International Container Terminal Services, Inc. (ICTSI) posted impressive growth for the first nine months of 2024, reporting a 31% increase in net income attributable to equity holders to USD 632.58 million, up from USD 484.54 million in the same period last year.

Chairman and President Enrique K. Razon Jr. highlighted the company’s robust performance.

“I am pleased to report another excellent set of results in which we have delivered impressive revenue growth, up 14 percent to USD 2.01 billion. EBITDA rose by 19 percent to USD 1.32 billion while net income attributable to equity holders was up 31 percent to USD 632.58 million, both new records for ICTSI,” Razon said.

Revenues from port operations grew 14% to USD 2.01 billion from USD 1.76 billion in 2023, driven by increased volume, a favorable container mix, and higher ancillary service revenues.

EBITDA margins improved to 65%, reflecting the company’s focus on cost optimization and efficient operations.

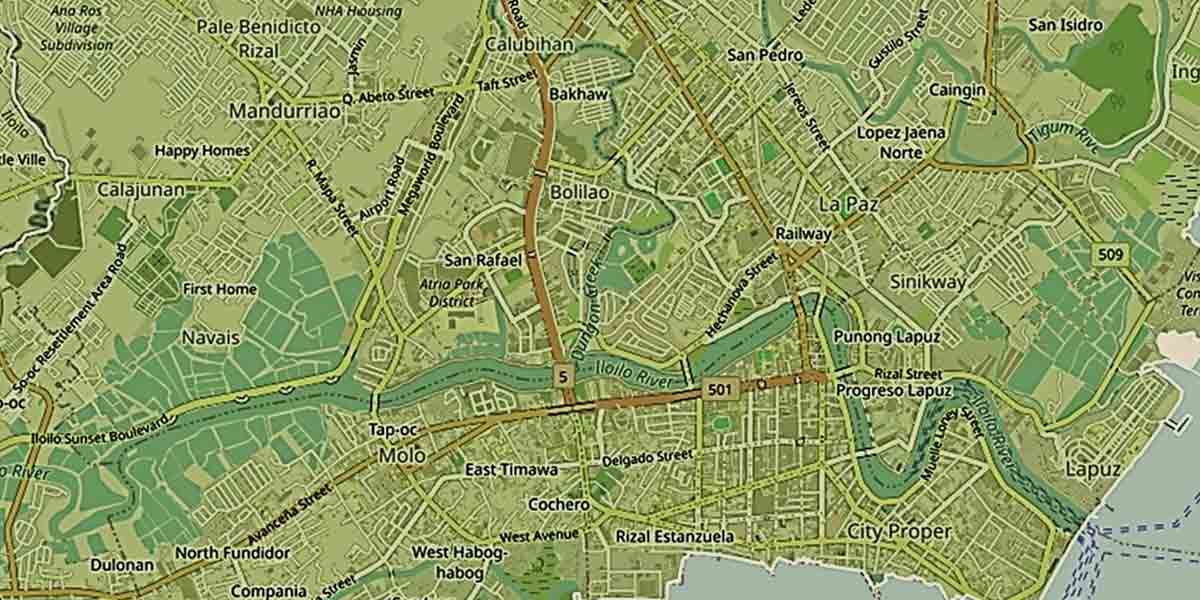

The company handled 9.60 million twenty-foot equivalent units (TEUs) from January to September, marking a 2% increase from 9.45 million TEUs in the same period in 2023. This growth was primarily supported by new services and stronger trade at specific terminals, including the contribution of Visayas Container Terminal (VCT) in Iloilo, Philippines.

However, the volume increase was partially offset by lower throughput at Contecon Guayaquil in Ecuador, the end of ICTSI’s concession in Karachi, Pakistan, and the deconsolidation of its Jakarta operations.

Net income growth was bolstered by nonrecurring income from the settlement of legal claims at ICTSI Oregon and impacts from divestitures in Indonesia, while the previous year had been affected by an impairment related to ICTSI’s operations in Pakistan.

Excluding one-time items, recurring net income grew 24% to USD 613.72 million.

For the third quarter of 2024, ICTSI reported revenues of USD 691.70 million, a 16% increase year-on-year. Net income for the quarter reached USD 212.03 million, 24% higher than the USD 170.74 million recorded in the third quarter of 2023. Diluted earnings per share climbed 33% to USD 0.303 for the nine-month period.

“Our strategy is centered on our international portfolio, and its diversity has enabled us to capitalize on growth opportunities globally,” Razon emphasized.

He noted the strength of ICTSI’s cash flow, which rose by 18% to USD 849 million, underlining the company’s financial resilience and ability to invest in new and ongoing projects.

ICTSI’s capital expenditures for the nine-month period reached USD 298.63 million, approximately 66% of its USD 450 million budget for 2024. Investments were directed towards the expansion of Contecon Manzanillo in Mexico, berth extension at ICTSI Rio in Brazil, and initial development at VCT in Iloilo, among others.