By Joseph Bernard A. Marzan

If you want to buy again an item that you bought back in 2018, you will not get the same quantity, or you may even opt for a cheaper alternative, as the average purchasing power of the Philippine Peso dwindled even as inflation was determined to have stabilized last month, according to an official of the Philippine Statistics Authority-Region 6 (PSA-6) on Friday.

PSA-6 Statistical Specialist II Miguel Gallego told Bombo Radyo Iloilo on Friday that ₱1 in 2018 was equivalent to only ₱0.81 in January 2023.

This meant that the actual value of P1,000 in Western Visayas five years ago is only P810 as of last month. The depreciation of the purchasing power or value of the peso could either prompt a buyer to buy less or look for a cheaper alternative.

“If you bought something in the past few months or years, you can no longer buy the same quantities for the same price because of inflation. One of the things there is that if you want to buy it like you did then, you have to increase the money spent, or if you want to spend the same amount, you will have to compromise [by] buying less or buy another cheaper variant,” Gallego said.

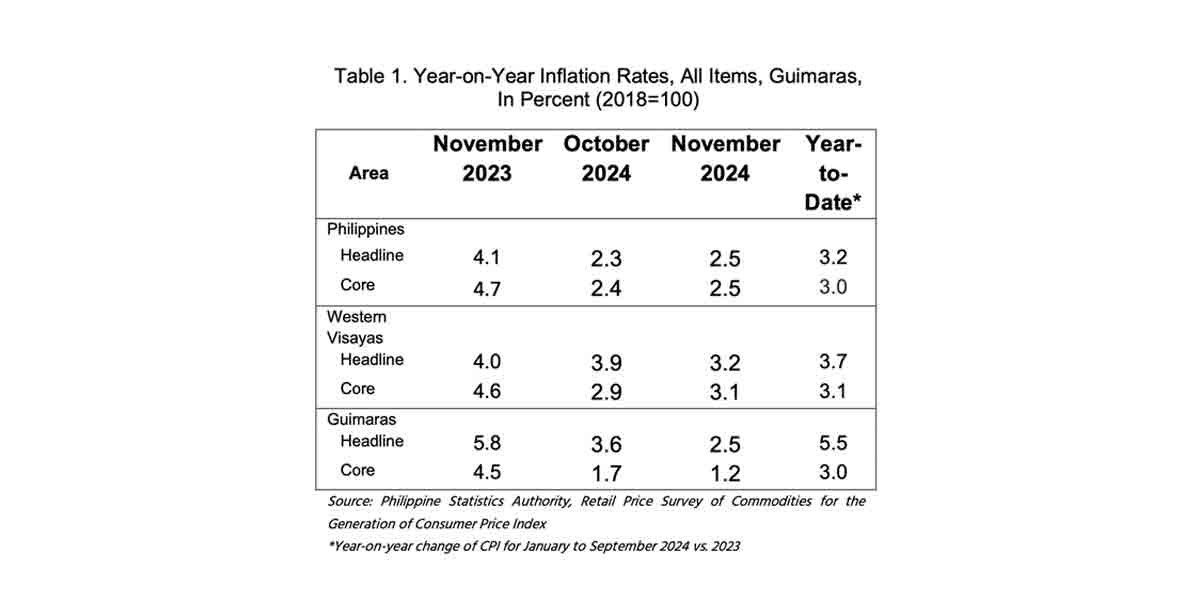

Gallego said this was the adverse effect of the continued rise in inflation rates until January 2023, which was at 10.3 percent, slightly down from 10.5 percent in December 2022, but still drastically higher compared to 4.5 percent in January 2022.

The inflation rate in the region also remains to be the highest in the country, due to increases in housing, water, electricity, gas and other fuels, and transport commodity groups.

Gallego also explained that the region’s inflation rate has cumulatively increased by 24 percent since the Consumer Price Index (CPI) was reset to 2018 levels.

The CPI for January 2023 increased to 124.1 from the 100 base of the year 2018, which was set by the national PSA board in 2021. Meaning that as of last month, prices have increased by 24 percent.

The base rate for the CPI was based on the Family Income and Expenditure Survey conducted by the PSA that year, where the weight of commodities was paired with the level of household consumption.

Gallego stressed that the inflation rate per region depends on the chunk of household income dedicated to commodity groups.

This meant that even if prices of goods here in Western Visayas would be the same as in the National Capital Region (NCR), the inflation rate would be higher here if there is a higher percentage of household consumption.

“Our starting point [for the CPI] was in 2018, and this January [2023], our [CPI] is 124.1, and what that means is […] this [month], prices of goods and services had increased on average by 24.1 percent, starting from [comparisons to] 2018 [prices],” he said.

“For example, based on the consumption of our households in Western Visayas, it was at 42 percent [of household income], as compared to NCR or the whole of the Philippines, it was at an average of 37 percent consumption. That means that if inflation in prices of food in Western Visayas rises, there is a bigger impact here as compared to the inflation [in other places] in the Philippines,” he added.