By Francis Allan L. Angelo and Rjay Zuriaga Castor

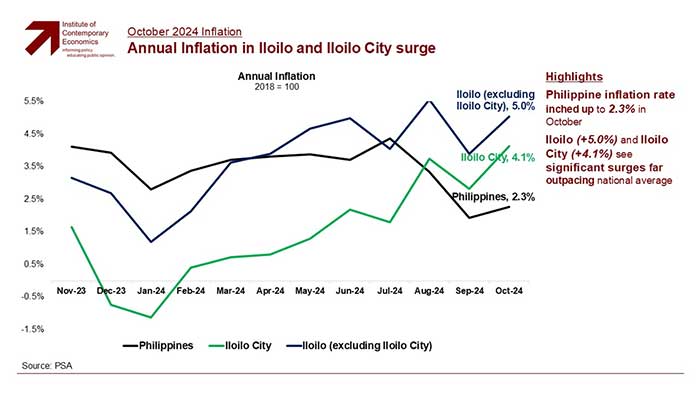

The annual inflation rate in Iloilo City and the rest of Iloilo province surged significantly in October 2024, far outstripping the national average, according to an analysis by Iloilo-based think tank Institute of Contemporary Economics (ICE) of recent data released by the Philippine Statistics Authority (PSA).

Inflation in Iloilo City climbed to 4.1%, while the province of Iloilo (excluding the city) recorded a steeper increase of 5.0%.

The figures starkly contrast with the national inflation rate, which edged up to 2.3% during the same period. The disparity also highlights a localized economic pressure that residents in Iloilo are facing compared to other parts of the Philippines.

The October data underscored a trend that began earlier this year, marked by fluctuating inflation rates across the country.

Iloilo City’s inflation rate began 2024 on a lower trajectory, reflecting a decline from the late 2023 spike when it hovered around 3.5%.

The province experienced a similar trend but saw a more pronounced rise starting mid-year, ultimately culminating in the 5.0% rate in October.

By contrast, the national inflation rate demonstrated relatively modest increases throughout the year.

The Philippines’ overall rate dipped to nearly 1.5% in the early months of 2024 before gradually climbing to 2.3% by October.

Despite this uptick, it remained well below the figures reported in Iloilo City and province.

Inflation is defined by the PSA as the rate at which the general level of prices for goods and services is rising, and, consequently, the purchasing power of the currency is falling.

It is a crucial economic indicator that reflects the increase in the cost of living over time.

The PSA monitors inflation through the Consumer Price Index (CPI), which measures the average change over time in the prices paid by consumers for a market basket of goods and services.

The PSA tracks these changes to understand how inflation impacts consumers, businesses, and the overall economy.

The CPI includes various categories such as food, housing, transportation, and utilities, ensuring a comprehensive representation of consumer spending.

The inflation rate is determined by comparing the current CPI to that of the same period in the previous year. For example, if the CPI increases from 120.0 to 124.8 over a year, the inflation rate would be approximately 4%.

In economic analyses, understanding the different types of inflation is crucial for an accurate assessment of price stability.

Headline inflation refers to the overall change in the Consumer Price Index (CPI), encompassing all items including the more volatile categories such as food and energy. This type of inflation provides a broad view of price changes but can be significantly influenced by short-term price swings in essential goods.

In contrast, core inflation excludes these volatile items, offering a more stable measure that helps to discern long-term price trends.

RENTAL INFLATION

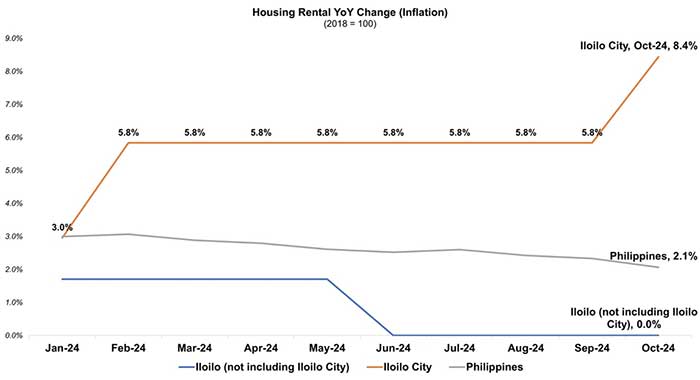

Further compounding the economic concerns, housing rental inflation in Iloilo City experienced a significant spike.

The year-on-year change for housing rentals reached 8.4% in October 2024, a sharp increase from the stable rate of 5.8% recorded from February to September 2024.

This spike in Iloilo City far exceeds the 2.1% national average and dwarfs the 0.0% rate reported for Iloilo province (excluding the city).

