City Hall should check its ego at the door and keep an open mind. Listening to good counsel—even when it comes from an outsider—can sometimes bring the clarity we need to see through local challenges.

Makati City Mayor Abby Binay’s recent remarks about diversifying revenue sources deserve a second look. While no city’s fiscal realities are the same, there’s wisdom in learning from Makati’s success.

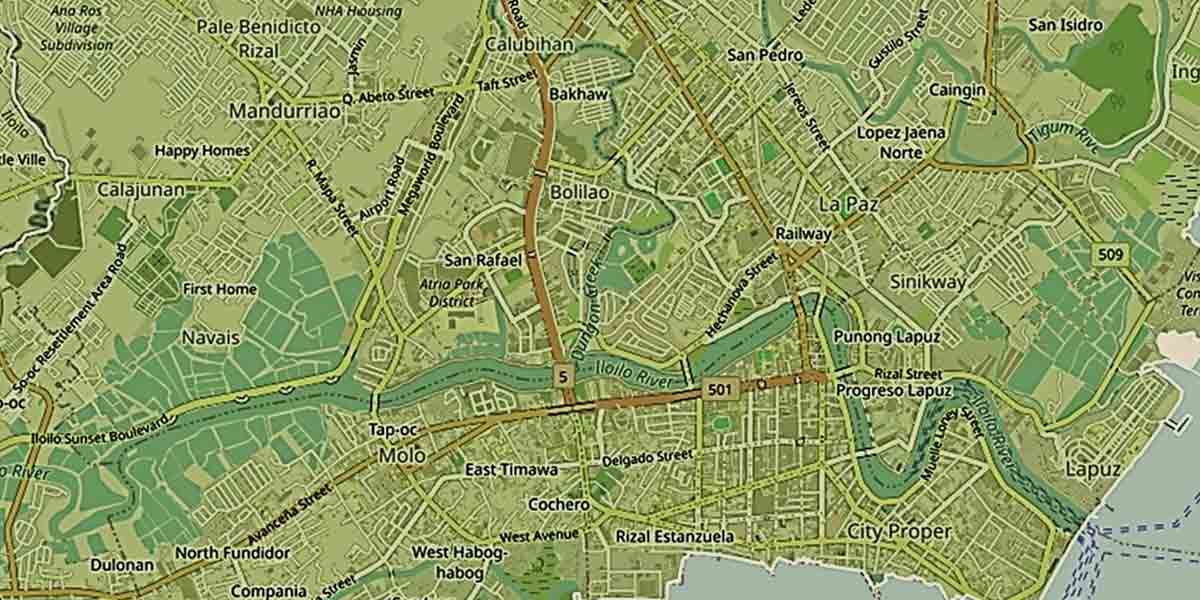

Binay, in Iloilo for the CityNet Executive Committee Meeting, emphasized the importance of reducing dependency on real property tax (RPT) by cultivating a robust business environment. The gathering of over 100 urban leaders at the Iloilo Convention Center aims to tackle global urban development issues—a timely backdrop to her suggestions for Iloilo City.

Makati stands as a model of fiscal independence, with over 80% of its tax revenue coming from business taxes. In contrast, Iloilo City faces backlash over its 300% RPT hike in 2024, a decision that left many local business owners questioning their financial stability. While City Hall responded with a two-year, 40% discount for taxpayers, concerns linger about the city’s overreliance on RPT as a revenue lifeline.

A Department of Finance report places Makati first among cities in fiscal autonomy, a testament to its local revenue-generating power. For 2022 and 2023, Makati’s local source revenues accounted for over 86% and 90% of its operating income, respectively. Such achievements are grounded in creating an ecosystem that attracts businesses while ensuring that taxpayers see tangible returns.

The city’s secret? A business-friendly environment, backed by visible programs and services that compel residents and companies to willingly pay their dues. Makati invested PHP 24,050 per capita in public services in 2022, the highest among Philippine cities.

By comparison, Iloilo City must grapple with the implications of its current RPT strategy. The 300% increase raised land levy rates and ad valorem taxes, burdening both business owners and idle landholders. While the measure aims to boost city revenues, it risks alienating the very taxpayers it seeks to engage.

The advice to attract businesses aligns with data from government records. Studies on local governance show that cities with diverse revenue streams enjoy greater stability, flexibility, and independence from national tax allocations. The DOF’s Bureau of Local Government Finance points to Makati’s ability to exceed revenue targets and register new businesses as an outcome of its sound fiscal management.

Binay, however, didn’t stop at revenue strategies. She stressed the importance of accountability, reminding leaders that taxes must translate into public services that inspire trust. Taxpayers, after all, are more likely to comply when they see real benefits.

City Hall’s leaders should reflect on Binay’s words, not as criticism, but as sincere counsel. Not every callout aims to diminish; some come from a place of shared experience and constructive advice.

As Iloilo City hosts the CityNet meeting, let this be an opportunity to not only showcase its strengths but also embrace lessons from others. Binay’s visit is more than just a senatorial aspirant’s foray into the city; it’s a chance for Iloilo to grow through dialogue with local and global leaders alike.

Diversifying revenue is a long-term goal, but the first step is ensuring a business climate that attracts investments. Perhaps it’s time to turn the mirror inward and ask: How can Iloilo City do better—not just for today, but for the future?

City Hall, remember, sincere advice doesn’t bruise egos; it builds better cities.