The Philippines’ retirement income system has been ranked the second lowest in Asia, and 41st out of 43 retirement systems globally, according to the 13th annual Mercer CFA Institute Global Pension Index (MCGPI)[i].

The 2021 Global Pension Index reviews each retirement system through three weighted sub-indices (adequacy, sustainability and integrity) and includes four new systems this year – Iceland, Taiwan, UAE and Uruguay.

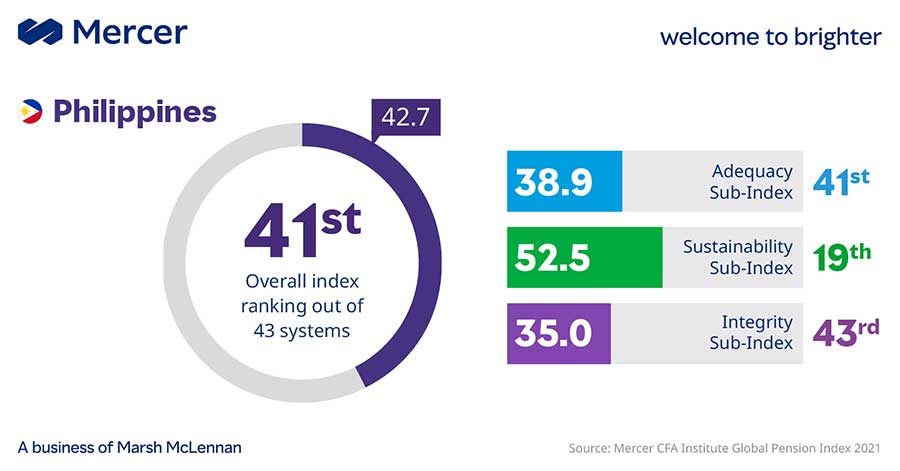

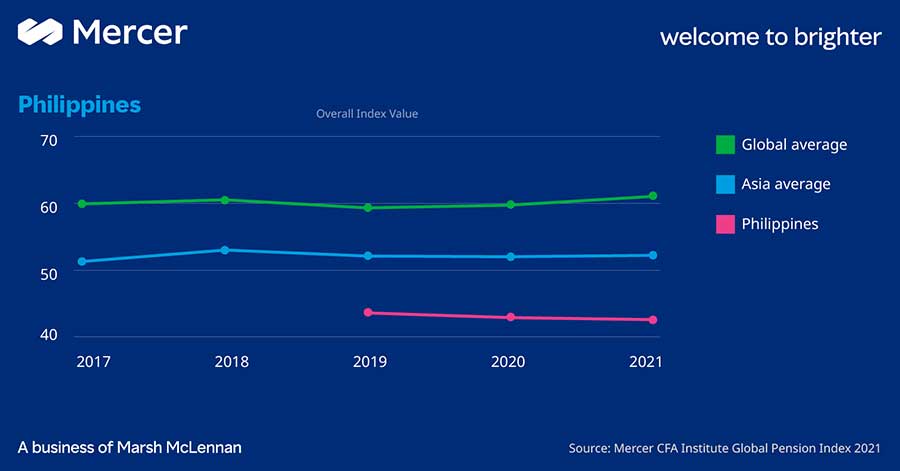

The overall index value for the Philippines dropped slightly from 43.0 in 2020 to 42.7 in 2021, primarily due to a fall in the country’s real economic growth rate. For each sub-index, the Philippines scored highest for sustainability (52.5) which was more than the Asia average at 48.1, followed by adequacy (38.9) and integrity (35), which improved 0.2 points from 34.8 in 2020.

The Philippines is ranked 19th globally for the sustainability sub-index, which measures the likelihood of the system’s ability to provide benefits in the future; 41st for adequacy, which considers how the country’s system is designed to provide adequate retirement benefits, and the lowest in the world for the integrity sub-index, where factors affecting the citizens’ confidence level in the retirement system are considered.

Harold Tan, Mercer’s Wealth Business Leader in the Philippines, said: “Although there was a slight increase in the integrity score this year, there is still room for improvement. The voluntary direct compensation scheme needs to be reinforced and reinvigorated, while the government has to start looking at ‘no cash-out’ options to preserve savings and benefits for employees when they retire. In addition, investment of pension assets are not sufficiently diversified outside of the Philippines and hence, return-risk ratios are not fully optimized across a larger and more prosperous financial market. All of these factors can help to build confidence and improve the Philippines’ overall index value.”

The CFA Institute Asia-Pacific Research Exchange’s Engagement Committee Chair, Francis Adrian Viernes, said, “For the long-term sustainability of the Philippines’ pension system, there is a need to account for longer life expectancies and ensure there are enough pension savings to see retirees through more years in retirement. Compounding the issue, the gender pension gap presents additional and urgent challenges, with women facing their retirement years with fewer benefits. With these concerns in mind, the promise of a secure retirement depends on policymakers and industry stakeholders taking collective action to examine the strengths and weaknesses of pension systems, with the purpose of delivering better retirement benefits to every individual.”

The Philippines retained its D-grade, connoting a pension system that has some desirable features but its efficacy and sustainability are in doubt if major weaknesses or omissions are not addressed. It was given the same grade as a number of Asian countries like India, Japan, South Korea and Thailand.

