Q2 2021 Developments

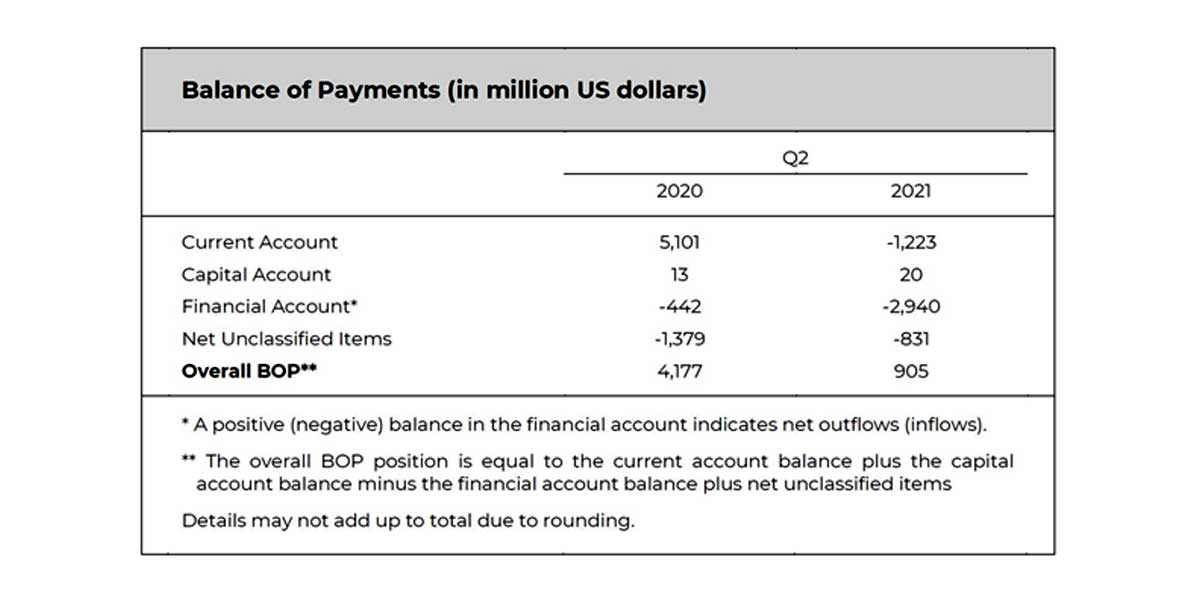

The country’s balance of payments (BOP) posted a surplus of US$905 million in Q2 2021, lower by 78.3 percent than the US$4.2 billion surplus in the same quarter last year. This was due to the reversal of the current account to a deficit in Q2 2021 from a surplus in Q2 2020.

Current Account. The current account reversed to a deficit of US$1.2 billion from a US$5.1 billion surplus in Q2 2020. In particular, the merchandise trade deficit widened due to the sustained growth in imports, following the gradual resumption of domestic economic activities.

Capital Account. Net receipts in the capital account grew by 49.8 percent to US$20 million in Q2 2021 from US$13 million in Q2 2020 due to the decline in net payments for non-produced nonfinancial assets (e.g., patents, trademarks, and copyrights).

Financial Account. Net inflows in the financial account rose substantially by 565.9 percent to US$2.9 billion from US$442 million last year. The increase in net inflows was due mainly to the reversal of the portfolio (due, in turn, to non-residents’ investments in government bond issues) and other investment accounts to net inflows and the increase in net inflows of direct investments.

January-June 2021 Developments

The overall BOP position reversed to a deficit of US$1.9 billion in the first half of 2021 from a US$4.1 billion surplus in the same period last year.

Current Account. The current account reversed from a surplus of US$4.8 billion in the first half of 2020 to a deficit of US$1.2 billion in the first half of 2021. The merchandise trade deficit widened further to US$22.5 billion from US$15.3 billion last year as the growth in imports (by 31.6 percent to US$49.3 billion) outpaced that of exports (by 21.3 percent to US$26.8 billion). Meanwhile, net receipts of primary income declined by 12.4 percent to settle at US$1.7 billion.

Capital Account. Net receipts in the capital account rose by 41.1 percent to US$37 million in the first half of 2021 from US$26 million last year due mainly to the decline in net payments for non-produced nonfinancial assets (e.g., patents, trademarks, and copyrights).

Financial Account. The financial account net outflows contracted by 28.7 percent to US$1.2 billion in the first half of 2021 from US$1.7 billion in the same period in 2020. This development was due to the reversal of the other investment account to net inflows of US$2.1 billion (from net outflows of US$3.3 billion) and the 89.3 percent increase in net inflows of direct investments to US$3.4 billion (from US$1.8 billion).

Gross International Reserves

The country’s gross international reserves (GIR) amounted to US$105.8 billion as of end-June 2021, significantly higher than the US$93.5 billion level registered as of end-June 2020. At this level, the reserves can adequately cover 10.6 months’ worth of imports of goods and payments of services and primary income. It was also equivalent to 7.5 times the country’s short-term external debt based on original maturity and 5.1 times based on residual maturity. The year-on-year increase in reserves largely reflected inflows from the National Government’s (NG) net foreign currency deposits with the BSP as well as the net foreign exchange operations and income of the BSP from its investments abroad. Moreover, the upward adjustment in the value of the BSP’s gold holdings due to the increase in the price of gold in the international market contributed also to the increase in the GIR level.

Exchange Rate

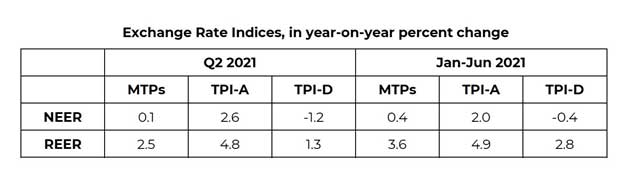

In the second quarter and the first half of the year, the peso appreciated against the baskets of currencies of major trading partners (MTPs) and trading partners in advanced (TPI-A) economies in nominal and real terms, indicating a slight loss in external competitiveness against these trade baskets of currencies for the said periods. Meanwhile, in Q2 and the first half of 2021, the nominal effective exchange rate (NEER) index depreciated against the basket of currencies of developing (TPI-D) countries by 1.2 and 0.4 percent, respectively.