By Francis Allan L. Angelo

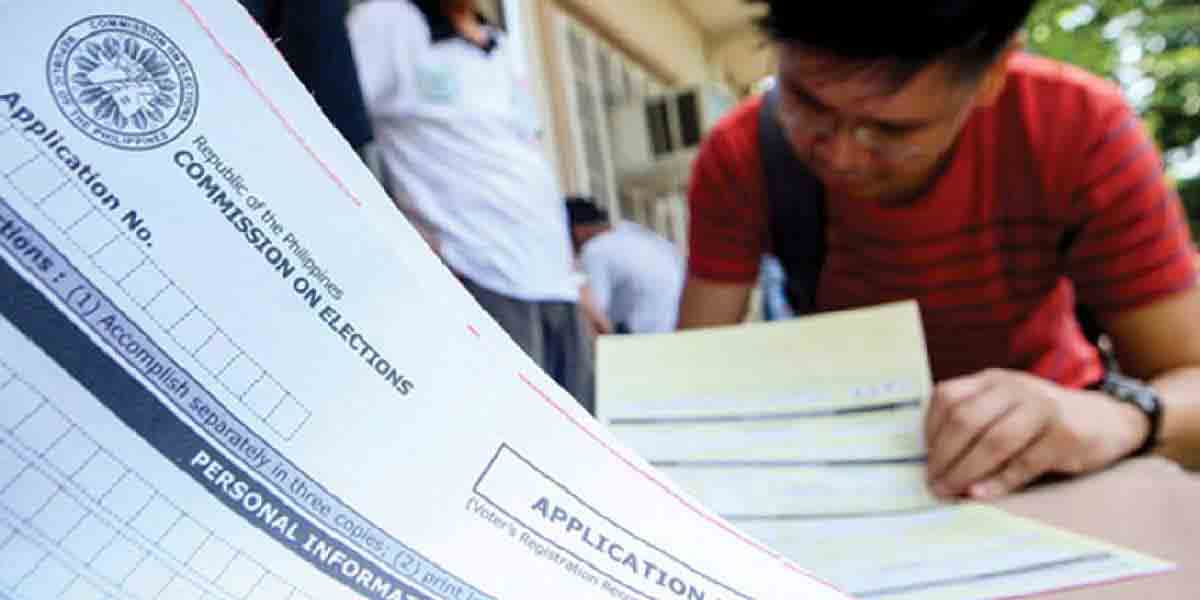

The Maharlika Investment Corporation (MIC), in a bid to fortify its commitment to transparency and good governance, has announced its intention to become an Associate Member of the International Forum of Sovereign Wealth Funds (IFSWF).

This initiative was set into motion after receiving the green light during the fourth MIC board meeting which took place under the leadership of Finance Secretary and MIC Chairperson Ralph G. Recto on the leap year day, February 29, 2024.

The IFSWF, a global coalition of sovereign wealth funds, is committed to fostering cooperation and strengthening its members through dialogue, research, and self-assessment.

By joining this organization, the MIC positions itself to further align with international best practices, especially those outlined in the Santiago Principles—guidelines designed to ensure the effective operation of sovereign wealth funds on a global scale.

This strategic step is in harmony with the legislative requirements of RA 11954, also known as the Maharlika Investment Fund Act of 2023, which dictates adherence to the Santiago Principles for both the MIC and the Maharlika Investment Fund (MIF).

In what marks a significant advancement for the institution, the MIC board has designated President and CEO Rafael Jose D. Consing, Jr., Regular Director Vicky Castillo L. Tan, and Independent Director German Q. Lichauco II as the official representatives to the IFSWF.

The fourth board meeting saw attendance from key figures including MIC Regular Director Vicky Castillo L. Tan; MIC Independent Directors Atty. German Q. Lichauco II, Andrew Jerome T. Gan, and Roman Felipe S. Reyes; LBP PCEO Lynette V. Ortiz; and DBP PCEO Michael O. de Jesus.

The session also included the presence of the MIC’s Advisory Body, represented by Officer in Charge Treasurer Sharon P. Almanza, reflecting the collaborative effort among various stakeholders within the organization.

The pursuit of Associate Membership in the IFSWF, typically granted for a three-year term to institutions in the early stages of developing their sovereign funds, underscores the MIC’s proactive approach to governance and international engagement.

As MIC oversees the governance and utilization of the MIF, its primary goal is to leverage state assets in investment ventures to optimize returns and bolster public funds.

This development signals the MIC’s resolve to not only embrace global standards of transparency and governance but to also lead by example in the stewardship of national assets.

By seeking association with the IFSWF, the MIC is setting the stage for enhanced credibility, greater investor confidence, and the long-term sustainability of the MIF.

As the MIC forges ahead with its application to join the IFSWF, it reinforces the Philippines’ position on the global financial stage as a nation committed to the principles of accountability and sound financial management.

The move heralds a new era for the MIC, marked by robust governance and strategic international alliances, propelling the Philippines closer to its goal of creating a legacy of fiscal prosperity.