The credit card market in the Philippines continues to experience robust growth, driven by greater financial inclusion and the increasing participation of younger consumers, according to an analysis by TransUnion presented at the 2024 TransUnion Financial Services Summit in Hong Kong.

The study reveals that credit card originations per quarter approached the one million milestone in Q3 2023, with Gen Z Filipinos emerging as a significant consumer group.

Surge in Credit Card Originations and Spending

Total outstanding credit card volumes saw a year-over-year increase from 9.3 million in Q4 2022 to 11.2 million in Q4 2023.

The credit card penetration rate also rose, reaching over 15% of Filipino adults.

Data from the Credit Card Association of the Philippines (CCAP) corroborated these findings, showing a 39% increase in credit card spending, reaching PHP 853 billion in the first half of 2023.

Weihan Sun, Principal of Research and Consulting for Asia Pacific at TransUnion, highlighted the impact of younger consumers on the market.

“The credit card market in the Philippines will continue to experience growth as demand remains high, especially amongst younger consumers. Gen Z is quickly emerging as a cornerstone for future market growth,” Sun said.

This generation places high importance on accessing credit to achieve financial goals, with almost all surveyed Gen Z Filipinos (98%) seeing credit as crucial.

Gender Disparity in Credit Market

Despite the overall market growth, gender parity in credit card ownership remains elusive.

Male borrowers accounted for 60% of credit card originations, while females comprised only 40%. This ratio has remained consistent over the past five years.

Additionally, women held only 39% of all active credit card accounts, indicating a need for greater financial inclusion among female consumers.

“Lenders should consider offerings specifically tailored to female consumers to foster a more financially inclusive credit market,” Sun suggested.

The approach could help capitalize on the growth potential of an expanding market while promoting gender parity.

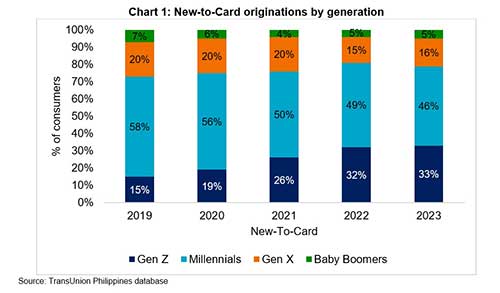

New-to-Card Borrowers: A Growth Opportunity

New-to-Card borrowers, those originating their first-ever credit card, represent a significant growth opportunity. They accounted for nearly 30% of all outstanding credit card balances during the first nine months of 2023, up from 19% in 2019.

This trend indicates a growing market of first-time credit card users, driven by value-added services like reward points, installment payment facilities, and discounts.

“Bringing New-to-Card consumers into the formal financial system can drive greater financial inclusion,” Sun said.

“TransUnion Philippines is committed to using alternative data to help more consumers access the credit they need, contributing to the development of the country as a whole.”

The Future of Financial Inclusion

The credit card market in the Philippines is poised for further growth, with opportunities to expand through financial inclusion and targeted efforts to address gender disparities.

By leveraging AI and alternative data, institutions can better assess creditworthiness and extend credit to underserved populations.