Q4 2021 Developments

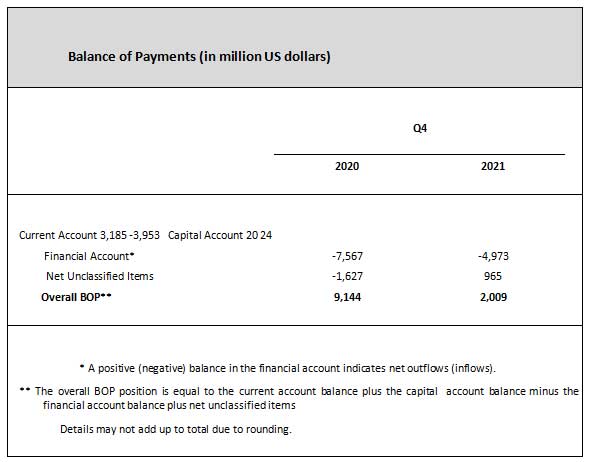

The country’s balance of payments (BOP) position posted a lower surplus of US$2 billion in Q4 2021 from the US$9.1 billion surplus registered in the same quarter in 2020.

Current Account. The current account recorded a deficit of US$4 billion (equivalent to -3.5 percent of GDP) in Q4 2021, a reversal of the US$3.2 billion surplus (equivalent to 3.0 percent of GDP) posted in the same quarter in 2020. This outcome was brought about by the widening of the trade in goods deficit, alongside the downtrend in net receipts of services and primary income accounts.

The deficit, however, was tempered in part by the increase in net receipts of secondary income.

Capital Account. The capital account posted net receipts of US$24 million in the fourth quarter of

2021, equivalent to a 19.3 percent growth from the US$20 million net receipts recorded a year ago. This ensued on account of the reversal to gross disposal/sale (from gross acquisition) of nonproduced non-financial assets (e.g., patents, trademarks, and copyrights).

Financial Account. The financial account recorded net inflows (or net borrowing by residents from the rest of the world), amounting to US$5 billion in Q4 2021. However, this was lower by 34.3 percent from the US$7.6 billion net inflows recorded in the same quarter last year. This was largely on account of the reversal to net outflows of the portfolio investment account alongside the decline in net inflows of other investments. These net outflows were partially offset by the increase in net inflows in the direct investment and financial derivatives accounts.

January-December 2021 Developments

The BOP position yielded a lower surplus of US$1.3 billion in 2021 from the US$16 billion surplus recorded in the previous year.

Current Account. The current account recorded a deficit of US$6.9 billion (equivalent to -1.8 percent of GDP) in 2021, a reversal of the US$11.6 billion surplus (equivalent to 3.2 percent of GDP) recorded in 2020. The reversal of the current account surplus to a deficit emanated from the widening of the merchandise trade gap, coupled with the reduction in net receipts in the primary income account. This was partly mitigated by the expansion in net receipts of the secondary income and trade in services accounts.

Capital Account. The capital account posted a 26.3 percent growth in net receipts to reach US$80 million in 2021 from US$63 million in 2020. This resulted from the lower gross acquisition of non-produced non-financial assets, which fell by 77.2 percent to US$4 million.

Financial Account. The net inflows in the financial account rose moderately by 0.5 percent in 2021 with the level broadly unchanged at US$6.9 billion. An increase in net inflows was noted in the direct and other investment accounts as well as the financial derivatives account. However, these inflows were offset in part by the reversal of the portfolio investment account to net outflows.

Gross International Reserves

The country’s gross international reserves (GIR) amounted to US$108.79 billion as of end-December 2021, lower than the US$110.12 billion level registered as of end-December 2020. At this level, the reserves adequately covered 9.6 months’ worth of imports of goods and payments of services and primary income. It was also equivalent to 7.2 times the country’s short-term external debt based on original maturity and 5.1 times based on residual maturity. The year-on-year decrease in reserves reflected outflows largely from the National Government’s payments of its foreign currency debt obligations and downward adjustments in the value of the BSP’s foreign currency-denominated reserve assets and gold holdings. By asset component, the bulk of international reserves were held in the form of foreign investments (84.2 percent), gold (8.6 percent), and the rest in aggregated holdings of Special Drawing Rights (3.6 percent), foreign exchange

(2.8 percent), and reserve position in the Fund (0.7 percent).

Exchange Rate

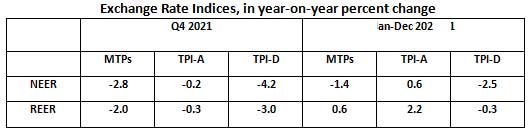

For Q4 2021, the peso depreciated by 4.3 percent against the US dollar to average P50.45/US$1 from the Q4 2020 average of P48.27/US$1. The peso was observed to be more volatile during the quarter in review as the standard deviation of the peso rose to P0.28 from the P0.19 posted in the same quarter in 2020. On an annual basis, the peso appreciated slightly by 0.8 percent from P49.62/US$1 in 2020 to P49.25/US$1 in 2021. For the fourth quarter of 2021, the peso depreciated against the basket of currencies of major trading partners (MTPs), trading partners in advanced (TPI-A) and developing (TPI-D) economies in both nominal and real terms. For full-year 2021, the peso weakened against the basket of currencies of TPI-A, but gained in external price competitiveness against the basket of currencies of TPI-D in both nominal and real terms.

Exchange Rate Indices, in year-on-year percent change