Ant International, a global leader in digital payments and financial technology, reported robust growth across its four core businesses in 2024, underscoring its transformative year driven by innovation and inclusivity.

The company’s businesses—Alipay+, Antom, WorldFirst, and Embedded Finance—achieved significant milestones, fueled by advanced AI and blockchain solutions.

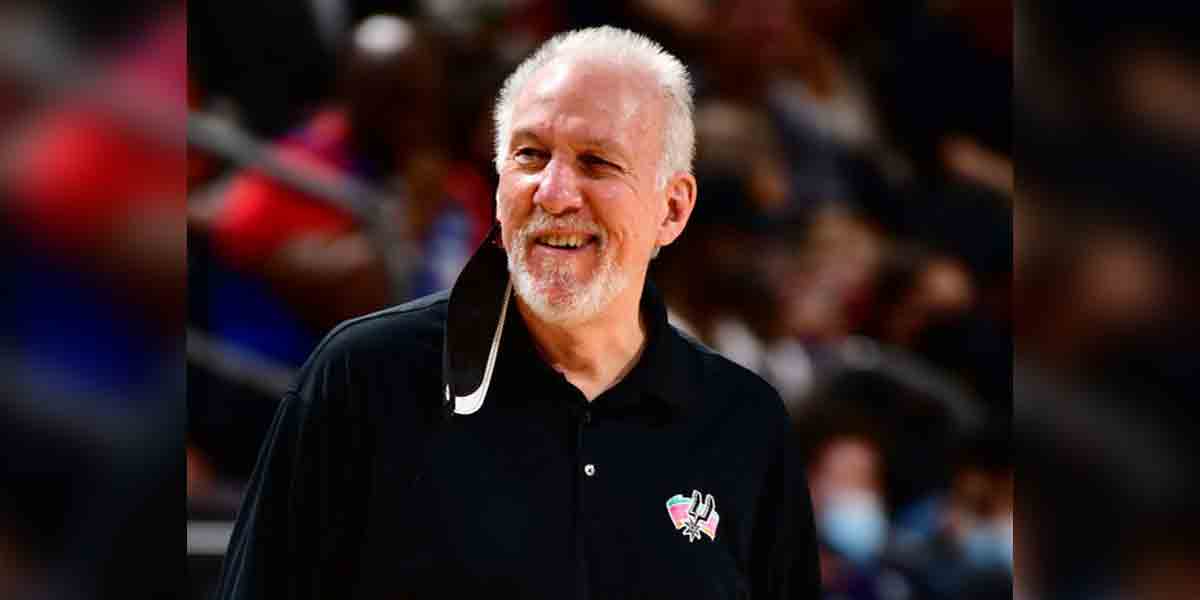

“2024 has been a transformative year for Ant International,” said Peng Yang, CEO of Ant International. “We are committed to advancing inclusive growth through AI-powered innovation and collaboration on cross-border travel, trade, commerce, and inclusive finance.”

Key Achievements Across Pillar Businesses

Alipay+ expanded its cross-border payment and digitalization ecosystem, integrating with 35 mobile payment partners, including e-wallets and banking apps, across 66 markets. It connected over 90 million merchants to 1.6 billion user accounts.

Notably, cross-border transactions via Alipay+ tripled in 2024 compared to the previous year. Over 90% of merchants accepting Alipay+ are small and medium enterprises (SMEs), reflecting Ant International’s commitment to inclusive growth.

Antom strengthened its position as a leading merchant payment and digitization provider, nearly doubling its total payment volume (TPV) from January to November 2024 compared to 2023.

The company introduced groundbreaking tools like Antom Copilot, reducing payment integration time to minutes, and Antom EasySafePay, streamlining digital wallet payments and enhancing security.

WorldFirst, a digital payment platform for global businesses, hit a major milestone, reaching an annual TPV of $100 billion, four times its 2020 figure. Since its acquisition five years ago, WorldFirst has served over 1 million SMEs globally, processing a cumulative $300 billion in payments.

Embedded Finance emerged as a new growth pillar, offering FX, treasury management, and credit solutions to underserved markets. Through partnerships in Bangladesh and Indonesia, Ant International enabled over 11 million micro-businesses and first-time borrowers to access uncollateralized loans via the bettr platform.

“By leveraging AI-powered Credit Tech and Risk Tech capabilities, we’re helping SMEs unlock growth opportunities,” Yang added.

Innovation and Inclusivity Drive Progress

Ant International emphasized its role in lowering cross-border payment costs, in line with G20 goals, through its AI FX models. These solutions provide real-time currency predictions with over 90% accuracy, reducing uncertainty for merchants.

In 2024, the company’s blockchain solution supported over one-third of its total processing volume, offering 24/7 real-time cross-border settlement services. Loans under management for SME financing doubled compared to the previous year.

Yang reaffirmed Ant International’s commitment to SMEs, stating, “In 2025, we will continue to be laser-focused on supporting SMEs across borders with AI-powered innovative and trusted payment, digitalization, and inclusive financing solutions.”

Ant International plans to expand its collaboration with public and private sectors to drive global financial inclusivity.