Most banks in the Philippines have kept their credit standards unchanged for both business and consumer loans in the second quarter of 2024, according to the latest Senior Bank Loan Officers’ Survey (SLOS) conducted by the Bangko Sentral ng Pilipinas (BSP).

The SLOS, which measures loan officers’ perceptions on credit standards and loan demand, underscores a cautious but stable banking environment amidst economic challenges.

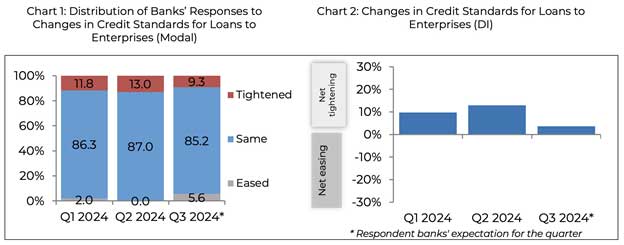

The survey, which gathered responses from 55 out of 60 surveyed banks, revealed that 87.0% of banks retained their credit standards for businesses, a slight increase from 86.3% in the first quarter. This stability was assessed using the modal approach. However, the diffusion index (DI) method indicated a net tightening of credit standards due to the deterioration of borrowers’ profiles and the profitability of banks’ portfolios.

Changes in Credit Standards

Loans to Enterprises

For the second quarter of 2024, most banks maintained their credit standards for business loans. The modal approach showed that 87.0% of banks reported unchanged standards, while the DI method revealed a net tightening due to the worsening profiles of borrowers and declining profitability in banks’ portfolios.

Looking ahead to the third quarter, 85.2% of banks expect to maintain their lending standards for businesses. However, the DI approach suggests banks anticipate a net tightening of credit standards, driven by concerns over borrowers’ profiles and the profitability and liquidity of banks’ portfolios.

Loans to Households

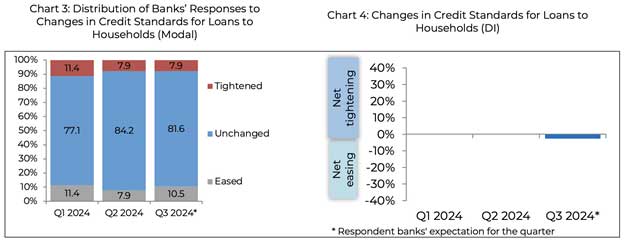

The modal approach showed that 84.2% of banks maintained their credit standards for household loans in Q2 2024, up from 77.1% in Q1 2024. The DI method also reflected unchanged credit standards, attributed to stable borrower profiles and unchanged risk tolerance among banks.

For the next quarter, 81.6% of banks expect to keep household loan standards unchanged. The DI method, however, indicates an expectation of net easing in lending standards due to banks’ higher risk tolerance, improved loan portfolio profitability, and a more optimistic economic outlook.

Changes in Loan Demand

Loans to Enterprises

In the second quarter of 2024, 72.2% of banks reported unchanged overall demand for business loans, a slight increase from 70.6% in Q1 2024. The DI method showed a higher net increase in business loan demand, driven by increased inventory and accounts receivable financing needs, and an improved economic outlook.

For the third quarter, 66.0% of banks expect steady loan demand from firms. However, the DI method suggests banks anticipate a net rise in credit demand from businesses due to higher inventory and accounts receivable financing needs.

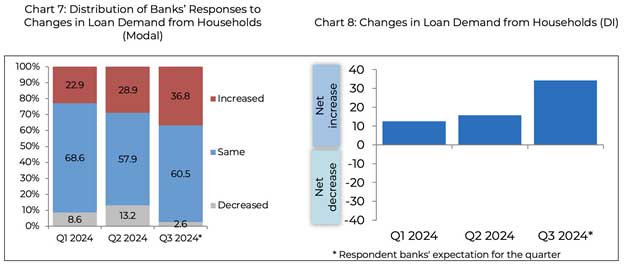

Loans to Households

The modal approach revealed that 57.9% of banks indicated unchanged household loan demand in Q2 2024, down from 68.6% in the previous quarter. The DI method showed a higher net increase in household loan demand, driven by more attractive financing terms and increased household consumption and housing investment.

Looking ahead, 60.5% of banks expect steady demand for household loans in the next quarter. The DI method indicates an expected net increase in household loan demand, fueled by rising household consumption and banks’ more attractive lending terms.