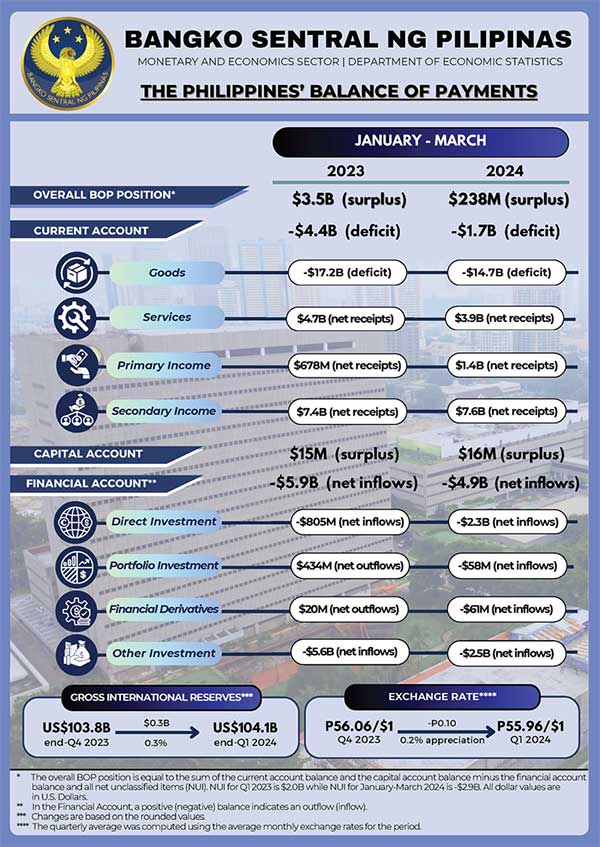

The country’s balance of payments (BOP) position registered a surplus of US$238 million in Q1 2024, lower than the US$3.5 billion surplus recorded in Q1 2023.

The BOP surplus declined in Q1 2024 due to lower net inflows in the financial account, notwithstanding the contraction in the current account deficit.

Current Account. The current account deficit in Q1 2024 reached US$1.7 billion (equivalent to -1.6 percent of the country’s GDP), lower by 60.6 percent than the US$4.4 billion deficit (equivalent to -4.3 percent of the country’s GDP) posted in Q1 2023. This development reflected the narrowing trade in goods deficit and the expansion of net receipts in the primary and secondary income accounts. This was partly muted by the contraction of net receipts from trade in services.

The trade in goods deficit narrowed as exports rose and imports fell. An estimated 98.4 percent of the increase in the exports value was due to volume changes, while 99.1 percent of the decrease in the imports value was driven by price changes.[1]

Capital Account. The capital account recorded net receipts of US$16 million in Q1 2024, up by 11.5 percent from the US$15 million net receipts recorded in Q1 2023. This developed on account of the increase in net receipts from other capital transfers (to US$17 million from US$15 million).

Financial Account. The financial account registered net inflows (or net borrowings by residents from the rest of the world) of US$4.9 billion in Q1 2024, lower by 17.1 percent compared with the US$5.9 billion net inflows posted in Q1 2023. This was attributable mainly to the decrease in net inflows in the other investment account. The decline, however, was tempered by the increase in the net inflows in the direct investment account, and the reversal of the portfolio investment account and financial derivatives account to net inflows (from net outflows).

Gross International Reserves

The country’s gross international reserves (GIR) amounted to US$104.1 billion as of end-March 2024, higher than the US$101.5 billion level registered as of end-March 2023.

Exchange Rate

The peso averaged P55.96/US$1 in Q1 2024, appreciating by 0.2 percent from P56.06/US$1 in Q4 2023. However, on a year-on-year basis, the peso depreciated by 2.0 percent from P54.86/US$1 in Q1 2023.

[1] Estimates were based on the Philippine Statistics Authority’s (PSA) International Merchandise Trade Statistics (IMTS)