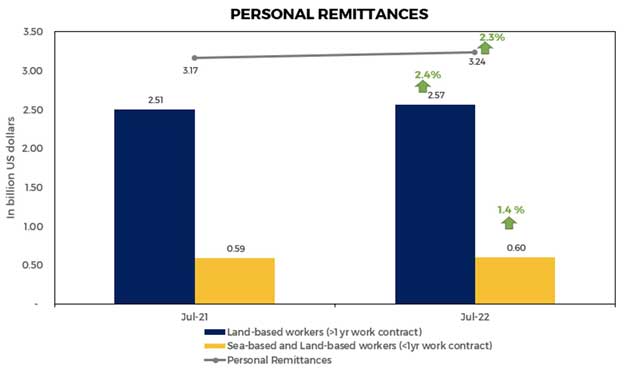

Personal remittances from Overseas Filipinos (OFs) reached US$3.24 billion in July 2022, higher by 2.3 percent than the US$3.17 billion posted in the same month last year.

This resulted in the cumulative personal remittances rising by 2.7 percent to US$20.33 billion in the first seven months of 2022 from US$19.78 billion registered in the comparable period in 2021.

The increase in personal remittances in July 2022 was due to remittances sent by 1) land-based workers with work contracts of one year or more, and 2) sea- and land-based workers with work contracts of less than one year.

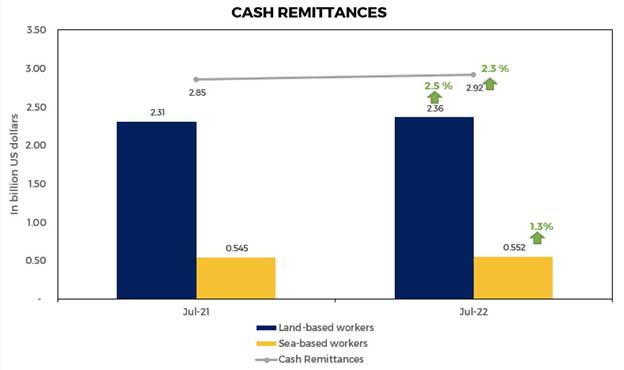

Similarly, cash remittances coursed through banks grew by 2.3 percent to US$2.92 billion in July 2022 from US$2.85 billion recorded in the same month last year. On a year-to-date basis, cash remittances amounted to U$18.26 billion in January-July 2022, up by 2.8 percent from US$17.77 billion recorded in the same period last year.

The expansion in cash remittances in July 2022 was due to the growth in receipts from land-based and sea-based workers.

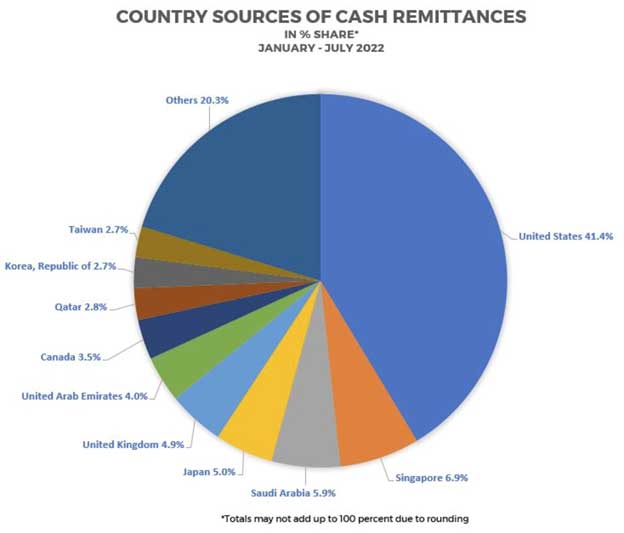

In terms of country source, the growth in cash remittances from the United States (US), Saudi Arabia, Singapore, and Qatar contributed largely to the increase in remittances in the first seven months of 2022.[1]

[1] There are some limitations on the remittance data by source. A common practice of remittance centers in various cities abroad is to course remittances through correspondent banks, most of which are located in the U.S. Also, remittances coursed through money couriers cannot be disaggregated by actual country source and are lodged under the country where the main offices are located, which, in many cases, is in the U.S. Therefore, the U.S. would appear to be the main source of OF remittances because banks attribute the origin of funds to the most immediate source. The countries are listed in order of their share of cash remittances, i.e., from highest to lowest