The gross merchandise value (GMV) of items bought using buy now, pay later (BNPL) options is expected to surge 173% by 2024, driven significantly by an increase in mobile commerce (m-commerce) penetration, a new study from in-app and in-store financing solutions provider UnaCash reveal.[1]

The number is a wide increase from GMV of items bought via BNPL in 2023est (154%), 2022 (178%) and 2021 (118%), indicating a clear synergy between the BNPL market and the mobile commerce market.

“Buy Now, Pay Later is consistently on the rise,” said Aleksei Kosenko, president of UnaCash. “This can be regarded as a modern digital-era payment solution, not just in the Philippines, which offers convenience to both consumers and its partner merchants by minimizing the initial cost of purchases. Innovative upgrades like point-of-sale loans will allow this payment method to experience remarkable growth in the years to come.”

Buy Now, Pay Later allows consumers to purchase products immediately and avail through convenient installment periods. There are approximately 15% of all online transactions in the Philippines which utilize BNPL solutions, which has further amplified its relationship in the purchasing behavior of consumers.

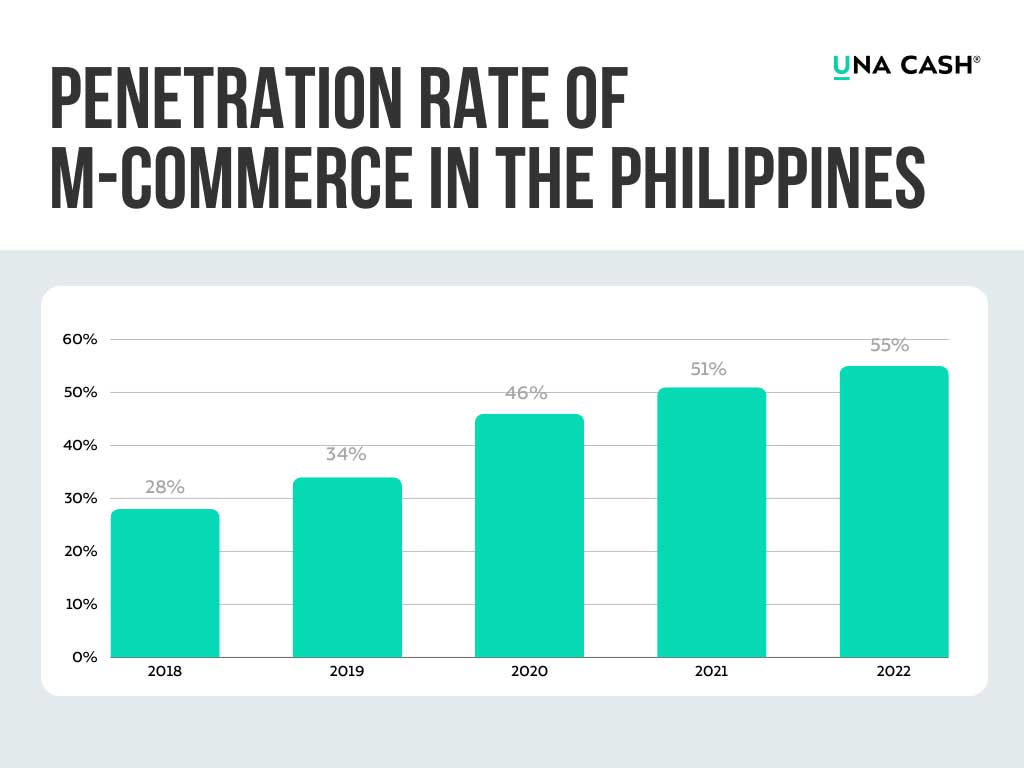

Use of m-commerce, — conventionally understood as online transactions carried out on wireless devices, such as smartphones, smartwatches or tablets — has doubled over the past five years. By the end of 2022, more than half of the Philippine population was involved in mobile commerce, with penetration reaching 55%. Every year, the percentage of mobile commerce usage increased by an average of 6%. The largest increase in the indicator was observed in 2020, at 12% — primarily due to the impact of the pandemic.

In terms of sales, m-commerce had an average annual growth rate of 47.4% from 2018 to 2022. The most significant surge occurred in 2019, with a remarkable increase of 63.4% in sales through m-commerce, signifying a 4.7-fold increase or an equivalent of ₱243.3 billion. By 2022, it was worth ₱308.7 billion.

M-commerce has gradually increased its share in the larger e-commerce industry, initially having just a 16% stake in 2018 to an historical high of 74% in 2022. Share of m-commerce into e-commerce is projected to reach 80% by 2024.

UnaCash also estimates that the e-commerce market in the Philippines will grow 84% by 2024, considering the doubling of mobile commerce use from 2018 to 2022.

The e-commerce audience in the Philippines, predominantly mobile, are persons aged 25-34 years old, making up more than 30% of users, followed by those aged 18-24 years.[2]

[1]The analysis considered mobile internet and e-commerce penetration rates, along with the proportion of mobile commerce within total e-commerce volume in the Philippines. Growth coefficients for external variables were determined yearly. Using these growth rates and the known mobile commerce penetration level in 2017 (25%), the target indicator was estimated. Missing mobile e-commerce sales values for 2018-2020 were reconstructed using Newtonian interpolation. The Buy Now Pay Later (BNPL) market size was assessed by multiplying BNPL usage data from DataReportal by the e-commerce market size.

[2] The conclusions are based on an analysis of statistics from the Lazada e-commerce platform.