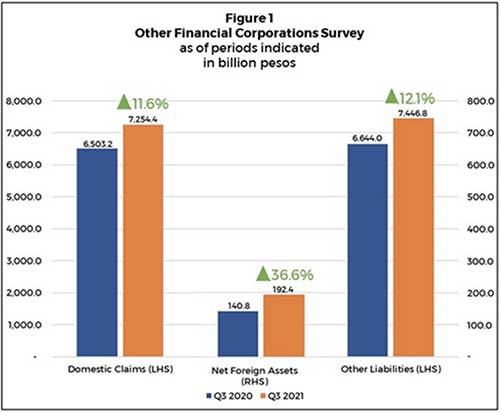

Based on preliminary data on the Other Financial Corporations Survey (OFCS), the domestic claims of the OFCs grew by 11.6 percent in Q3 2021 to ₱7,254.4 billion from ₱6,503.2 billion in Q3 2020 (Figure 1).[1]

This increase was primarily attributed to the higher claims on the private sector, which expanded by 22.7 percent in Q3 2021 to ₱3,935.6 billion from ₱3,207.9 billion in Q3 2020, owing to OFCs’ higher investments in equity securities issued by private nonfinancial corporations and loans extended to households.[2]

In addition, claims on depository corporations inched up by 0.8 percent from ₱1,638.6 billion in Q3 2020 to ₱1,652.5 billion in Q3 2021 on account of higher investments in bank-issued equity securities and increased deposits in banks. Net claims on the central government also increased, albeit marginally, by 0.5 percent to ₱1,648.7 billion in Q3 2021 from ₱1,640.8 billion in the same period last year. This was largely due to the rise in the sector’s holdings of debt securities issued by the National Government.

Meanwhile, the net foreign assets (NFA) of the OFCs grew by 36.6 percent from ₱140.8 billion in Q3 2020 to ₱192.4 billion in Q3 2021. The growth was driven by higher claims of OFCs on nonresidents, which were mostly in the form of investments in debt and equity securities.

The increase in the OFCs’ assets was funded mainly by the sector’s issuances of shares and other equity. The upturn in equity and insurance technical reserves (ITR), resulted in a 12.1 percent rise in the other liabilities of OFCs, amounting to ₱7,446.8 billion in Q3 2021 from the ₱6,644 billion in Q3 2020.[3] (BSP)

[1] The OFCS presents the comprehensive measure of the claims and liabilities of the OFCs. OFCs refer to institutional units providing financial services other than banks, non-banks with quasi-banking functions, nonstock savings and loan associations, and the central bank. These institutional units are: 1) trust entities, 2) private and public insurance corporations, 3) holding companies, 4) government financial institutions (specifically government-owned or -controlled corporations engaged in financial intermediation), 5) non-money market funds covering unit investment trust funds and investment companies, and

6) other financial intermediaries and auxiliaries (consisting of offshore banking units and non-banks without quasi-banking functions).

[2] The private sector is composed of other nonfinancial corporations, and households and non-profit institutions serving households. The other nonfinancial corporations refer to private corporations and quasi-corporations whose principal activity is the production of market goods or nonfinancial services.

[3] The ITR are amounts set aside by insurance companies to meet future insurance liabilities, such as but not limited to unearned premiums, outstanding claims, expected losses, bonuses and rebates (for life insurance).