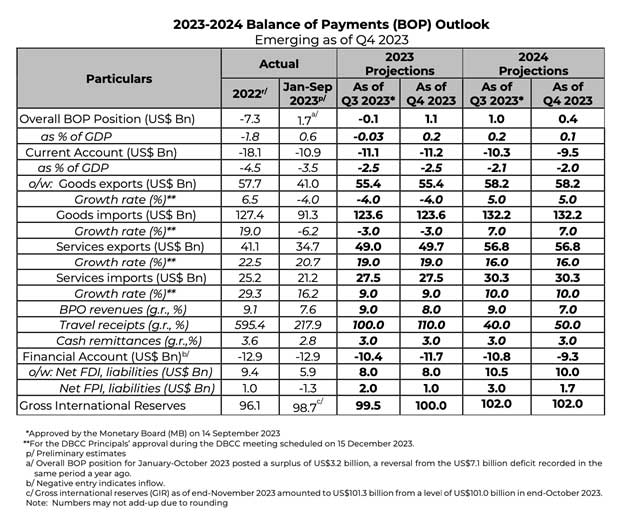

The Monetary Board approved the new set of 2023 and 2024 balance of payments (BOP) projections during its 14 December 2023 meeting.

The new set of BOP projections incorporates latest available data and developments.

The emerging external outlook for 2023 and 2024 is primarily influenced by the same set of factors that were identified in the previous round of the BOP projection exercise.

As the key assumptions factored into the Q4 2023 round of the BOP outlook assessment remain generally consistent with those incorporated in the Q3 2023 exercise, the new set of external account projections are primarily maintained or revised only slightly to reflect latest available data.

Key downside risks to the country’s external position continue to come from subdued global demand conditions, weak trade and investment prospects, lingering high interest rate environment, elevated inflation, and the escalation of geopolitical tensions in various parts of the world.

On the domestic front, a weaker-than-target GDP outturn and higher-for-longer interest rate environment are among the key factors that could weigh on the country’s external outlook over the near term.

Meanwhile, positive reinforcements to the country’s external sector continue to include the rebound in the global tech cycle supporting the recovery of electronics exports, the international lifting of the state of health emergency which will support both travel and the hiring of Filipino workers overseas, with the latter benefitting as well from labor shortages in countries challenged by an ageing population.

For 2023, the overall BOP is seen to settle to a surplus position as the latest current account forecast remain broadly unchanged while the financial account has been revised upward.

The latter is reflective of the actual trend seen in the first nine months of year, particularly for the other investments account, underpinned by inflows from foreign loan availments that is partly in line with the government’s foreign borrowing plans.

While the overall BOP is projected to register a surplus, the current account is expected to remain in deficit driven by the persistent trade-in-goods gap despite the recent contraction in goods imports due mainly to easing global commodity prices.

Goods exports are seen to register a decline in 2023, unchanged from the previous projection, amid the slowdown in external demand.

Nonetheless, the country’s current account deficit is attenuated by the stronger-than-expected improvements in travel receipts as well as the sustained resilience in BPO revenues and OF remittances.

The lifting of the COVID 19 as a global health emergency by the World Health Organization (WHO) in May 2023 further hastened the recovery of the tourism industry while the demand for BPO services remains upbeat as companies opt to use the outsourcing and global services model to drive cost-cutting initiatives.

The projected inflows of foreign direct investments (FDI) have been kept unchanged while that of foreign portfolio investments (FPI) have been revised downward consistent with an overall subdued investment climate.

For 2024, the overall BOP is projected to retain its surplus position, albeit lower than the earlier forecast.

This reflects the estimated narrower current account gap for next year as well as the slightly lower than previously projected non-resident investment inflows. The foreseen improvement in the current account balance is supported largely by the upward revision in the growth forecast for travel receipts as well as the stable expansion of BPO revenues and OF remittances.

The upbeat demand for meetings, incentives, conferences, and exhibitions (MICE) facilities and the resumption of cruise tourism, are seen to buttress the growth in travel receipts, which is projected to breach its pre-pandemic level by 2024.

The improvement in the net services and income accounts more than offset the wider trade-in-goods deficit next year with the rebound in global trade activity supporting the expansion of exports and the larger growth in imports.

Meanwhile, tighter financing conditions, amid a high interest rate environment, place some downward pressure on both foreign direct and foreign portfolio investments.

Nonetheless, foreign investment prospects find some support from the government’s thrust to implement key amendatory laws that eased rules on foreign investor participation in key industries as well as its plan to keep infrastructure spending at above 5.0 percent of GDP.