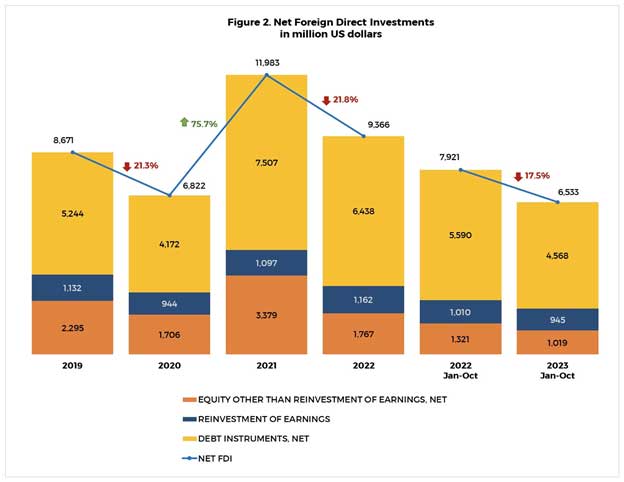

Foreign direct investment (FDI) posted US$655 million net inflows in October 2023, lower by 29.6 percent than the US$930 million net inflows registered in the same period last year (Figure 1).1, 2

This was due largely to the 26.1 percent decrease in net investments in debt instruments to US$504 million from US$682 million.[3]

Nonresidents’ net investments in equity capital (other than reinvestment of earnings) and reinvestment of earnings also declined by 54.4 percent and 10.3 percent to US$74 million (from US$163 million) and US$76 million (from US$85 million), respectively.

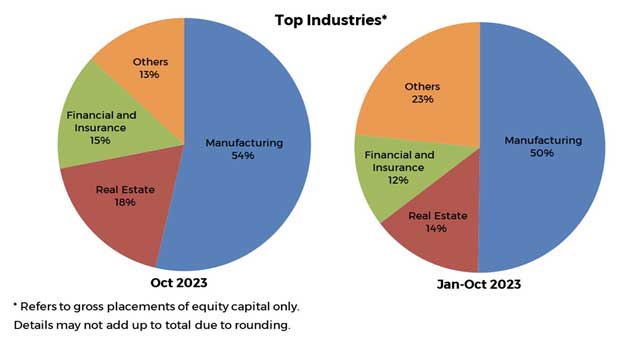

The bulk of the equity capital placements during the reference month originated from Japan, the United States, and Singapore. These were directed mostly to the 1) manufacturing; 2) real estate; and 3) financial and insurance industries.

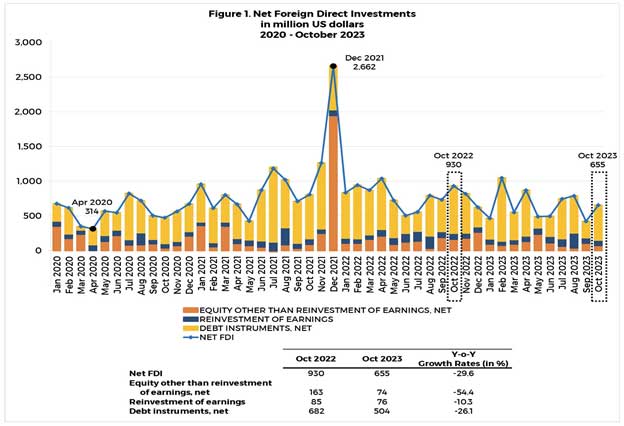

On a cumulative basis, net FDI inflows for the period January-October 2023 were lower by 17.5 percent at US$6.5 billion compared with the US$7.9 billion in January-October 2022 (Figure 2).

While FDI continued to record net inflows, the recent decline in levels reflect the adverse impact of persistent inflationary pressures and slowing global growth prospects on investor decisions.