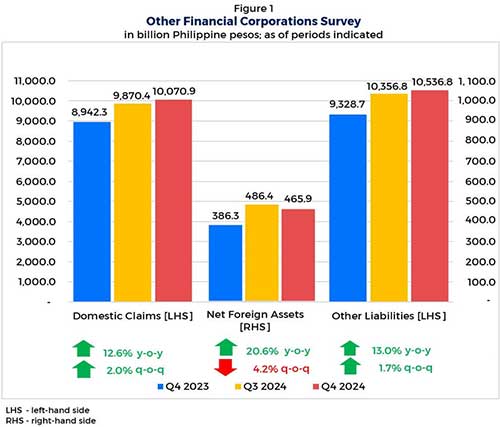

Domestic claims by other financial corporations (OFCs) in the Philippines climbed to ₱10.07 trillion in the fourth quarter of 2024, marking a 2.0 percent quarter-on-quarter increase and a 12.6 percent rise from the same period in 2023, according to preliminary data from the Bangko Sentral ng Pilipinas (BSP).

The increase from ₱9.87 trillion in the third quarter of 2024 and ₱8.94 trillion in the fourth quarter of 2023 was driven largely by higher bank deposits, the BSP said in its Other Financial Corporations Survey (OFCS).

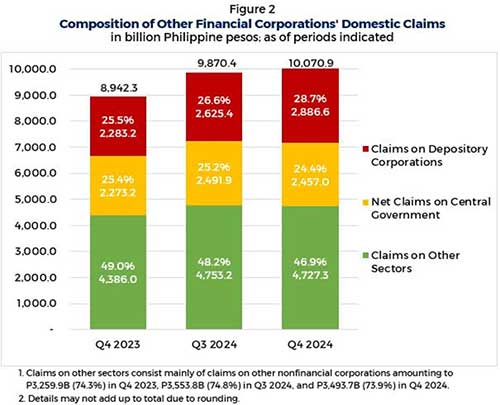

“The quarter-on-quarter growth was primarily due to a rise in claims on depository corporations, especially in the form of bank deposits,” the BSP noted.

Despite the overall rise, the report pointed out that domestic claims were partially offset by reduced holdings of government debt and a decline in equity investments in nonfinancial corporations.

“Claims on the central government declined due to lower holdings of government-issued debt securities,” the BSP said. “Likewise, claims on other sectors fell as the reduction in investments in equity shares issued by other nonfinancial corporations more than offset the increase in loans extended to households.”

Net foreign assets of OFCs dropped by 4.2 percent quarter-on-quarter to ₱465.9 billion in Q4 2024, down from ₱486.4 billion the previous quarter, as deposits with foreign banks and investments in nonresident-issued debt securities declined.

In contrast, liabilities rose by 1.7 percent to ₱10.54 trillion due to greater share and equity issuances, highlighting continued capital-raising efforts in the sector.

Year-on-year, the 12.6 percent rise in domestic claims outpaced the 11.9 percent increase in Q3, with the expansion attributed to stronger deposits with banks, increased household loans, and renewed investments in government-issued securities.

“Claims on other sectors also expanded due to higher holdings of equity shares issued by other nonfinancial corporations and more loans extended to households,” the BSP said. “Moreover, claims on the central government rose due to higher investments in government-issued debt securities.”

While net foreign assets posted a strong 20.6 percent year-on-year gain in Q4 2024, this marked a slowdown from the 31.1 percent rise seen in the previous quarter.

By component, claims on other sectors — particularly other nonfinancial corporations — made up the bulk of OFCs’ domestic claims, followed by those on depository corporations and the central government.

The OFCs’ growing role in the financial ecosystem is underscored by the sector’s doubling of domestic claims since the survey’s inception in Q1 2017.

From an initial ₱5.03 trillion in Q1 2017, domestic claims surged by 100.2 percent to reach ₱10.07 trillion in Q4 2024, demonstrating the sector’s expanded financial influence.

Similarly, other liabilities more than doubled — increasing by 109.8 percent from ₱5.02 trillion in Q1 2017 — as institutions raised more funds through shares and other equity instruments.

The OFCS covers a broad set of financial entities that operate outside traditional banking, including insurance firms, pension funds, trust institutions, money market funds, and other intermediaries that play a key role in credit allocation and capital formation.

According to the BSP, OFCs are “institutional units providing financial services other than banks, non-banks with quasi-banking functions, and the central bank,” encompassing entities critical to the nation’s broader financial stability.