The Bureau of Internal Revenue (BIR) and the Bureau of Customs (BOC) significantly enhanced revenue collections in 2024 through intensified digitalization and strict enforcement initiatives.

Total tax collections by the end of November 2024 reached PHP 3.55 trillion, a 11.5% increase from the same period in 2023. Emerging collections for the year are projected to hit PHP 3.82 trillion, representing 14.4% of GDP, up from 14.1% last year.

“I commend the BIR and BOC for their accomplishments. Their efforts have funded the government’s priority projects and programs, ensuring a better future for Filipinos,” said Finance Secretary Ralph G. Recto. “We continue to work non-stop to strengthen our tax system to inspire trust and compliance.”

The BIR collected PHP 2.67 trillion as of November 2024, marking a 13.9% growth. Key to this success was the acceleration of its Digital Transformation (DX) Program, which completed or piloted 16 out of 27 projects.

Among these is the Online Registration and Update System (ORUS), which issued 470,387 digital Tax Identification Number (TIN) IDs.

The enhanced One-Time Transaction (ONETT) System generated PHP 4.37 billion in collections from 33,198 Electronic Certificates Authorizing Registration (eCAR).

The BIR also optimized Chatbot Revie for interactive taxpayer queries and expanded its Run After Fake Transactions (RAFT) program, collecting PHP 3.44 billion from 1,500 assessment notices.

Its Run After Tax Evaders (RATE) program filed cases involving PHP 1.78 billion in tax liabilities from January to November 2024.

Meanwhile, the BOC’s collections rose by 4.7% to PHP 850 billion. The agency achieved a 97% digitalization rate with systems such as the Overstaying Cargo Tracking System and Enhanced e-Travel System.

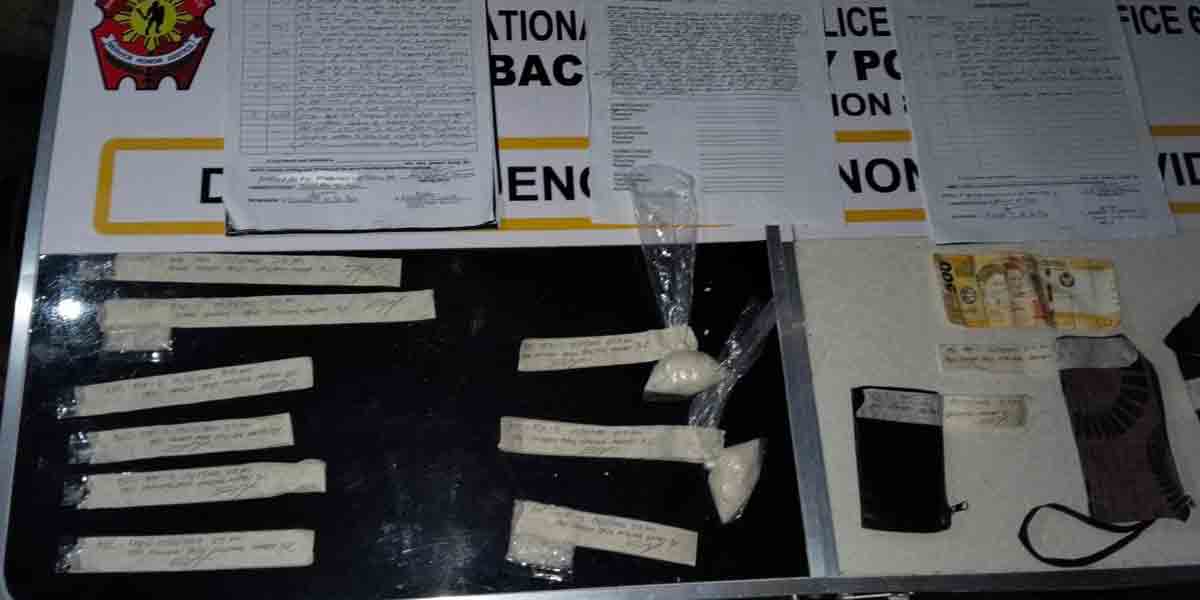

The BOC seized PHP 84.36 billion worth of smuggled goods, including counterfeit items, illegal drugs, and cigarettes.

Notably, it donated 21 containers of confiscated frozen mackerel worth PHP 178.5 million to 150,000 marginalized families.

The BOC collected PHP 220.77 billion in taxes under the Fuel Marking Program, marking 18.23 billion liters.

Enhanced inspections led to the closure of 14 bonded warehouses, while 75 scanning machines at airports and 34 scanners at seaports boosted detection capabilities.

Through collaborative efforts like the Customs Industry Consultative and Advisory Council (CICAC), the BOC strengthened ties with 181 organizations to improve customs processes and resolve industry concerns.