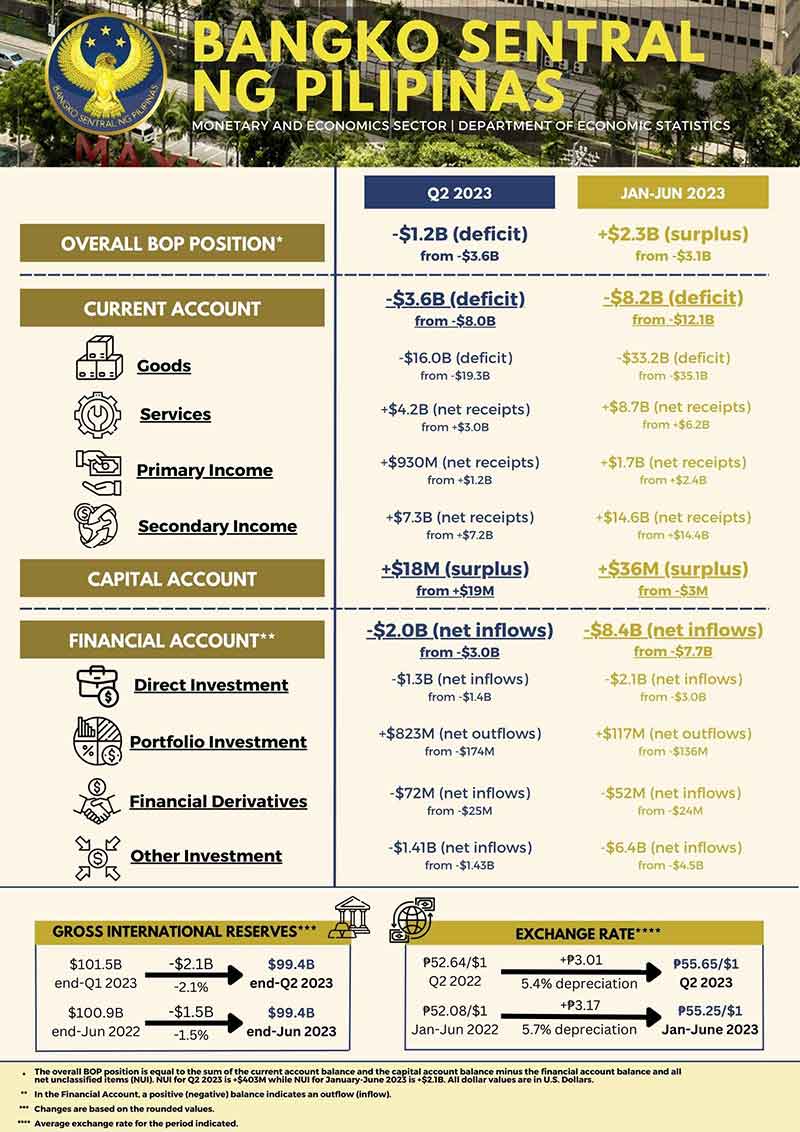

The country’s balance of payments (BOP) position registered a deficit of US$1.2 billion in Q2 2023, lower than the US$3.6 billion deficit recorded in the same quarter last year.

This development was due to the decline in the current account deficit, which resulted largely from the narrowing of the trade in goods deficit and the increase in net receipts of trade in services.

Meanwhile, the financial account posted lower net inflows in Q2 2023 due mainly to the reversal of the portfolio investment account to net outflows.

Current Account. The current account registered a deficit of US$3.6 billion (equivalent to -3.4 percent of the country’s GDP) in Q2 2023, lower than the US$8.0 billion deficit (equivalent to -7.8 percent of the country’s GDP) recorded in the same quarter in 2022. This development resulted mainly from the narrowing of the trade in goods deficit alongside the increase in net receipts in the trade in services and secondary income accounts. This was partly muted by the decrease in net receipts in the primary income account.

Capital Account. The capital account recorded net receipts of US$18 million in Q2 2023, slightly lower by 4.5 percent than the US$19 million net receipts recorded in Q2 2022. In particular, net capital transfers of financial corporations and other sectors declined to US$1 million in the second quarter of 2023 from US$3 million in Q2 2022.

Financial Account. The financial account recorded net inflows (or net borrowing by residents from the rest of the world) of US$2.0 billion in the second quarter of the year, lower by 34.9 percent than the US$3.0 billion net inflows posted in the same period a year ago. This was on account of the reversal of the portfolio investment account to net outflows coupled with moderately lower net inflows of direct and other investments.

January – June 2023 Developments

The BOP position posted a surplus of US$2.3 billion in the first half of 2023, a reversal from the US$3.1 billion deficit recorded in the same period a year ago. This outcome was due primarily to the decline in the current account deficit, which resulted from higher net receipts of trade in services and lower trade in goods deficit. Moreover, the financial account posted higher net inflows mainly from other investments.

Current Account. The current account recorded a deficit of US$8.2 billion (equivalent to -4.0 percent of GDP) in the first half of 2023, lower by 32.2 percent than the US$12.1 billion deficit (equivalent to -6.1 percent of GDP) recorded in the same period last year. The lower current account deficit emanated from the increase in net receipts of the trade in services and secondary income accounts, alongside the narrowing of the trade in goods deficit. This was partly mitigated by the lower net receipts in the primary income account.

Capital Account. The capital account recorded net receipts amounting to US$36 million in the first semester of 2023, a reversal from the US$3 million net payments in the same period last year. This was due mainly to the decline in gross acquisitions of non-produced non-financial assets (e.g., patents, trademarks, and copyrights) to US$3 million in the first semester of 2023 from the US$44 million recorded in Q2 2022.

Financial Account. The financial account posted net inflows (or net borrowing by residents from the rest of the world) amounting to US$8.4 billion the first half of the year, higher by 8.7 percent than the US$7.7 billion in the comparable period in 2022. The increase in net inflows emanated mainly from the higher net inflows of other investments, which more than offset the decline in net inflows of direct investments and the reversal of the portfolio investment account to net outflows.

Gross International Reserves

The country’s gross international reserves (GIR) settled at US$99.4 billion as of end-June 2023, lower than the US$100.9 billion level registered as of end-June 2022.

Exchange Rate

The peso averaged at P55.65/US$1 in Q2 2023, depreciating by 1.4 percent from an average of P54.86/US$1 in Q1 2023. Similarly, the peso depreciated year-on-year by 5.4 percent from an average of P52.64/US$1 in Q2 2022. For January to June 2023, the peso averaged at P55.25/US$1, depreciating against the US dollar by 5.7 percent from an average of P52.08/US$1 in the first half of 2022.

View Full Report: https://www.bsp.gov.ph/Media_And_Research/Balance%20of%20Payments%20Report/2023/BOP_2qtr2023.pdf