Results of the Q1 2024 Senior Bank Loan Officers’ Survey (SLOS)[1] indicated that majority of the participating banks maintained their credit standards for loans to businesses and consumers as shown by the modal approach.[2]

Meanwhile, the diffusion index (DI) method[3],[4] reflected a net tightening of lending standards for loans to businesses and an unchanged credit standards for loans to households.

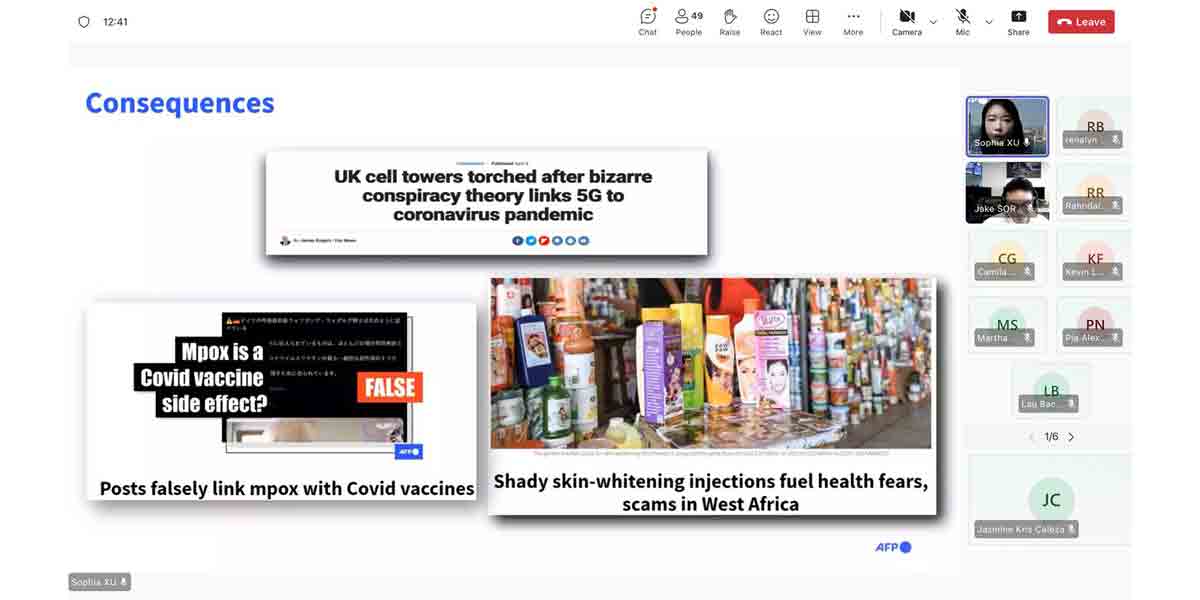

Lending Standards for Loans to Enterprises

Results for Q1 2024 showed that most respondents (86.3 percent) retained loan standards for firms based on the modal approach. Meanwhile, the DI approach indicated a net tightening of lending standards across all borrower firm sizes due to a deterioration of borrowers’ profiles and profitability of bank portfolios and banks’ lower risk tolerance.

For the next quarter, the modal approach showed participant banks’ anticipation of steady lending standards for enterprises. Meanwhile, the DI method pointed to expectations of tightening loan standards given the deterioration in the profitability and liquidity of banks’ portfolios and borrowers’ profiles.

Commercial Real Estate Loans. Q1 2024 SLOS results showed a higher number of respondents (88.9 percent) that maintained overall credit standards for commercial real estate loans (CRELs). Meanwhile, the DI results indicated net tightening credit standards for CRELs largely due to banks’ reduced tolerance for risk, and a deterioration in borrowers’ profiles and profitability of banks’ portfolios. Over the following quarter, a larger percentage of bank participants anticipate to retain their lending standards for CRELs based on the modal approach, while the DI-based method pointed to expectations of net tightening loan standards.

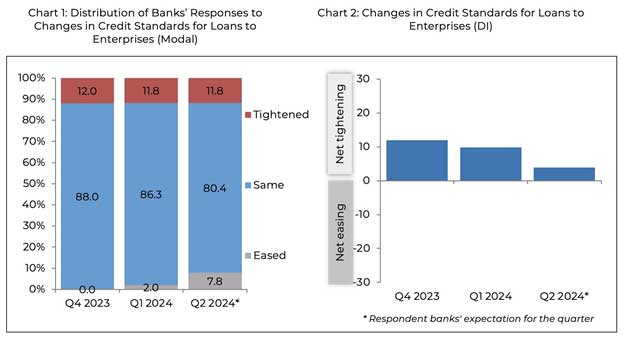

Lending Standards for Loans to Households

In Q1 2024, both the modal and DI methods revealed that surveyed banks maintained lending standards to household loans due to banks’ unchanged risk tolerance, steady profitability of banks’ asset portfolios, as well as stable economic outlook and profile of borrowers.

In the next quarter, modal results showed a higher number of bank respondents anticipating maintained loan standards for households. Meanwhile, the DI approach indicated a net tightening of credit standards largely due to banks’ expectations of a deterioration in the profitability of their portfolios and on borrowers’ profiles as well as banks’ reduced tolerance for risk.

