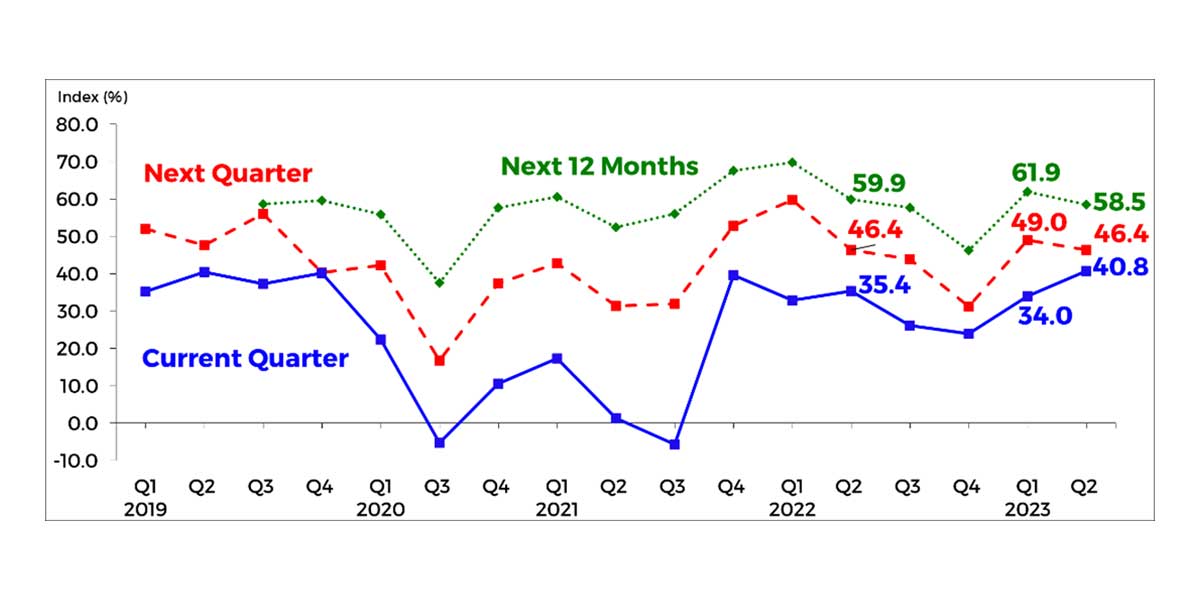

Business confidence in the economy improved for Q2 2023 as the overall confidence index (CI) rose compared to Q1 2023. This is reflective of the increase in the percentage of optimists and the decrease in the percentage of pessimists during the quarter. The respondent firms’ optimism stemmed from their expectations of: (a) increase in sales and production due to stronger demand for goods and services across all sectors, (b) continued post-pandemic recovery, (c) fully reopened economy, (d) easing inflation, and (e) seasonal uptick in demand for certain goods and services during the hot dry season. However, the business sentiment for Q3 2023 and the next 12 months was less buoyant as the overall CIs declined from the previous quarter’s survey results.

Business sentiment across all sectors is mainly more optimistic for Q2 2023. The CIs of the industry, services, and wholesale and retail trade sectors for Q2 2023 increased, while the CI of the construction sector declined.

Business confidence across all types of trading firms was generally more upbeat for Q2 2023. Specifically, exporters, dual-activity and domestic-oriented firms were more optimistic, while importers were less buoyant in the current quarter.

Capacity utilization slightly declined for Q2 2023. The average capacity utilization in the industry and construction sectors for Q2 2023 edged lower to 71 percent from 71.5 percent (revised) in Q1 2023.

Firms expect less tight financial condition and access to credit for Q2 2023. Firms expected their financial condition to be less tight and their access to credit to remain tight for Q2 2023 as their corresponding indices became less negative and steady, respectively.

Firms expect a weak peso, and higher borrowing and inflation rates for Q2 2023. Businesses expect that the peso may depreciate against the U.S. dollar for Q2 2023, but may appreciate for Q3 2023 and the next 12 months. Meanwhile, firms expect that the peso borrowing and inflation rates may rise for the current quarter and the near term. Although businesses expect that inflation may remain above the upper end of the National Government’s 2–4 percent inflation target range for 2023-2024, inflation expectations among businesses may ease in the near term as the number of respondents who expected higher inflation declined compared with the Q1 2023 survey results. Particularly, businesses are expecting that the inflation rate for Q2 2023, Q3 2023 and the next 12 months may average at 7.2 percent, 7.1 percent, and 6.9 percent, respectively.

View Full Report here: https://www.bsp.gov.ph/Lists/BusinessExpectations Report/Attachments/21/BES_2qtr2023.pdf

[1] The Q2 2023 BES was conducted during the period 5 April – 24 May 2023. There were 1,549 firms surveyed nationwide, consisting of 580 companies in the NCR and 969 firms in AONCR, covering all 16 regions nationwide. Samples were drawn from the Top 7,000 Corporations ranked based on total assets in 2016-2017 from the Bureau van Dijk (BvD) database. The nationwide survey response rate for this quarter was slightly lower at 59.4 percent (from 60.6 percent in Q1 2023). The response rate was lower for the NCR at 57.8 percent (from 61.3 percent) but slightly higher for AONCR at 60.4 percent (from 60.2 percent).