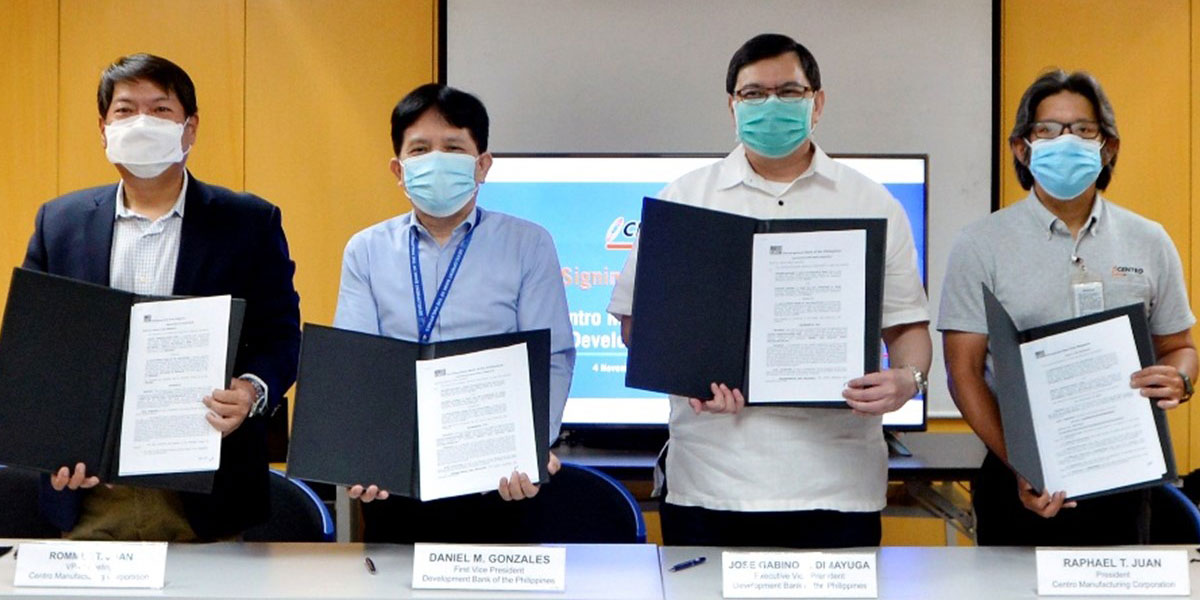

State-owned Development Bank of the Philippines (DBP) has granted a P100-million revolving credit line to Centro Manufacturing Corporation (CMC) to finance its working capital requirements for the assembly of truck bodies, automotive parts and accessories, a top official said.

DBP President and Chief Executive Officer Emmanuel G. Herbosa said the funding assistance would support the production of about 3,000 units of various types of trucks and utility vans, with about 21 percent or 630 units allotted for public utility vehicles (PUVs) in support of the National Government’s PUV Modernization Program.

“As the country’s premiere infrastructure bank, DBP prioritizes support to initiatives that further develop our transport systems and supply chains,” Herbosa said. “For us, it is the building of networks all over the country in which economic growth and global competitiveness rests.”

DBP is the sixth largest bank in the country in terms of assets and provides credit support to four strategic sectors of the economy – infrastructure and logistics; micro, small and medium enterprises; the environment; and social services and community development.

CMC is a prominent truck body builder and provider of truck-related equipment and services to various automotive companies and brands in the country, including Toyota, Mitsubishi, Nissan, among others. The company has manufacturing facilities in Novaliches, Cavite, and Bulacan, and is the only ISO-certified truck body builder in the country.

DBP Executive Vice President Jose Gabino D. Dimayuga underscored the importance of providing funding support for the transport sector to hasten economic recovery by facilitating the movement of people, basic commodities and other goods.

He said DBP recognizes the essential role of the public transport sector as it caters to daily wage workers who work for micro, small and medium enterprises, which employ about 66.2 percent of the country’s entire workforce.

“Ensuring convenient, economical and efficient public transport systems through strategic financial support remain a priority for financing institutions such as DBP as it is a vital key in attaining expansion and growth,” Dimayuga said.