Settling tax obligations will be “friendlier” with the signing of the Ease of Paying Taxes Law, according to the Bureau of Internal Revenue.

On the sidelines of the agency’s nationwide campaign for tax compliance, BIR Commissioner Romeo Lumagui Jr. said he welcomes the signing of the law as it will eventually lead to better collection of taxes.

“We welcome that development kasi bago yung batas na yan, marami rin restrictions at marami kami hindi magawa dahil walang kaukulang batas. With this Ease of Paying Taxes, mas maraming proseso ang pwede natin padaliin,” Lumagui told reporters on Thursday.

“Ang concentration talaga natin is mapagaan ang transaction sa ating ahensya,” he added.

The Ease of Paying Taxes Act was signed into law last January 5, 2024. It aims to simplify tax filing and modernize tax administration in the country. The implementing rules are still pending.

“Sa ginagawa naming pagpapagaan ng transaksyon sa ahensya, mas mapapadali ang pag-comply sa tax obligations at kapag napadali, inaasahan natin na mas marami ang magbabayad ng tamang buwis,” Lumagui said.

“Karamihan naman ng mga negosyante diyan gusto magbayad ng tamang buwis, ngunit dahil mahirap ang sistema, napipilitan na hindi magcomply,” he added.

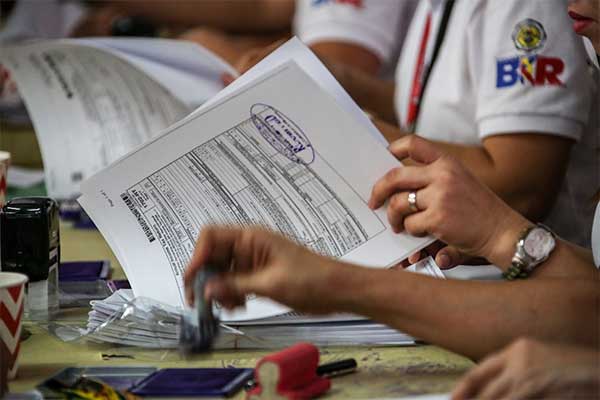

On Thursday, BIR held a nationwide verification drive for tax compliance.

Lumagui himself led officials in checking three high-end stores in a mall in Ortigas, Mandaluyong City. The shops visited included a luxury brand of watches, a cafe and bakery shop, and a food court restaurant.

All three shops in the mall were found to be compliant. Among the documents checked were the Certificate of Registration, Book of Accounts, and other permits.

BIR clarified they held the nationwide drive to educate and not penalize taxpayers.

“Ngayong panahon na ito dahil renewal ng business permits, sinasabayan natin, gusto natin matulungan ang tax payers na masigurado na nagcocomply sila ng registration requirements, rehistro sa negosyo nila, compliant with the tax obligations,” Lumagui said.

“Naisipan natin na magsagawa ng tax compliance verification drive, buong pilipinas ito ginagawa ngayon, layunin nito para ma educate ang tax payers at hindi para mag penalize, tinitingnan natin ano mga pagkukulang nila at potential na hindi ginagawa, tinituruan natin ano pwede nila magawa,” he added.

“This is a friendly approach, ang gusto natin concentration ngayon, tulungan ang tax payers. Sa ngayon, may penalty pag may violations, pero kakampi nyo ang BIR, magtulungan tayo mag comply,” Lumagui ended. (ABS-CBN News)