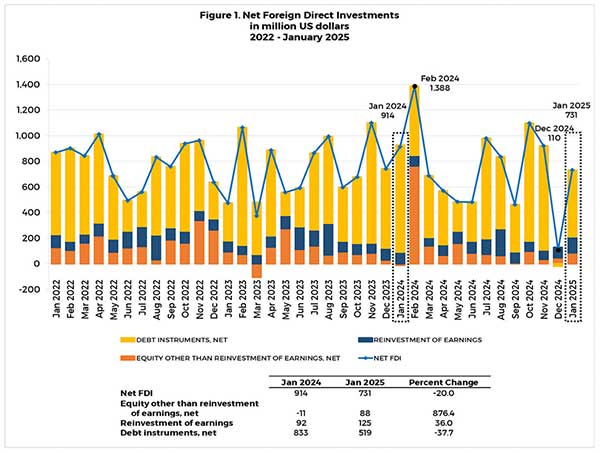

Foreign direct investment (FDI) net inflows into the Philippines reached US$731 million in January 2025, marking a 20.0 percent decline from US$914 million posted during the same period last year, according to data released by the Bangko Sentral ng Pilipinas (BSP).

The decrease was primarily driven by a 37.7 percent drop in nonresidents’ net investments in debt instruments, which fell to US$519 million from US$833 million in January 2024.

Despite the downturn, the decline was partially offset by improved sentiment in equity capital placements, as nonresidents’ net investments in equity capital rose to US$88 million, reversing from a net outflow of US$11 millionlast year.

Reinvestment of earnings also provided support, increasing by 36.0 percent to US$125 million, up from US$92 millionin January 2024.

The BSP noted that equity capital infusions came largely from Japan, the United States, Singapore, and Malaysia, indicating sustained investor confidence from key economic partners.

These capital placements were directed primarily toward the manufacturing, financial and insurance, and real estatesectors—industries considered critical for the country’s long-term economic growth.

According to the BSP, the FDI figures are compiled based on the Balance of Payments and International Investment Position Manual, 6th Edition (BPM6), and cover actual flows, in contrast to investment commitments reported by other government agencies.

Net investments in debt instruments, which mainly reflect intercompany borrowings between foreign investors and their local affiliates, remain the largest FDI component despite the sharp monthly decline.

FDI plays a vital role in the Philippine economy by providing capital, employment, and access to global markets, though recent global uncertainties have dampened cross-border investment appetite.

The BSP continues to monitor macroeconomic indicators closely as it aims to support stable financial conditions to attract and retain long-term foreign investment.

As of January 2025, the Philippine peso traded around PHP 56.00 to the U.S. dollar, putting the PHP equivalent of the month’s FDI inflows at approximately PHP 40.9 billion.