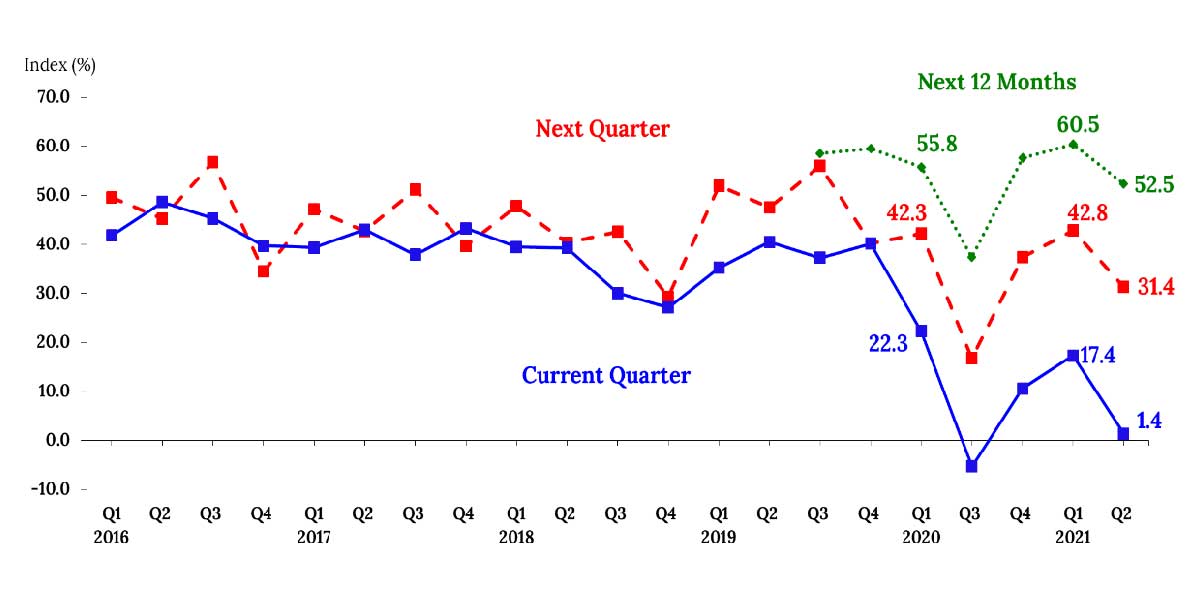

Business confidence weakened for Q2 and Q3 2021, as the overall confidence index (CI) for both quarters decreased from previous quarter’s survey results. In particular, the CI for Q2 2021 dropped to 1.4 percent from 17.4 percent in Q1 2021 while that for Q3 2021, declined to 31.4 percent from the previous quarter’s survey result of 42.8 percent.

The respondents’ less optimistic outlook for the two quarters of 2021 was attributed primarily to the following: (a) upsurge of COVID-19 cases, (b) re-imposition of stricter community quarantine, particularly in NCR Plus, and (c) elevated inflation rate due to supply constraints. Respondents also cited concerns over the pace of the vaccination roll-out for the current quarter as well as the expected seasonal factors for Q3 2021 such as the close of the milling season and the usual slack in demand for power and construction materials during the rainy season as reasons for their less buoyant sentiment for Q2 and Q3 2021, respectively.

Similarly, due to the aforementioned reasons, the business outlook on the country’s economy for the next 12 months was less upbeat as the CI decreased to 52.5 percent from the Q1 2021 survey result of 60.5 percent.

OUTLOOK

A less favorable sentiment generally prevailed across the different types of trading firms

(i.e., exporter, importer, dual-activity, and domestic-oriented). Importer, dual-activity, and domestic-oriented respondent firms were less confident on the business environment for Q2 2021, while exporters were more optimistic. For Q3 2021 and the next 12 months, the weaker business sentiment persisted across the different types of respondent trading firms as the indices were lower than the Q1 2021 survey results. The waned outlook across trading firms was predominantly due to the aforementioned reasons.

BUSINESS SENTIMENT WEAKENS

For Q2 and Q3 2021 and the next 12 months, the business sentiments of the industry, services, and wholesale and retail trade sectors weakened. Meanwhile, the outlook of the construction sector was more buoyant for Q2 2021 and the next 12 months, but was optimistic and broadly steady for Q3 2021.

PESSIMISTIC OUTLOOK

The outlook of firms on their own business operations turned pessimistic for Q2 2021. This pessimism mainly emanated from the negative views of firms from the wholesale and retail trade and services sectors on the volume of business activity and total orders booked. For Q3 2021 and the next 12 months, the outlook on the volume of business activity was less upbeat across sectors, except for the construction and industry sectors, which was more optimistic for the next quarter and the next 12 months, respectively.

EMPLOYMENT OUTLOOK STILL FAVORABLE

The employment outlook index decreased for Q3 2021 (from 5.7 percent in the Q1 2021 survey results) but was higher for the next 12 months at 14.7 percent (from 11.7 percent). The positive readings suggest that firms are looking forward to hiring people in Q3 2021 and the next

12 months.

LOWER CAPACITY UTILIZATION

The average capacity utilization in the industry and construction sectors for Q2 2021 decreased slightly to 69.6 percent (from 70.1 percent in Q1 2021). Based on Q2 2021 survey results, the percentage of businesses with expansion plans in the industry sector rose for Q3 2021 and the next 12 months.

FINANCIAL CONDITIONS, ACCESS TO CREDIT

The financial conditions index improved slightly albeit remaining in the negative territory at -32.1 percent for Q2 2021 from -32.9 percent in the previous quarter. Further, firms indicated that their access to credit in Q2 2021 was still constrained as the credit access index remained negative at -8.2 percent for Q2 2021 from -7.5 percent in Q1 2021.

BORROWING RATES AND INFLATION

The survey results showed that businesses expect the peso to depreciate against the U.S. dollar and peso borrowing rates and inflation to rise for Q2 2021, Q3 2021, and the next 12 months. Inflationary pressures may ease for the said periods as the number of respondents that expected higher inflation decreased vis-à-vis the Q1 2021 survey results. Further, businesses expected that inflation will breach the upper end of the government’s 2–4 percent inflation target range for 2021 and 2022.

The Q2 2021 BES was conducted during the period 7 April–27 May 2021.[1] There were 1,513 firms surveyed nationwide, consisting of 585 companies in NCR and 928 firms in AONCR, covering all 16 regions nationwide. Samples were drawn from the Top 7,000 Corporations ranked based on total assets in 2016 from the Bureau van Dijk (BvD) database The nationwide survey response rate for this quarter was higher at 66 percent (from 63.8 percent in the Q1 2021). The response rate was slightly lower for NCR at 60.9 percent (from 61 percent) but higher for AONCR at 69.2 percent (from 65.6 percent).

[1] Approval for the conduct of the Q2 2021 BES was issued on 1 July 2019 through PSA Approval Nos. BSP-1939-01 to 04, which refers to the 4 questionnaire types of the BES.