The Philippines’ inflation rate rose to 2.9% in December 2024 from 2.5% in November, primarily driven by higher costs of housing, utilities, and transportation, according to the Philippine Statistics Authority (PSA).

The December figure was lower than the 3.9% recorded in the same month in 2023.

For the entire year, the average inflation rate for 2024 stood at 3.2%, well within the government’s 2% to 4% target range and significantly below the 6.0% average seen in 2023.

The PSA reported that the uptick in December was largely due to a faster annual increase in the index of housing, water, electricity, gas, and other fuels, which climbed to 2.9% from 1.9% in November.

The transportation sector also reversed its trend, posting a 0.9% increase after a 1.2% decline in November.

Recreation, sport, and culture expenses rose by 2.5%, up slightly from 2.4% in the prior month.

Core inflation, which excludes volatile food and energy prices, increased to 2.8% in December from 2.5% in November but was lower than the 4.4% recorded in December 2023.

Food inflation remained steady at 3.5% in December 2024, a significant decrease compared to 5.5% in December 2023.

The food sector contributed 41.9% or 1.2 percentage points to overall inflation in December.

The top contributors to food inflation included vegetables, tubers, plantains, cooking bananas, and pulses, which accounted for a 34.5% share or 1.2 percentage points.

Meat and animal products followed, contributing 27.4% or 1.0 percentage point, while cereals and cereal products, such as rice and bread, accounted for 13.9% or 0.5 percentage point.

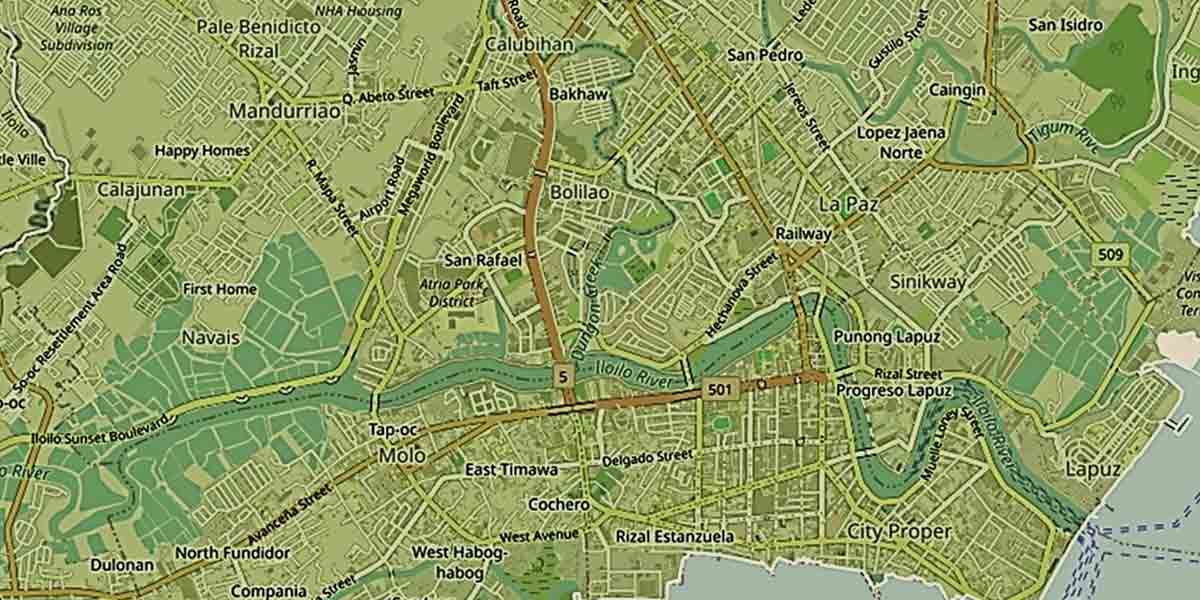

In the National Capital Region (NCR), inflation accelerated to 3.1% in December from 2.2% in November, mainly due to rising housing and utility costs.

Areas outside NCR (AONCR) also saw inflation rise to 2.9% from 2.6%, with eight regions reporting higher rates. Cagayan Valley had the highest regional inflation at 4.6%, while SOCCSKSARGEN posted the lowest at 1.2%.

PSA data indicated a generally improving inflation trend in 2024, with rates declining from a peak of 4.4% in July.

BSP and NEDA Outlook

The Bangko Sentral ng Pilipinas (BSP) confirmed that December’s 2.9% inflation rate was within its forecast range of 2.3% to 3.1%, bringing the full-year average inflation to 3.2%.

BSP stated that the inflation outlook remains consistent with the target range over the policy horizon, but risks remain tilted to the upside due to potential increases in transport fares and electricity rates. Meanwhile, lower rice import tariffs serve as a downside risk.

The BSP’s monetary policy remains calibrated, balancing the need for price stability and sustainable economic growth.

National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan emphasized that the December inflation rate brought the year-to-date average to 3.2%, reflecting significant progress compared to 2023’s 6.0% average.

“Despite challenges, our efforts to manage inflation have proven effective. We will build on this momentum to keep inflation within target in 2025,” Balisacan said.

The Development Budget Coordination Committee (DBCC) has retained the 2% to 4% inflation target for 2025 to 2028.

Measures to Address Inflation Risks

The PSA highlighted the ongoing effects of La Niña, which is expected to continue until February 2025, potentially impacting agricultural productivity and food prices.

To mitigate risks, the Department of Social Welfare and Development (DSWD) plans to expand programs like Local Adaptation to Water Access (LAWA) and Breaking Insufficiency through Nutritious Harvest for the Impoverished (BINHI) to 323 municipalities by 2025.

Increased funding under the amended Agricultural Tariffication Law, raising the Rice Competitiveness Enhancement Fund to PHP30 billion annually until 2031, is also expected to bolster the agriculture sector.

Efforts to support the hog industry include the fast-tracking of African Swine Fever vaccine approvals and streamlining the withdrawal of frozen pork stocks from cold storage facilities.

Additionally, the Energy Regulatory Commission has mandated refunds of unspent regulatory reset fees to consumers, totaling PHP1.18 billion.

“We remain optimistic about addressing inflation through proactive measures while focusing on improving productivity, food security, and consumer purchasing power,” Balisacan added.