Housing Loans. Results of the modal approach for Q1 2024 indicated that most respondents (75.0 percent) maintained credit standards for housing loans. Similarly, the DI method indicated unchanged housing loans standards due to banks’ steady risk tolerance and stable economic outlook. Over the following quarter, respondent banks continue to anticipate unchanged lending standards for housing loans in terms of both modal and DI methods.

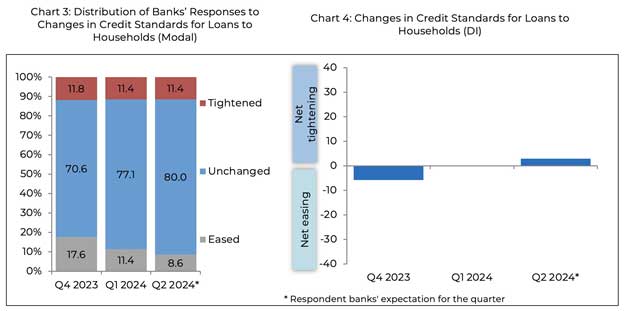

Loan Demand from Enterprises

A majority of the surveyed banks (70.6 percent) pointed to a steady overall demand for business loans based on the modal method. Meanwhile, the DI approach showed a net increase in loan demand from across all firm classifications driven by banks’ more attractive financing terms, bank customers’ lack of alternative sources of funds, and improvement in clients’ economic expectations, among others.

Over the following quarter, most of the participating banks anticipate broadly steady business loan demand. Meanwhile, the DI method indicated that participating banks expect a net increase in credit demand from businesses in Q2 2024 as firms finance their accounts receivable and operational requirements, such as increasing inventory levels to meet expected demand amid a more optimistic economic outlook. [5]

Commercial Real Estate Loans. Based on the modal approach, loan demand for CRELs was generally unchanged in Q1 2024 and is also expected to remain steady in Q2 2024. However, the DI-based results showed a net increase in CREL demand for Q1 2024 and in the succeeding quarter which is associated with higher customer inventory and accounts receivable financing needs, improvement in customers’ economic outlook, among other factors.

Loan Demand from Households

A steady household loan demand was reflected by most surveyed banks (68.6 percent) in Q1 2024 based on the modal results. On the other hand, the DI method showed a net increase in demand from all key household loan categories driven by increasing household consumption and banks’ more attractive financing terms.[6]

For Q2 2024, modal results indicated that most respondent banks expect basically unchanged credit demand from households. Meanwhile, the DI method showed an anticipated net increase in consumer loan demand due mainly to higher household consumption and banks’ favorable financing terms.

Housing Loans. A higher proportion of survey participants (75.0 percent) noted unchanged loan demand for housing for Q1 2024 and expect the same for Q2 2024 based on the modal method. Meanwhile, the DI approach reflected a net increase in housing loan demand for the current quarter and the next quarter due mainly to banks’ attractive financing terms and higher household investment for housing. (BSP)

[1] The SLOS consists of questions on loan officers’ perceptions relating to the overall credit standards of their respective banks, as well as to factors affecting the supply of and demand for loans to both enterprises and households. The analysis of the results of the SLOS focuses on the quarter-on-quarter changes in the perception of respondent banks. The responses for the Q1 2024 SLOS were gathered between 28 February to 8 April 2024 with a total of 53 respondent banks out of 60 surveyed banks. The response rate of 88.3 percent is higher compared to the response rate of 83.6 percent in the previous quarter.

[2] In the modal approach, the results of the survey are analyzed by looking at the option with the highest share of responses. The three options for the modal approach are either 1) tightening, 2) easing, or 3) unchanged credit standards for loans to enterprises and for loans to households.

[3] In the DI approach, a positive DI for credit standards indicates that the proportion of respondent banks that have tightened their credit standards exceeds those that eased (“net tightening”), whereas a negative DI for credit standards indicates that more respondent banks have eased their credit standards compared to those that tightened (“net easing”). Meanwhile, an unchanged credit standards in the DI approach indicates that the proportion of the respondent banks that have tightened their credit standards is equal to those that eased their credit standards.

[4] During the Q1 2010 to Q4 2012 survey rounds, the BSP used the DI approach in the analysis of survey results. Beginning in Q1 2013, the BSP used both the modal and DI approaches in assessing the results of the survey.

[5] The BSP Business Expectations Survey (BES) indicated that businesses are less optimistic in Q1 2024. For the next quarter, however, the country’s business confidence was more bullish as the overall confidence index (CI) rose to 48.1 percent from 38.2 percent in the Q4 2023 survey result. The firms’ more optimistic outlook for Q2 2024 was attributed to their expectations of: (a) higher demand for products and services, (b) completion of more projects due to a more conducive business environment, (c) seasonal uptick in business activities in the tourism and fisheries sub-sectors during the summer and open fishing seasons, (d) business expansions and development of new products, and (e) easing inflation.

[6] The BSP Q1 2024 Consumer Expectations Survey (CES) stated that the consumer sentiment in the Philippines improved in Q1 2024 as the overall confidence index (CI) became less negative at -10.9 percent from -19 percent in Q4 2023. This improvement means that although the pessimists continued to outnumber the optimists, the number of pessimists declined compared to the Q4 2023 survey results. According to the respondents, their improved outlook in Q1 2024 was brought about by their expectations of: (a) additional and higher income, (b) availability of more jobs and permanent employment, and (c) additional working family members.