By Joseph Bernard A. Marzan

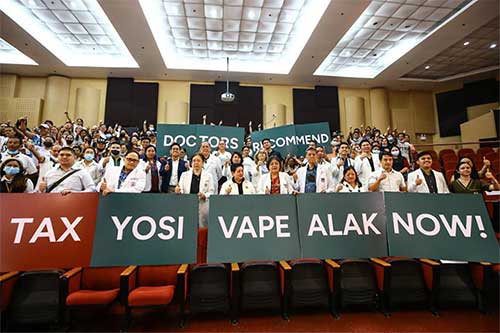

QUEZON CITY — More than 200 doctors and health advocates gathered on April 8, 2025, to urge candidates in the upcoming midterm elections to support higher taxes on cigarettes, vapes, and alcohol to combat what they described as an emerging epidemic of youth addiction.

The event, held at the Lung Center of the Philippines in Quezon City, featured a forum identifying current and former senators as either “Health Tax Heroes” or “Health Tax Hazards” based on their voting records on sin tax legislation.

Participants included the Sin Tax Coalition, the Philippine Medical Association (PMA), the Philippine College of Chest Physicians, and the Hepatology Society of the Philippines.

The forum followed a March campaign by the PMA and the Sin Tax Coalition, which raised the alarm over rising alcohol and tobacco use among Filipino adolescents.

Re-electionist and former senators who consistently backed higher taxes on cigarettes, vapes, and alcohol were hailed as “Heroes,” while those seen as favoring industry interests were labeled “Hazards.”

Among the “Health Tax Heroes” were Senators Pia Cayetano and former senators Ping Lacson, Manny Pacquiao, and Kiko Pangilinan.

Senators Bong Revilla and Imee Marcos were identified as “Health Tax Hazards,” along with other figures such as Senators Bato dela Rosa, Bong Go, Lito Lapid, and Tito Sotto.

House members seeking Senate seats were also mentioned, including former Makati City Rep. and now Mayor Abigail Binay and outgoing Las Piñas Rep. Camille Villar.

The event also spotlighted House Bill No. 11360, dubbed by advocates as the “Sin Tax Sabotage Bill,” which seeks to lower tobacco product taxes to 2 percent.

The bill was approved by the House on third reading on February 3 and transmitted to the Senate the following day, where it remains pending with the Committee on Ways and Means.

Principal authors of the bill include Reps. Kristine Singson-Meehan (Ilocos Sur-2nd), Mikaela Angela Suansing (Nueva Ecija-1st), Rufus Rodriguez (Cagayan de Oro City-2nd), and party-list representatives from LPGMA, ACT-CIS, AKO BISAYA, Abono, United Senior Citizens, Manila Teachers, Kabayan, Philreca, APEC, and TGP.

While not included in the forum’s gallery, Iloilo City Rep. Julienne Baronda was also verified to be a principal author of the measure.

Dr. Hector Santos, president of the PMA, called the 2025 elections a critical opportunity for Filipinos to choose leaders who will prioritize public health.

“We need leaders who will take [a] stand to protect [Filipinos] from non-communicable diseases and socio-economic [burdens] of alcohol, tobacco, and vapes,” Santos said.

“We need leaders who will oppose measures that harm the health of Filipinos and only benefit the alcohol and tobacco industry,” he added.

Santos also stressed the importance of sin taxes in funding public health programs.

“We need leaders who will support measures that will provide a source of funding for Universal Healthcare,” he said.

Data from Action for Economic Reforms show that excessive use of tobacco and alcohol costs the government PHP1.055 trillion annually due to lost productivity and healthcare costs.

Sin taxes are imposed on goods considered harmful to public health and society, including cigarettes, alcoholic beverages, and vapes.

The Philippines began implementing higher sin taxes through Republic Act No. 10351 in 2012, amending the National Internal Revenue Code.

Further hikes were introduced through the Tax Reform for Acceleration and Inclusion (TRAIN) Law in 2017 and Republic Act No. 11346 in 2019, followed by RA No. 11467 in 2020 which covered e-cigarettes and increased taxes on alcohol.

Doctors and advocates warned that lowering taxes on these harmful products could reverse years of public health gains.

The coalition is expected to continue lobbying Senate candidates to block any attempt to dilute sin tax policies and push for higher rates in the next Congress.