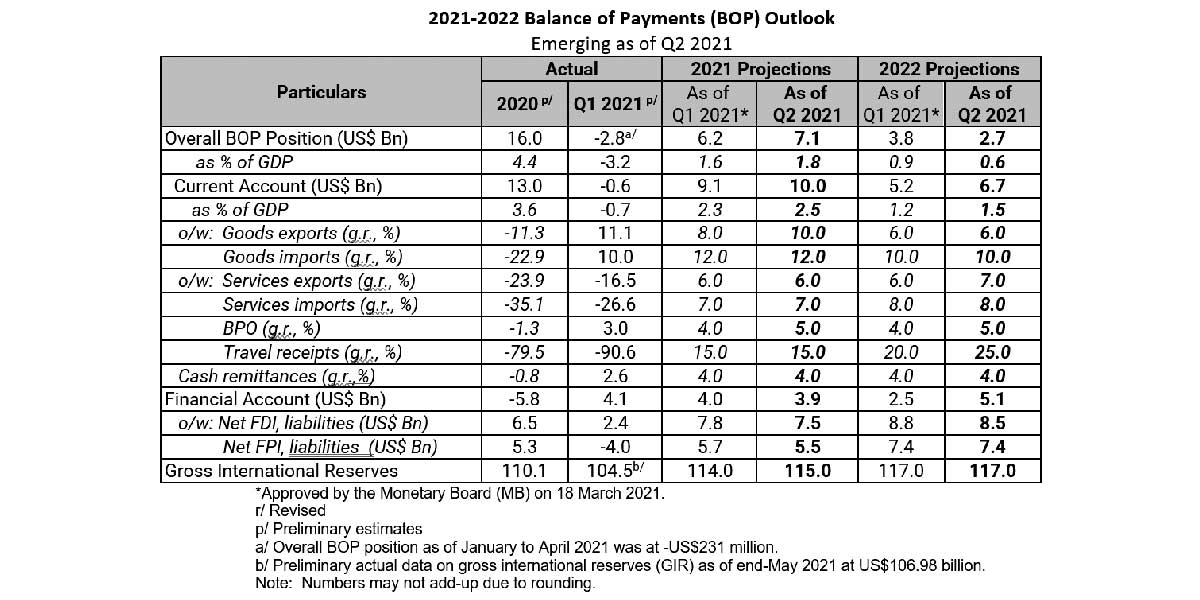

The Monetary Board approved the new set of 2021 and 2022 balance of payments (BOP) projections during its 17 June 2021 meeting. This latest set of BOP projections revisits the forecast for 2021 and 2022, approved by the MB on 18 March 2021, given latest data as well as actual and emerging developments.

Overall, the latest BOP assessment for 2021 reflects sustained optimism fueled by expectations of improved global and domestic economic landscape moving into the second half of 2021. The better-than-expected global economic outlook for the year is driven by upward revisions in the growth prospects of major advanced economies such as the US and Japan, the country’s major trading partners.

On the domestic front, the continued strong whole-of-government support to stimulate recovery along with efforts of both the public and private sectors to accelerate the rollout of COVID-19 vaccines particularly in the latter part of the year, are expected to provide a boost to market confidence and encourage further expansion of domestic economic activities over the near term.

For 2022, both global and domestic economic activities are expected to carry on the same momentum of recovery anticipated in the second half of 2021. As governments continue to pour in significant fiscal support to steer their respective economies back on track and with vaccine production and distribution foreseen to be more widely facilitated globally, external demand in both goods and services are seen to pick up further.

These developments should support prospects for the gradual return of international travel in 2022 and could pave the way for increased deployment/re-deployment of overseas Filipino workers. Nonetheless, uncertainties remain high as the virus continues to evolve.

The latest estimated 2021 BOP surplus of US$7.1 billion (1.8 percent of GDP) is lower than the 2020 outturn yet higher than the US$6.2 billion (1.6 percent of GDP) projection released in March 2021. This is primarily reflective of the upward revision in the current account to a surplus of US$10.0 billion (2.5 percent of GDP) in 2021 from the previous projection of US$9.1 billion (2.3 percent of GDP).

The upward revision is supported by an anticipation of an accelerated recovery in goods exports by 10.0 percent (from an Initially projected growth of 8.0 percent) amid expected quicker resumption in global economic activity during the year, as well as goods imports growth likely to gain momentum at 12.0 percent (unchanged from the previous exercise).

Services exports and imports are seen to grow by 6.0 percent and 7.0 percent, respectively, in 2021, consistent with the foreseen improvements, albeit modest, in both travel and business process outsourcing receipts during the year.

OF cash remittances are seen to recover by 4.0 percent in 2021, unchanged from the previous projection. This is supported by expectations of improved labor mobility following rising vaccination levels in the country and in major OF-destination countries, easing of travel restrictions, and re-opening of borders to foreign workers.

The financial account is projected to post lower net outflows on the back of the expected higher foreign direct investments (FDIs) of US$7.5 billion and foreign portfolio investments (FPIs) of US$5.5 billion alongside foreign exchange inflows arising from the programmed borrowings of the government.

The emerging 2021 GIR is seen at US$115 billion (equivalent to 11.9 months of imports of goods and payments of services and primary income). The revised GIR forecast is US$1 billion higher than the March 2021 projection of US$114 billion due to revaluation adjustments and projected sustained foreign borrowings by the national government in response to the COVID-19 pandemic as well as to aggressively fund recovery-supportive infrastructure.

In 2022, the overall BOP surplus is forecasted to settle lower than in 2021 at US$2.7 billion (0.6 percent of GDP), driven mainly by the anticipated narrower current account surplus of US$6.7 billion (1.5 percent of GDP) for the year. This outlook is hinged mainly on the projected sustained positive performance of both exports (6.0 percent growth) and imports (10.0 percent) of goods as the more widespread vaccine rollout could lessen mobility issues and bottlenecks affecting supply chains.

Meanwhile, FDI and FPI inflows are projected to reach US$8.5 billion and US$7.4 billion, respectively, as the investment climate improves further. The emerging GIR level in 2022 is estimated to reach US$117 billion in anticipation of continued NG foreign currency deposits to address the impact of the pandemic and to fast-track its infrastructure program.

Overall, in this assessment of the BOP outlook, both upside and downside risks remain significant. The new set of projections factor in potential downside risks emanating from the ongoing disruptions from the pandemic.

The threat of resurgence of COVID-19 cases as well as the emergence of new and more transmissible variants of the virus coupled by concerns over the risk of slower-than-expected vaccine deployment amid supply issues could cast a shadow on the projected recovery path as these could continue to pose mobility limitations.

As such, it is deemed imperative to remain mindful and vigilant of risks attributed to the efficacy of vaccines in the face of constant virus mutation, appropriate timing of withdrawal of policy support and in ensuring that the unprecedented rise in both government and corporate debt levels will not escalate into another crisis of its own.

The BSP therefore continues to emphasize limitations to the projections given the current volatile environment. Moving forward, the BSP will continue to remain vigilant in monitoring emerging external sector developments and risks and how these may impact the BSP’s fulfillment of its price and financial stability objectives.