Results of the Q4 2024 Senior Bank Loan Officers’ Survey (SLOS)[1] showed that most banks kept their lending standards generally steady for loans to businesses and consumers based on the modal approach.[2] Meanwhile, the diffusion index (DI) method[3] indicated a net tightening of credit standards for business loans, while loan standards for households were reportedly unchanged.

Changes in Credit Standards

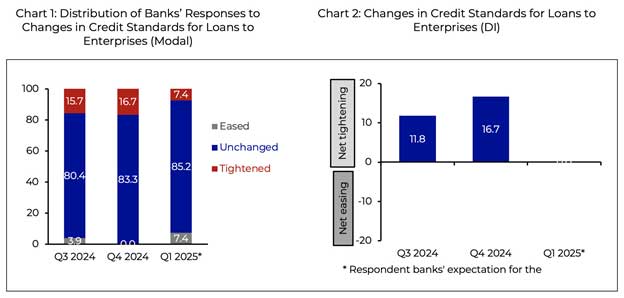

Loans to Enterprises

The Q4 2024 survey results showed that a majority of respondent banks (83.3 percent) maintained their credit standards for businesses using the modal approach. This marks an increase from the previous quarter, where 80.4 percent of respondents reported unchanged loan standards. On one hand, the diffusion index approach indicated a net tightening of credit standards in Q4 2024, due to the deterioration in borrowers’ profiles and the profitability of the bank’s portfolio.

Over the next quarter, the modal approach showed that 85.2 percent of participating banks expect lending standards for enterprises to remain generally unchanged. Meanwhile, the DI results suggest that loan standards for Q1 2025 are anticipated to remain steady due to stable economic outlook and unchanged risk tolerance and borrower profiles.

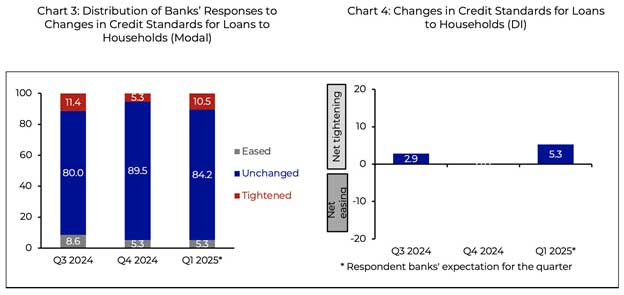

Loans to Households

The modal results indicated that a higher percentage of banks maintained their credit standards for household loans in Q4 2024 (89.5 percent) compared to Q3 2024 (80.0 percent). Similarly, the DI method showed generally unchanged credit standards in Q4 2024, following a slight net tightening in the previous quarter. The broadly steady loan standards for households were mainly due to the unchanged profile of borrowers, tolerance for risk, and the profitability of the bank’s portfolio.

Over the following quarter, the modal results showed that a majority of respondents (84.2 percent) anticipate unchanged consumer loan standards. Meanwhile, the DI approach revealed an outlook of net tightening standards, driven by banks’ expectations of a deterioration in the profitability of their portfolios, as well as lower risk tolerance.

Changes in Loan Demand

Loans to Enterprises

Most participating banks in the survey (74.1 percent) indicated unchanged overall demand for enterprise loans in Q4 2024 based on the modal approach. This proportion was slightly higher than in the previous quarter (72.5 percent). The DI method showed a net increase in loan demand from firms in Q4 2024, though slightly lower than the previous quarter. This increase was driven by higher customer inventory financing needs, clients’ more optimistic economic expectations, and an increase in borrowers’ short-term financing needs.[4]

Over the following quarter, the modal method indicated that a majority of respondents (61.1 percent) expect steady overall loan demand from enterprises. In contrast, the DI results indicated that surveyed banks anticipate a net rise in loan demand from businesses in Q1 2025, driven by similar factors associated with the increase in credit demand for the current quarter.

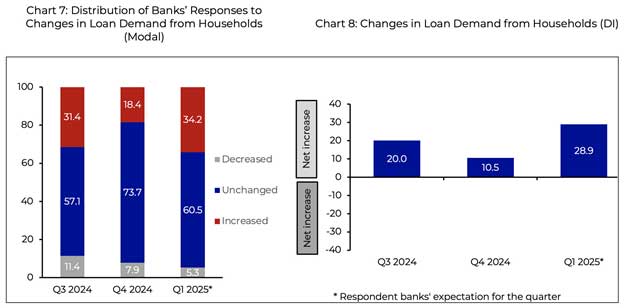

Loans to Households

Modal-based results showed a larger percentage of banks indicating unchanged consumer loan demand in Q4 2024 (73.7 percent) compared to Q3 2024 (57.1 percent). Meanwhile, the DI approach indicated a lower net rise in demand for household loans in Q4 2024 compared to the previous quarter. The overall increase in household loan demand was mainly due to banks’ more attractive financing terms and higher consumption.[5]

Over the next quarter, results from the modal approach showed that more than half of surveyed banks (60.5 percent) expect steady demand for household credit. Meanwhile, DI results showed banks’ expectations of a net increase in household loan demand amid the rising consumption and banks’ more favorable credit terms.

[1] The SLOS consists of questions on loan officers’ perceptions relating to the overall credit standards of their respective banks, as well as to factors affecting the supply of and demand for loans to both enterprises and households. The analysis of the results of the SLOS focuses on the quarter-on-quarter changes in the perception of respondent banks. The responses for the Q4 2024 SLOS were gathered between 25 November 2024 to 16 January 2025 with a total of 55 respondent banks out of 60 surveyed banks, reflecting a higher response rate of 91.7 percent from 86.7 percent in the previous quarter.

[2] In the modal approach, the results of the survey are analyzed by looking at the option with the highest share of responses. The three options for the modal approach are either 1) tightening, 2) easing, or 3) unchanged credit standards for loans to enterprises and for loans to households.

[3] In the DI approach, a positive DI for credit standards indicates that the proportion of respondent banks that have tightened their credit standards exceeds those that eased (“net tightening”), whereas a negative DI for credit standards indicates that more respondent banks have eased their credit standards compared to those that tightened (“net easing”). Meanwhile, an unchanged credit standards in the DI approach indicates that the proportion of the respondent banks that have tightened their credit standards is equal to those that eased their credit standards. During the Q1 2010 to Q4 2012 survey rounds, the BSP used the DI approach in the analysis of survey results. Beginning in Q1 2013, the BSP used both the modal and DI approaches in assessing the results of the survey.

[4] The BSP Business Expectations Survey (BES) indicated that the business sentiment in the Philippines was more optimistic in Q4 2024 driven by firms’ anticipation of a net increase in demand for certain goods and services along with a seasonal uptick in business activities.

[5] The BSP Q3 2024 Consumer Expectations Survey (CES) indicated that consumer sentiment for Q4 2024 improved amid expectations of higher and additional sources of income, more working family members, and increase in available and permanent employment.