Critics have found NGCP’s transmission rates, set in 2009, to be “excessive.”

The ERC’s preliminary review of NGCP’s rates from 2016 to 2022 cut NGCP’s revenue requirement, essentially, the transmission operator’s allowable expenses, to more than half.

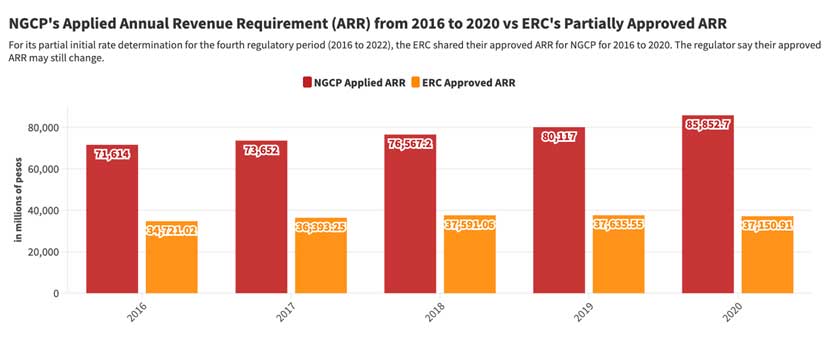

In its application, NGCP sought a revenue requirement worth P387.80 billion for 2016 to 2020, which meant an annual average of P129 billion. But the ERC, based on its initial review, found that allowable revenue should only be at P183 billion for the period, or about P36.67 billion a year.

The NGCP, from 2016 to 2020, operated on an interim maximum annual revenue (iMAR), approved by the ERC under a different leadership.

This iMAR, said NGCP Assistant Vice President Cynthia Alabanza, was only an estimate but was approved by the ERC as there was no regulatory review at that time.

“Just like when Congress hasn’t approved a government budget, the government would spend based on what was previously allowed. So that’s what we were doing… we were spending based on what was allowed [in the third regulatory period],” Alabanza said in Filipino in a news conference in November 2023.

But the iMAR could be subject to review and may be revised, based on ERC rules.

Majority of the ERC’s cuts in the preliminary review came from three major items:

- net efficiency adjustment

- revenue under-recoveries

- net performance incentive

These three items were worth P104 billion during the five-year review period.

The net efficiency adjustment is the incentive given to the NGCP for achieving “cost reductions in controllable costs,” while revenue under-recoveries are expense items not recovered during the previous regulatory period.

ERC said a decision on both items would be made in the final determination of the review due this quarter.

It is not, however, keen on granting a net performance incentive to the transmission operator.

This incentive is based on a performance incentive scheme (PIS), a set of service and operational performance criteria, which is supposedly set before the beginning of every regulatory period.

If the NGCP meets these criteria, it is rewarded with an incentive. Otherwise, penalties may be imposed.

In its application for the fourth rate reset, the NGCP adopted the PIS set during the third regulatory period. But the ERC said it was “constrained from upholding this position.”

“Considering that the PIS and its factors have not been established prior to the commencement of the fourth regulatory period, it follows that NGCP does not have the basis to enforce the incentives. Conversely, there appears to be no grounds for the imposition of penalties,” the November ERC order read.

Former ERC commissioner Alfredo Non said the ERC position was debatable because the NGCP should be recognized for meeting the criteria for incentives in the previous regulatory period.

“It is not NGCP’s fault that ERC failed to provide parameters for the fourth regulatory period,” said Non, who was ERC commissioner from 2012 to 2018.

ERC said the disallowances were intended to protect consumers.