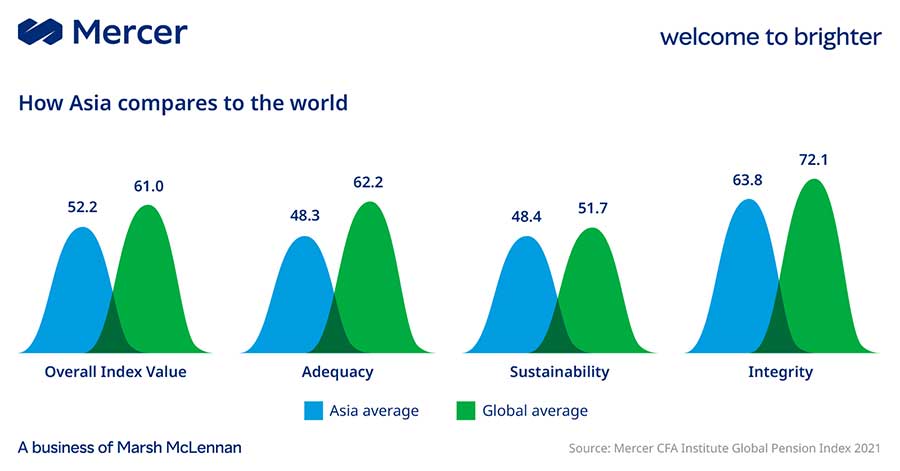

The 2021 Global Pension Index also found that Asia’s retirement systems continue to lag the world’s. Asia’s overall index value average was 52.2, against a global average of 61.

Globally, Iceland’s retirement income system (84.2) has been named the world’s best in its debut, closely followed by the Netherlands (83.5) and Denmark (82). For each sub-index, the systems with the highest values were Iceland for adequacy (82.7), Iceland for sustainability (84.6) and Finland for integrity (93.1). The systems with the lowest values across the sub-indices were India for adequacy (33.5), Italy for sustainability (21.3) and the Philippines for integrity (35.0).

Gender differences in pension outcomes

This year’s study also underscored the need for urgent reform to reduce the gender pension gap – an issue inherent in every system.

Across the Organisation for Economic Co-operation and Development (OECD) member countries, the gender pension gap or difference in retirement income that men and women receive, averages 26%, with the gap ranging from 3% in Estonia to 50% in Japan[ii]. The MCGPI’s analysis highlighted that the causes of the gender pension gap are multifold with employment-related, pension design and socio-cultural issues contributing to women being far more disadvantaged than men when it comes to retirement income.

In its 2021 Global Gender Gap report, the World Economic Forum ranked the Philippines 17th among 156 countries, with 78.4% of its overall gender gap closed to date. However, women should be incentivized to participate more in the broader labor force. Only 49.1% of women are in the job market, compared to 75.2% for men. On top of that, progress still needs to be made with 69.3% of the income gap closed so far.

While employment issues are major contributors and are well known – more female part-time workers, periods out of the workforce for caring responsibilities and lower average salaries, for example – the 2021 Global Pension Index found that pension design flaws were aggravating the issue. This includes non-mandatory accrual of pension benefits during parental leave, absence of pension credits while caring for young children or elderly parents in most systems, and the lack of indexation of pensions during retirement, which have a larger impact on women due to longer life expectancy.

Janet Li, Mercer’s Wealth Business Leader for Asia, said, “Closing the gender pension gap needs to be a multi-stakeholder undertaking, from employers playing an active role to ensure gender equity in pay, to individuals improving their financial literacy. Our study shows that failure to address the gender retirement savings gap will have long-term costs for businesses, particularly in their ability to attract and retain talent, as well as for society. We need to act now and urgently.

“The pension industry can take the lead by removing eligibility restrictions for individuals to join employment-related pension arrangements. This could be expanded to include part-time or informal workers who represent a large population of working women in Asia. Credits for those caring for the young and the old could also be introduced to ensure that individuals who have had to take time out of the formal workforce due to caregiving responsibilities are not left behind.”

The Global Pension Index benchmarks retirement income systems around the world highlighting some shortcomings in each system and suggests possible areas of reform that would provide more adequate and sustainable retirement benefits.

The Global Pension Index is a collaborative research project sponsored by CFA Institute, the global association of investment professionals, in collaboration with the Monash Centre for Financial Studies (MCFS), part of Monash Business School at Monash University, and Mercer, a global leader in redefining the world of work and reshaping retirement and investment outcomes.

This year, the Global Pension Index compares 43 retirement income systems across the globe and covers two-thirds (65 per cent) of the world’s population. The 2021 Global Pension Index includes four new systems – Iceland, Taiwan, UAE and Uruguay.

The Global Pension Index uses the weighted average of the sub-indices of adequacy, sustainability and integrity to measure each retirement system against more than 50 indicators.

[i] The MCGPI is a comprehensive study of global pension systems, accounting for two-thirds (65 per cent) of the world’s population. It benchmarks retirement income systems around the world highlighting some shortcomings in each system and suggests possible areas of reform that would provide more adequate and sustainable retirement benefits

[ii] Towards Improved Retirement Savings Outcomes for Women, March 2021, OECD