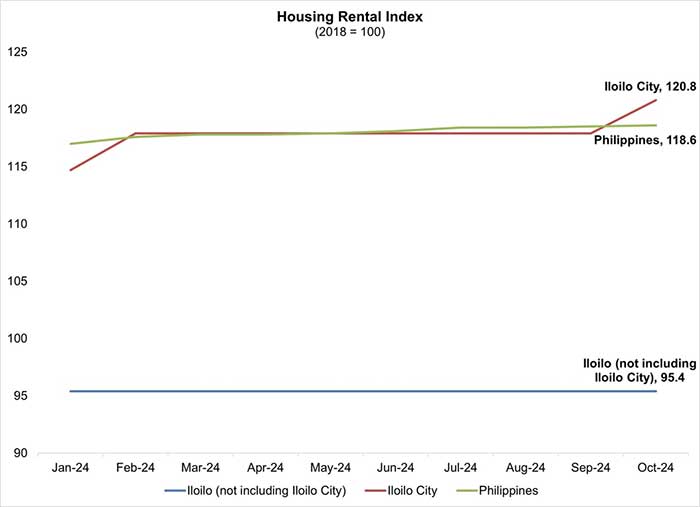

The housing rental index reflects this disparity, with Iloilo City at 120.8, surpassing the national index of 118.6 and significantly outpacing the provincial index of 95.4.

The disparity in housing rental inflation suggests that urban areas like Iloilo City face more acute economic pressures compared to their rural counterparts.

For the residents of Iloilo, the high inflation rate and rising rental costs translate to increased living expenses.

Basic goods and services, along with housing, have become more expensive, compounding the financial challenges for households in both urban and rural areas.

RPT-DRIVEN INFLATION DECOUPLING

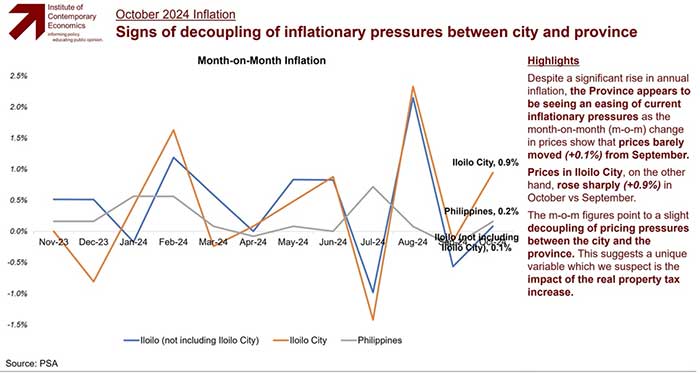

The ICE analysis also indicated a significant inflation gap between Iloilo City and its surrounding province, with the city recording a sharp 0.9% increase in October while the provincial areas saw just a 0.1% rise.

The divergence marks the first notable decoupling of pricing pressures between these two areas, according to the ICE data.

The gaping difference appears to be driven primarily by a real property tax (RPT) increase implemented by the administration of Iloilo City Mayor Jerry Treñas in early 2024, the report suggests.

The national inflation rate for the Philippines remained moderate at 0.2% month-on-month in October.

Historical data shows both city and province previously moved in relative tandem, with August seeing a pronounced spike of over 2% before dropping sharply in September.

The provincial areas have maintained more stable price levels since early 2024, fluctuating between 0.5% and 1% monthly increases.

In contrast, Iloilo City has experienced more volatile swings, including a significant -1.5% deflation in July followed by the August surge.

The data suggests that city dwellers are facing more immediate cost-of-living pressures than their provincial counterparts in the Iloilo region.

NOT ENOUGH

Mary Shiey Mangilaya, a customer support employee of a shared services company in Iloilo, said she is earning a monthly basic salary of P18,000.

Considering the skyrocketing prices of goods and services in Iloilo City, Mary Shiey’s current salary can make up for his monthly expenses including food, transportation, and monthly rent for her apartment.

“While we are only required to report onsite to the office for two days in a month, I am still reeling from the expensive market prices,” she said, noting that the minimal remaining amount of her salary goes to her family in Aklan.

On average, Mary Shiey can spend around P300 daily. This is not top of her monthly apartment rentals of P3,000 and around P1,000 for water and electricity.

Meanwhile, Jessica Dela Cruz, a rented boarding house owner in Jaro, said she plans to add P500 to the monthly rental of her rooms next year. Currently, she charges P6,000 for a room for two people.

“There’s a need for me to add P500 by January since the services now are expensive. For me to gain profit, I have to do it though it would be another pain to my customers or renters,” she said.

A local business owner told Daily Guardian that “We’re seeing higher prices across key products and services. This sudden rise is concerning for both business operations and customer spending.”

Residents echoed similar sentiments.

“Even routine purchases feel heavier on the budget now. It’s definitely more challenging,” according to Anna who supports her 3 younger siblings.