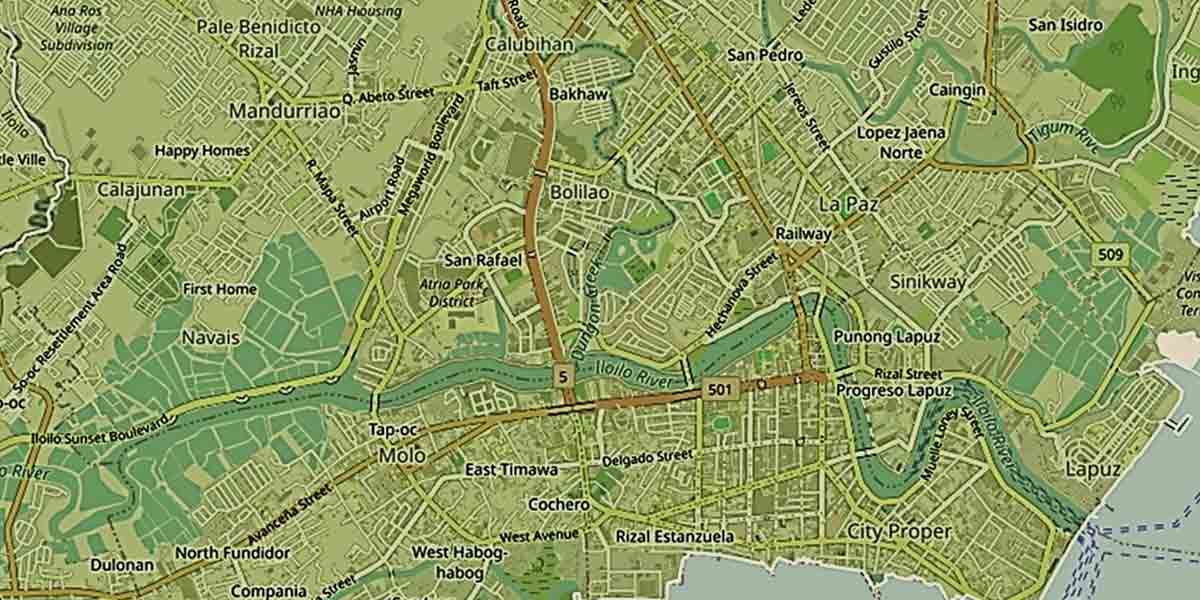

Iloilo City, leading the region’s financial network, hosts 327 of Western Visayas’ 811 banking institutions.

Neighboring Negros Occidental follows with 253 banks, while Capiz, Aklan, and Antique share 215 banks. Guimaras maintains 16 banks.

Automated teller machines (ATMs) complement banking services, with 1,191 units regionwide. Iloilo accounts for 428 ATMs, second only to Negros Occidental’s 443, reflecting the growing role of digital banking.

Despite this robust infrastructure, BSP Visayas Regional Office Economic Affairs Staff Head Gregorio Baccay III emphasized the need for improved credit strategies.

“The low LDR implies that a significant portion of deposits is not reinvested into the local economy,” Baccay said during a BSP media briefing in Iloilo City.

He urged policymakers to encourage micro, small, and medium enterprises (MSMEs) to tap into loan products.

If the deposits are not being invested here, it may go out of the economy of Western Visayas, Baccay added.

Non-bank financial institutions (NBFIs) also play a vital role in financial inclusivity.

The region supports 1,735 NBFIs, including 1,262 pawnshops and 473 money service businesses, providing alternative financial services to underserved communities.

The region’s economic growth, highlighted by a 7.2% increase in Gross Regional Domestic Product (GRDP) in 2023, remains anchored on its services sector.

Valued at PHP 1.024 trillion, the GRDP benefits from Iloilo’s business process outsourcing (BPO) industry and the tourism-driven economies of Aklan and Antique.

To unlock its full potential, Western Visayas must improve its LDR by incentivizing loans for MSMEs and other businesses.

Mobilizing deposits locally could ensure the region’s financial resources directly contribute to sustained economic growth while helping banks generate more income from their existing deposit base.