By Herbert Vego

By Herbert Vego

DURING a coffee break, media colleague Neri Camiña asked me how I managed to pay the hospital bills I had incurred during my recent 12-day confinement.

“It was not easy,” I lamented. “My siblings, relatives and friends lost no time chipping in some substantial amount for fear I would die of Covid-19. Their generosity really saved me from emptying my bank account.”

I had stashed away moderate savings in the one year that the pandemic has turned the economy upside down.

Neri agreed, adding that he had invested his own savings in shares of stocks of a corporation.

“I don’t have to be so ambitious,” I reacted. “Suffice it to say that bitter experiences from the past have taught me lessons to profit from.”

He asked me for specifics.

“I was earning well in entertainment journalism in Manila in the 1970s,” I revealed. “But I got so addicted to Jai-Alai gambling that it wiped out a decade of income from hard work.”

I am retelling this story to our readers now for whatever lesson it is capable of imparting. It’s not worth bragging about though. I look back to that vice as a learning experience from which to redirect my path. Experience, everybody knows, is the best teacher.

There was a time when I checked my bank account and discovered an almost zero balance. So I hammered my Buddha “bank” for coins to buy food for my family and my maintenance medicine.

On the way to the pharmacy, I stopped by a shoe store. The pair of leather shoes I had hoped to buy was still there but its inflated price only aggravated my sense of loss, realizing I had already buried myself in a mountain of debt.

One day I bought a second-hand book, I Made Millions and Lost Them. The riches-to-rags story of the late Francisco C. de la Rama jolted me. An Ilonggo heir of a shipping magnate, he had lost all his money in an extravagant lifestyle.

I took stock of my situation, thinking of ways and means to recover my respectable financial shape.

In the next few months, I kept an expense diary to know exactly how much and for what I had spent. It surprised me to find out that I had splurged on restaurant meals, beer and coffee – not just for myself but for the barkada.

Having traced the root of my financial problem – overspending — I started spending less on socials and non-necessities.

Having determined my shopping patterns, I steered clear of temptations.

To this day, I prefer bargain-hunting and shun impulse buying. Instead of buying branded denim, I buy ten pairs at the ukay-ukay stalls. Buying more items at the least cost now gives me the satisfaction of having beaten monetary inflation.

It’s the opposite of what I used to do when a splurge on credit-card purchases made me “high” – until payment was long overdue and I was receiving “love letters” from the card company threatening to see me in court.

Am I glad that I have paid up. I am free again from stressful debts. Whenever I feel like wanting to buy something I can live without, I distract myself with a priceless alternative – say, playing a computer game on my laptop, or watching a movie on YouTube.

At the end of every month, I go over my receipts to determine which bought items I could have lived without. That way, no matter how small, I manage to pile up an amount that could buy me a coveted appliance in due time.

—0—

LABOR DAY THEN AND NOW

The Labor Day rallies mounted by labor organizations nationwide on Labor Day (Saturday, May 1, 2021) saw them burning the effigies of President Rodrigo Duterte, demanding a P100 daily wage increase and a P10,000 cash aid for the poor and jobless.

Duterte was nowhere near any of the supposedly Labor Day celebrations. As usual, all he did was record a TV message. For that occasion, he expressed “my deepest gratitude to our hardworking healthcare workers and essential front liners for their unwavering commitment to ensure unhampered delivery of goods and services that continue to sustain our communities and industries during these difficult times.”

Unknown to today’s young generation, Labor Day in my youth would reunite the President and labor leaders in a festive get-together at the Quirino Grandstand at the Luneta (now Rizal Park) in Manila.

I vividly remember how my late father brought me to Luneta for the Labor Day speech of then-President Carlos P. Garcia on May 1, 1060. Since I was only a boy of 10, he had to seat me on his shoulders to see the dark but handsome President as the audience shouted “Mabuhay!” and other words of commendation or praise.

Those people could never have predicted that those words would eventually be changed to “Ibagsak” to denote “down with” whoever is President. They were happy with the minimum wage of four pesos a day, which could buy more goods then than today’s four hundred pesos.

—0—

METALS GET ‘TIRED’ TOO

“Metal fatigue” refers to a weakened condition induced in metal parts of machines, vehicles, or structures by repeated stresses or loadings, ultimately resulting in fracture under a stress much weaker than normally necessary to cause a breakdown.

That is the sad state of power lines afflicting the power distribution utilities,

As an integral part of its rehabilitation program as distribution utility in Iloilo City, MORE Power has been weeding out rusty wires that are prone to breakage and thus result in unscheduled brownouts. The company has brought in thousands of meters of new electricity lines to replace those that have outlived their usefulness after decades of use by the previous power franchisee.

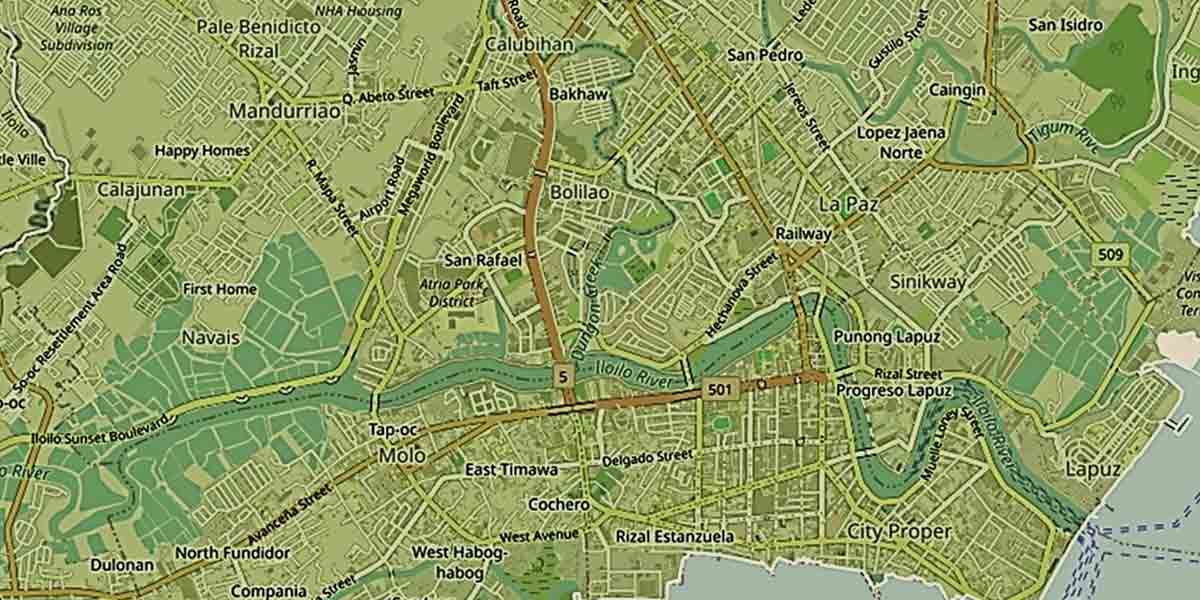

Replacement of wirings are often resorted to during replacements of dilapidated facilities that necessitate emergency outage, as in yesterday’s installation of 12 primary concrete poles and 26 crossarms at Guzman St., Mandurriao.

MORE Power President Roel Castro estimates it would take at least three years for the company to replace 1,500 rotting poles.

Well, as the saying goes, “A journey of a thousand miles begins with a single step.”