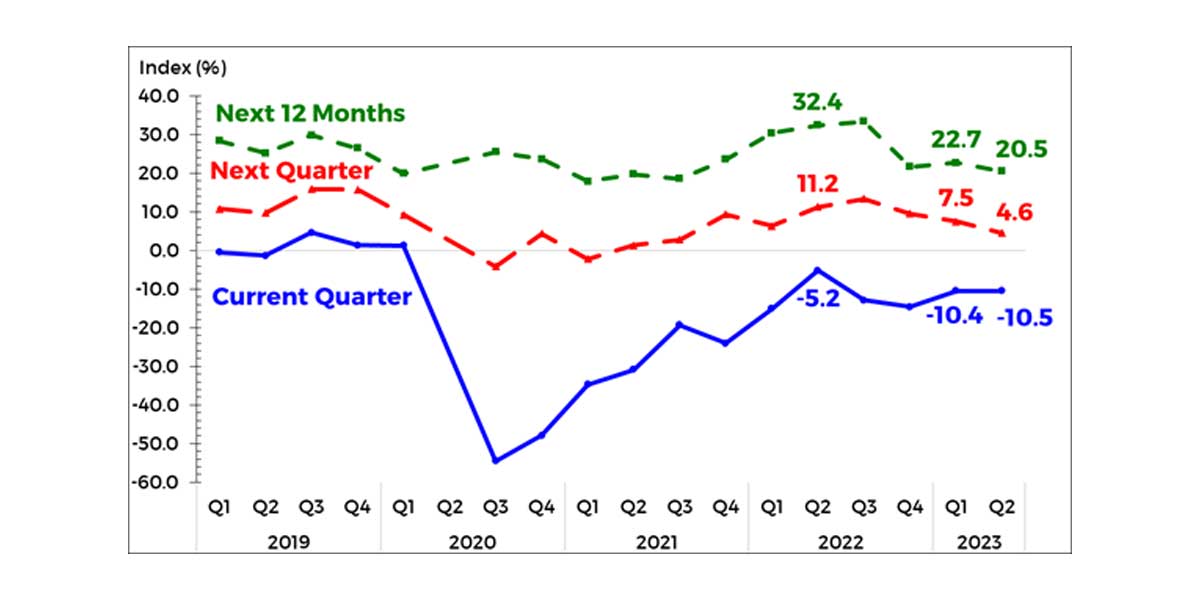

The consumer sentiment for Q2 2023 remained pessimistic as the overall confidence index (CI) was steady at -10.5 percent from -10.4 percent in Q1 2023 (see Table 1).

This means that the pessimists continued to outnumber the optimists, but the margin was almost unchanged from the previous quarter.

The sustained negative sentiment for Q2 2023 was attributed by consumers to their concerns over: (a) faster increase in the prices of goods and higher household expenses, (b) lower income, (c) fewer available jobs, and (d) the effectiveness of government policies and programs on inflation management, economic resilience, high-quality and well-paid job creation, and financial assistance to low-income households.

Meanwhile, consumers were less confident for the next quarter and the next 12 months as the CIs declined to 4.6 percent and 20.5 percent (from 7.5 percent and 22.7 percent), respectively.

Consumer outlook remains pessimistic across component indicators while it is mixed across income groups for Q2 2023. Consumers remained pessimistic across the three component consumer confidence indicators (i.e., country’s economic condition, family’s financial situation, and family income) while consumer sentiment was mixed across income groups (i.e., more pessimistic among the low-income group, steady among the middle-income group, but turned optimistic among the high-income group) for Q2 2023.

Consumers are less hesitant about buying big-ticket items in Q2 2023. The consumer sentiment on buying big-ticket items for Q2 2023 was less pessimistic as the CI turned less negative to -67.7 percent from -72.8 percent in Q1 2023.

The percentage of households with loans increases, while those with savings decreases. In Q2 2023, 24.8 percent of households availed of a loan in the last 12 months, higher than the 22.8 percent recorded in Q1 2023. Meanwhile, the percentage of households with savings decreased to 30.2 percent from 32.9 percent in Q1 2023.

Consumers expect higher interest and inflation rates, a weaker peso, and lower unemployment rate for Q2 2023 and the near term. Consumers anticipate that the interest rates may increase, the peso may depreciate against the U.S. dollar, and the unemployment rate may decline for Q2 and Q3 2023 and the next 12 months. Households also expect that the inflation rate may rise in all reference periods but at a slower pace. Specifically, consumers are expecting that the inflation rate may average at 5.2 percent for the next 12 months, which is above the upper end of the National Government’s inflation target range of 2 to 4 percent for 2023-2024.

View Full Report here: https://www.bsp.gov.ph/Lists/Consumer ExpectationReport/Attachments/22/CES_2qtr2023.pdf

The Q2 2023 CES was conducted during the period 3 – 18 April 2023. In Q2 2023 CES, 5,548 households were identified as eligible households – 2,766 (49.9 percent) were from the NCR and 2,782 (50.1 percent) from AONCR. Of the said sample size, 5,427 households participated in the survey, equivalent to a response rate of 97.8 percent (from 98.3 percent in the Q1 2023 survey). Respondents consisted of 2,696 households in the NCR (with 97.5 percent response rate) and 2,731 households in AONCR (with 98.2 percent response rate). The middle-income group comprised the largest percentage of respondents (39.8 percent), followed by the high-income group (34.4 percent) and the low-income group (25.9 percent).