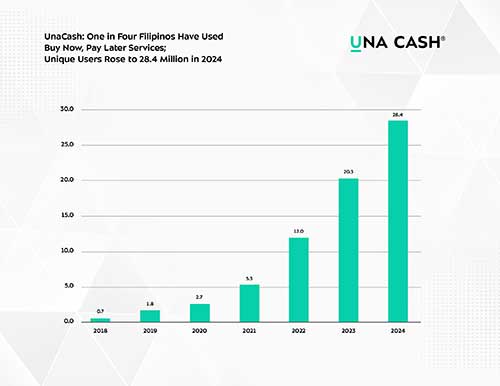

The Buy Now, Pay Later (BNPL) market in the Philippines has experienced rapid growth, with one in four Filipinos having used the service at least once between 2018 and the end of 2024.

New data from UnaCash shows that 28.4 million unique users accessed BNPL services as of end-2024.

This marks a 40% increase from the 20.3 million users recorded in 2023.

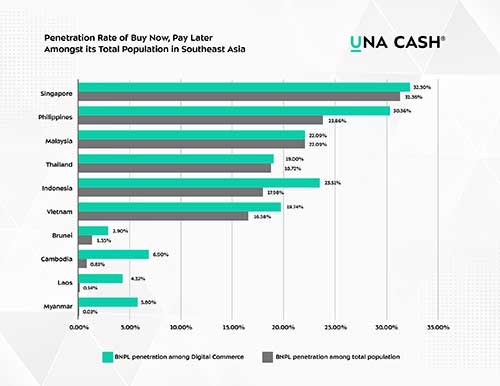

Comparing it with the rest of Southeast Asia (SEA), the country ranked second in terms of BNPL penetration rate amongst its total population, behind Singapore (31.36%, 1.9 million users out of a 6.05 million total population). Malaysia ranked third (22.09%, 8.15 million users out of a 34.67 million total population), followed by Thailand (18.72%, 13.46 million users out of a 71.89 million total population) and Indonesia (17.89%, 50.30 million users out of a 279.80 million total population).

Examining digital commerce users opting for BNPL options, Singapore led the category with 32.30%, followed by the Philippines (30.36%), Indonesia (23.51%), Malaysia (22.09%), and Vietnam (19.74%).

These data sets clearly illustrate the overall use of BNPL as a flexible payment option along with its significant role in expanding the digital marketplace. Internal behavioural data from UnaCash also revealed that consumers primarily focus on purchasing gadgets and electronics, particularly through mobile devices. As technology continues to evolve rapidly, the demand for these products remains high, contributing to the growth for BNPL.

“Filipinos are clearly embracing the flexibility and convenience that buy now, pay later services offer, and businesses are embracing this critical strategy to enhance customer accessibility and satisfaction,” explained Erwin Ocampo, head of product for UnaCash.

Looking ahead, UnaCash anticipates an increase of BNPL usage in the Philippines by 28.39% among the total population at the end of 2025. Its growth is also particularly notable among BNPL users on digital commerce platforms where there is an expected usage increase of 34.24%.

Ocampo added: “Flexible payment options are becoming the norm, a main selling point especially among GenZs and Millennials. Embracing partnerships with financial services players is a way for businesses to meet the shifting demands of consumers and position themselves for long-term success in the competitive marketplace.”