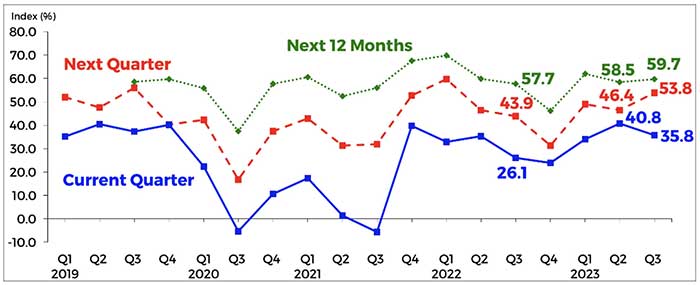

Business confidence weakened in Q3 2023 as the overall confidence index (CI) declined to 35.8 percent from 40.8 percent in Q2 2023. This is reflective of the combined decrease in the percentage of optimists and the increase in the percentage of pessimists during the quarter. The firms’ less optimistic sentiment in the current quarter was attributed to: (a) decline in sales and demand for goods and services mainly due to weather-related disruptions and other seasonal factors, (b) higher prices of raw materials and production costs, (c) elevated inflation and interest rates, and (d) peso depreciation. However, the business sentiment for Q4 2023 and the next 12 months was more upbeat as the overall CIs increased from the previous quarter’s survey results.

Business sentiment across all sectors is mainly less buoyant for Q3 2023. The CIs of the industry, services, and wholesale and retail trade sectors declined, while that of the construction sector increased.

Business outlook across all types of trading firms is less upbeat for Q3 2023. Importers, exporters, dual-activity and domestic-oriented firms were less optimistic in the current quarter.

Capacity utilization edges lower in Q3 2023. The average capacity utilization in the industry and construction sectors for Q3 2023 decreased slightly to 70.5 percent from 71 percent in Q2 2023.

Firms expect less tight financial condition and access to credit for Q3 2023. Firms expected their financial condition and access to credit to be less tight for Q3 2023 as their corresponding indices became less negative.

Businesses expect a firmer peso, and higher inflation and interest rates for the rest of 2023. Businesses expect that the peso may appreciate against the U.S. dollar and the peso borrowing rate may rise for the second semester of 2023, and the next 12 months. Meanwhile, firms expect that the inflation rate may rise for the second half of 2023 but may decline in the next 12 months. Although businesses expect that inflation may remain above the upper end of the National Government’s 2–4 percent inflation target range for 2023-2024, inflation expectations among businesses may further ease in the next 12 months as the number of respondents who expected lower inflation outnumbered those who said otherwise. In particular, businesses are expecting that the inflation rate may average at 5.9 percent for Q3 and Q4 2023 and at 5.7 percent for the next 12 months.

View Full Report via https://www.bsp.gov.ph/Lists/Business Expectations Report/Attachments/21/BES_3qtr2023.pdf

[1] The Q3 2023 BES was conducted during the period 5 July – 15 August 2023. There were 1,549 firms surveyed nationwide, consisting of 583 companies in the NCR and 966 firms in AONCR, covering all 16 regions nationwide. Samples were drawn from the Top 7,000 Corporations ranked based on total assets in 2016-2017 from the Bureau van Dijk (BvD) database. The nationwide survey response rate for this quarter was higher at 64.9 percent (from 59.4 percent in Q2 2023). The response rate was higher for both the NCR at

63.8 percent (from 57.8 percent) and AONCR at 65.5 percent (from 60.4 percent).