By Atty. Edward G. Gialogo

As of May 25,2020, the Philippines has recorded a total of 873 COVID-19 deaths.

Losing a loved one is a painful experience in itself. More so if the cause of death is COVID-19 because the remaining family members are not allowed to provide the customary funeral rites accorded to departed relatives.

Whether a death is caused by COVID-19 or not, it may trigger the payment of estate tax. In legal parlance, the properties left by a dead person or “decedent” are collectively called “estate”. Thus, the tax on the right of a decedent to transmit his/her estate to his/her heirs is called “estate tax”.

To properly settle the estate tax, it is important to know the answer to these questions: How is estate tax computed? When is the deadline for payment? Where should the return be filed? If the heirs cannot pay on time, can they request for an extension? Is it possible to pay by installment? Are there penalties for late payment? Aside from estate tax, are there other taxes that have to be paid?

FILING OF RETURN AND PAYMENT OF ESTATE TAX

Estate’s TIN

Just like a living person, the estate must also have its own Tax Identification Number (TIN) which is different from the TIN used by the decedent during his lifetime. This can be secured from the BIR office where the estate tax return (BIR Form 1801) shall be filed.

Deadline and place of filing

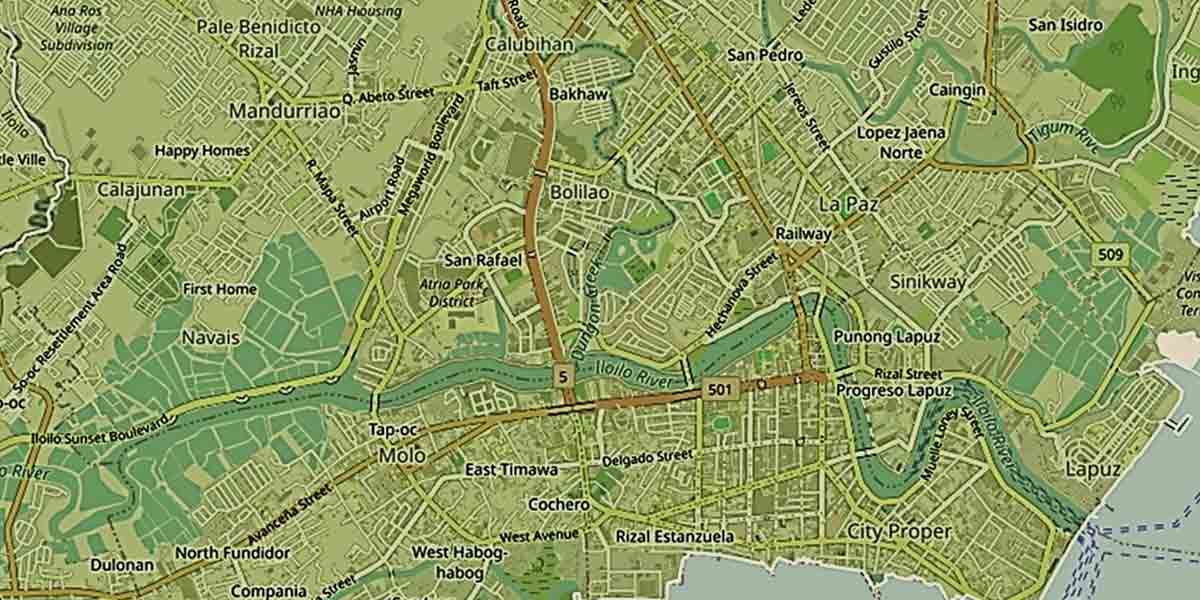

Within 1 year from death of the decedent, the estate tax return should be filed with the accredited bank of the BIR’s local office (Revenue District Office or RDO) that has jurisdiction over the place of decedent’s residence at the time of death. In meritorious cases, the BIR may grant an extension of not more than 30 days.

For a non-resident decedent (residing abroad at the time of death), the estate tax return may be filed with the accredited bank of RDO No. 39 in Quezon City.

Deadline of payment

The estate tax should be paid at the same time the return is filed.

Penalty

Late payment or any irregularity in the payment of estate tax may lead to the imposition of 25% or 50% surcharge, 12% interest per year, and/or compromise penalty.

Extension of time to pay

The BIR may allow an extension of time to pay the estate tax for a period of not more than 5 years in case the estate is settled through a court proceeding or 2 years in case the estate is settled extrajudicially.

Payment by installment

If cash is insufficient to pay the total estate tax due, the BIR may authorize the payment by installment (monthly, quarterly, semi-annually or annually) within 2 years from the filing of the return.

COMPUTATION OF ESTATE TAX

Gross estate

Gross estate is the total value of all properties belonging to the decedent at the time of his/her death.

For Filipino citizens and resident foreigners, the gross estate consists of all real (immovable) and personal properties of the decedent regardless of location. Personal property includes tangible and intangible property like shares of stocks.

In case of real property, its value shall be based on BIR’s zonal value or on the market value as stated in the tax declaration, whichever is higher.

For non-resident foreigners, the gross estate comprises only of all properties located in the Philippines.

Deductions

To arrive at net taxable estate, a number of deductions are allowed to be deducted from the gross estate. The usual deductions allowed are:

- Standard Deduction (no substantiation is required) of P5,000,000.00. For non-resident foreigners, the standard deduction is only P500,000.00.

- Family home (maximum of P10,000,000.00)

- Unpaid debts of the decedent

- Unpaid mortgages

- Net share of the surviving spouse in the conjugal or community property

The medical and funeral expenses are no longer deductible from gross estate under the TRAIN Law (RA 10963).

Net taxable estate

Net taxable estate is the remaining amount after deducting the applicable deductions from the gross estate. To compute the estate tax, the net taxable estate is simply multiplied by the estate tax rate of 6%.

Certificate Authorizing Registration

The Certificate Authorizing Registration or CAR is a proof/clearance from the BIR that the estate tax has already been paid. Without it, the Registry of Deeds will not process the transfer of title from the decedent to the heirs.

To secure the CAR, the basic documentary requirements include the TIN of the heirs and the estate, estate tax return, bank deposit slip (proof of payment), death certificate, Deed of Extrajudicial Settlement of Estate, title of land or condominium unit, tax declaration and certificate of deposit (in case of bank account). The BIR website (www.bir.gov.ph) may be visited for complete and detailed requirements for securing the CAR.

LOCAL TRANSFER TAX

Aside from estate tax, the Local Government Code also allows the province or city where the real property of the decedent is located to impose Local Transfer Tax or Tax on Transfer of Real Property Ownership at the rate of not more than 50% of 1% (province) or 75% of 1% (city) of the value of the real property.

Unlike estate tax, the BIR’s zonal value cannot be used in the imposition of Local Transfer Tax. Instead, only the market value as stated in the tax declaration shall be used as tax base. It should also be noted that, unlike estate tax which covers both the real and personal properties of the decedent, only real properties left by the decedent shall be subject to Local Transfer Tax.

Local Transfer Tax should be paid to the Provincial or City Treasurer within 60 days from death. Otherwise, a surcharge of 25% and interest of 2% per month (but not more than 72%) shall be imposed.

– 0 –

Benjamin Franklin said that in this world nothing can be said to be certain, except death and taxes. Indeed, death and taxes are constant facts of life to the extent that even death itself triggers taxes.

This article is for general information only and should not be used or relied upon as a substitute for professional advice. If you have any question or comment, you may email the author at info@gdlaw.ph.

Atty. Edward G. Gialogo is the managing partner of Gialogo Dela Fuente & Associates. He is also a tax speaker at Philippine Institute of Certified Public Accountants (PICPA).