The Bangko Sentral ng Pilipinas (BSP) and its partner organizations are working on online and innovative training platforms to broaden the reach of financial education (fin-ed) and strengthen consumer protection.

This was announced at the Launch of the Innovative Financial Education Programs at the BSP Manila Head Office on 5 August 2024.

Among others, the BSP has created the BSP E-Learning Academy, (BELA) an online platform that provides e-learning courses on personal finance, economics, and central banking. It complements the BSP’s existing fin-ed programs that are delivered face-to-face and through other modalities.

Select stakeholders are now testing BELA, which is expected to be fully accessible to the public by the second quarter of 2025.

BSP Deputy Governor Bernadette Romulo-Puyat said, “Our initiatives are designed to help people safeguard credit cardholders from potential pitfalls, transform over 37,000 DSWD employees and 3,600 local social welfare officers into champions of financial literacy, and capacitate over 10.8 million Filipino farmers and fisherfolk through innovative educational tools.”

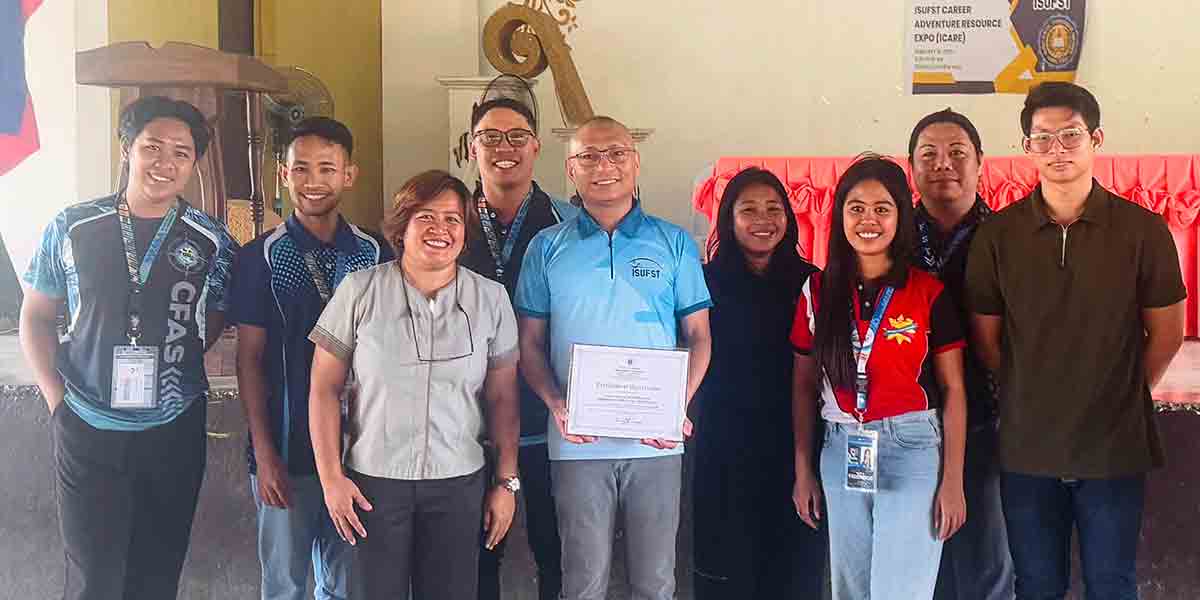

The event also served as venue for the signing of separate fin-ed partnership agreements for the BSP by Deputy Governor Romulo-Puyat, representing Governor Eli M. Remolona, Jr., with Department of Social Welfare and Development (DSWD) Secretary Rex T. Gatchalian, Department of Agriculture (DA) Undersecretary Asis G. Perez, Credit Card Association of the Philippines (CCAP) Chairman Rolando P. Ebreo, BDO Foundation (BDOF) President Mario A. Deriquito, and BDO Unibank, Inc. President and BDOF Trustee Nestor V. Tan.

BSP Managing Director Charina B. De Vera-Yap underscored the role of partner agencies in BSP’s fin-ed initiatives.

She said, “Our journey is just beginning, and every step we take brings us closer to a brighter future for every Filipino, ensuring that no one is left behind—na kabilang ang lahat.”

Launched at the event was the first batch of the BSP-BDOF fin-ed e-learning modules, covering financial planning, budgeting and saving, and debt management.

These can now be accessed through BELA and will soon be available on the e-learning platforms of the BSP’s institutional fin-ed partners.

Additional six courses being developed by the BSP-BDOF include the basics of investing, fraud and scams, financial consumer protection, digital financial literacy, Personal Equity Retirement Account, and relevant economic indicators. These will also be made available through BELA and to BSP’s institutional partners.

Meanwhile, the Memorandum of Agreement (MOA) between BSP, DSWD, and BDOF formalizes their cooperation in designing and implementing a fin-ed program for DSWD employees and social welfare officers of local government units. This will be part of the DSWD Academy’s regular training program.

In his message of support, DSWD Secretary Gatchalian said: “The launching of the innovative financial education programs of the BSP will bridge the gap and break barriers to the lack of accessible learning resources. It is imperative to shift towards greater financial independence and literacy as we embark on inclusive financial services for the Filipino people.”

The Memorandum of Understanding inked by BSP, DA, and BDOF aims to consolidate fin-ed programs they developed for farmers and fisherfolk.

These include the games Fish N’ Learn, which simulates real-life events that influence the financial behavior of fishermen and their families, and KITA Mo Na! (Kapital at Ipon Tungo sa Asenso), which emphasizes agripreneurship and good credit standing.

The BSP and CCAP also signed a MOA to craft a credit card e-learning course and provide stakeholders with learning resources. The course will also be accessible through BELA.

These initiatives are in line with the implementation of the National Strategy for Financial Inclusion 2022-2028, which aims to facilitate a well-coordinated, whole-of-nation undertaking to achieve inclusive growth and financial resilience for Filipinos.