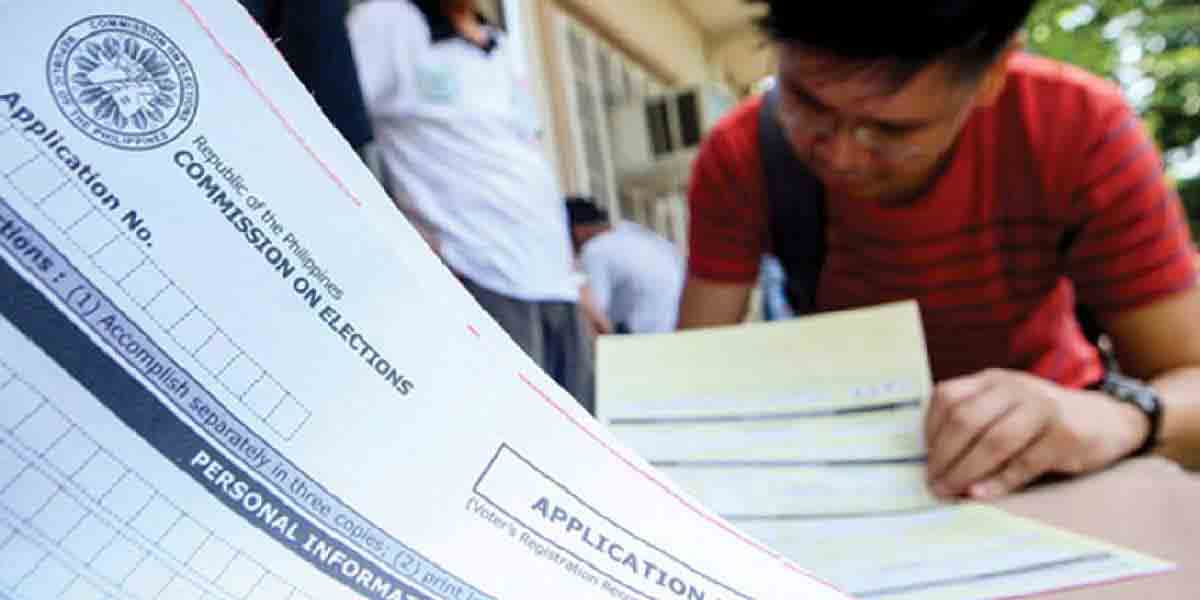

The Bangko Sentral ng Pilipinas (BSP) and the Alliance for Financial Inclusion jointly hosted the Knowledge Exchange Program on Central Bank Digital Currencies (CBDC) for Financial Inclusion from March 1-3, 2022.

This is part of ongoing efforts to explore and evaluate potential use cases of the technology.

“We can say that CBDC may be an idea whose time has come, but certainly it has many aspects that need to be better understood,” Governor Diokno said in his opening remarks.

In 2021, the BSP initiated an exploratory study on CBDC, followed by a national payment system assessment to identify relevant use cases for the digital fiat money.

“As next step, the BSP targets to roll-out in the near term, a pilot CBDC implementation which we call Project CBDCPh. The project aims to build organizational capacity and hands-on knowledge of key aspects of CBDC that are relevant for a use case around addressing frictions in the national payment system,” the Governor added.

The three-day knowledge exchange program featured insights from central banks, multilateral institutions, policy thinktanks, financial service providers and other private institutions. The program examined the potential and impact of CBDC on financial inclusion and looked at the various design considerations and implementation challenges, including the underlying technology.

Aside from the BSP, participants from the central banks of Malaysia, Thailand, Cambodia, Armenia, Bahamas, Ghana, and Sweden attended the three-day virtual knowledge exchange program.

The BSP is a founding member of AFI, a global network of 100 members from 89 countries composed of central banks and regulatory financial institutions working jointly to promote financial inclusion across the globe.